Macy’s (M): Assessing Valuation After New Earnings, Sales Outlook Revision, and Share Buyback Update

When a company lays all its cards on the table at once, investors tend to sit up and pay attention. That is exactly what happened with Macy’s (NYSE:M), following a morning packed with updates: new quarterly earnings, a revised full-year sales outlook, and fresh third quarter guidance. Despite headline numbers showing year-over-year declines in net income and sales, the company chose this moment to boost its annual sales expectations. Add in an active pace of share buybacks and you have a mix of signals vying for Wall Street’s attention.

It has already been quite the ride for Macy’s over the past year, with shares rising 22% even as annual revenue slipped and quarterly profit came in lighter than last year. Still, momentum has clearly accelerated in recent months, with the stock up roughly 57% in the past quarter alone. Macy’s also continued shrinking its share count, which can give earnings per share a boost even as sales fluctuate.

So, after this type of run and the latest guidance surprise, is there greater value ahead for patient investors or has the market already factored in Macy’s next steps?

Most Popular Narrative: 28.7% Undervalued

According to the most popular valuation narrative, Macy’s shares are trading at a steep discount to their estimated fair value. This narrative suggests the stock could offer substantial upside for those willing to look past recent headline pressure.

Macy’s owns significant real estate that can be sold to provide liquidity, pay down debt, and finance new investments. The firm intends to raise about $600 million to $750 million from real estate sales over the next three years.

Curious what’s fueling this big gap between share price and fair value? There is a bold mix of assumptions about growth, margins, and a future profit multiple that might surprise you. Ready to discover the details behind one of the retail sector's most intriguing targets? The full narrative breaks down every key driver behind the number.

Result: Fair Value of $24.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing store closures and uncertain takeover prospects could challenge Macy’s rebound story and temper expectations for a sustained turnaround.

Find out about the key risks to this Macy's narrative.Another View: SWS DCF Model

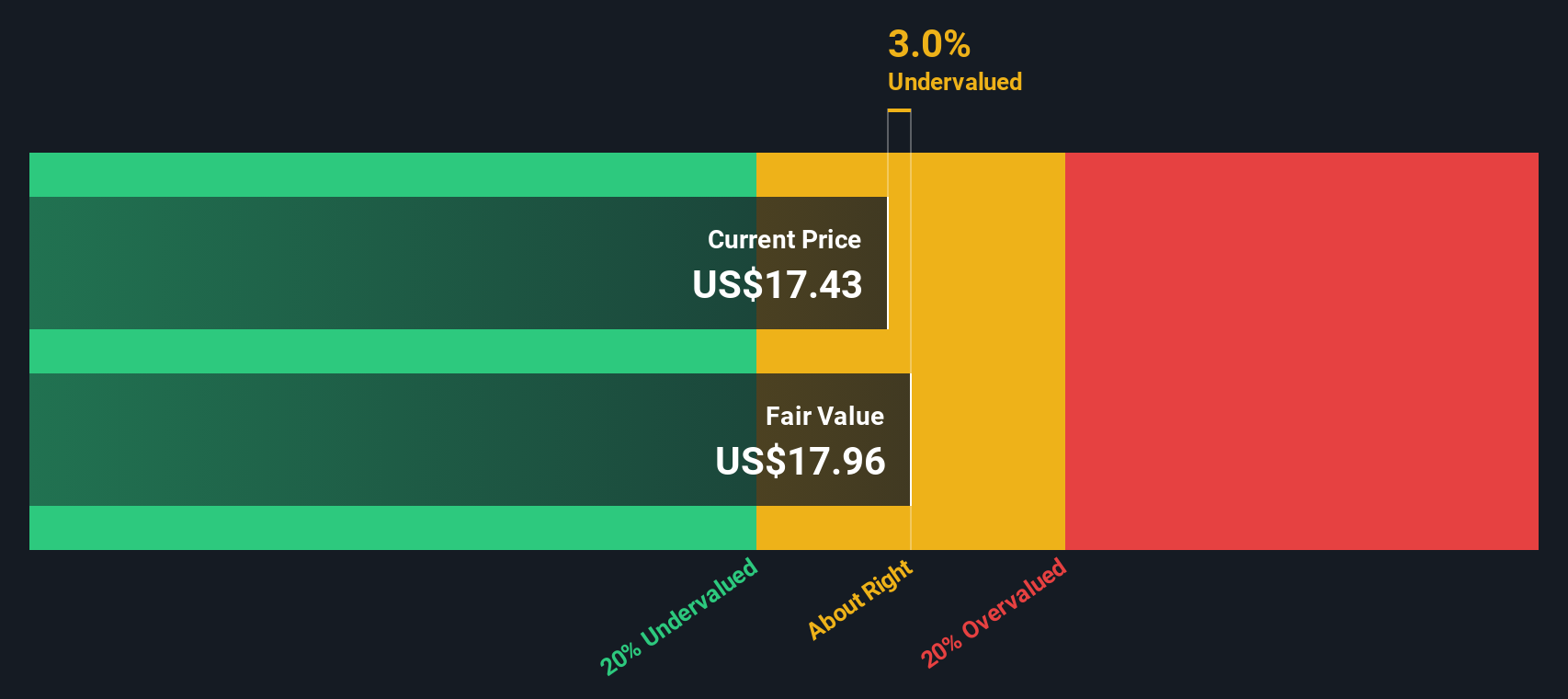

While the popular narrative argues Macy’s is underpriced, our SWS DCF model also supports this view. The analysis suggests the stock is trading below its estimated intrinsic value. But does the future really justify this optimism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Macy's Narrative

If you see things differently or want a closer look at the numbers, you can dive in and build your own narrative in just a few minutes. Do it your way

A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your portfolio miss out. Supercharge your research with tailored stock ideas that match your interests and strategy on Simply Wall Street.

- Uncover value by targeting companies trading well below their potential when you tap into undervalued stocks based on cash flows and see where overlooked gems are hiding.

- Boost your income by searching for market-leading businesses paying healthy yields, using dividend stocks with yields > 3% to focus on strong dividend sources.

- Ride the wave of tomorrow’s technology with stocks innovating in next-gen quantum breakthroughs. Get your custom shortlist via quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal