Assessing Evercore’s (EVR) Valuation as Analyst Upgrades and Growth Outlook Drive Investor Interest

Most Popular Narrative: 5.1% Undervalued

According to the most widely followed narrative, Evercore is trading below its calculated fair value, with analysts projecting continued upside based on growth and operational expansion.

The ongoing globalization of capital markets and an accelerating trend in cross-border M&A activity are providing an increasingly fertile environment for independent, conflict-free advisors like Evercore. The firm's continued expansion into key international markets, as evidenced by new offices and hiring in EMEA (France, Spain, Italy, Dubai, UK), positions it to capture an increasing share of growing advisory fee pools and drive top-line revenue over the long term.

Want to discover what powers this undervaluation call? Analysts are betting on strategic expansion and ambitious growth benchmarks. There is a bold assumption behind the future profit and revenue projections. What top-line shift and ambitious margin gains support that price target? Find out the financial logic that has consensus bullish on Evercore’s trajectory.

Result: Fair Value of $364.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, expanding fixed costs and rising competition could weigh on Evercore’s margins if deal volumes soften or if pricing pressure intensifies in the future.

Find out about the key risks to this Evercore narrative.Another View: What Do Valuation Ratios Suggest?

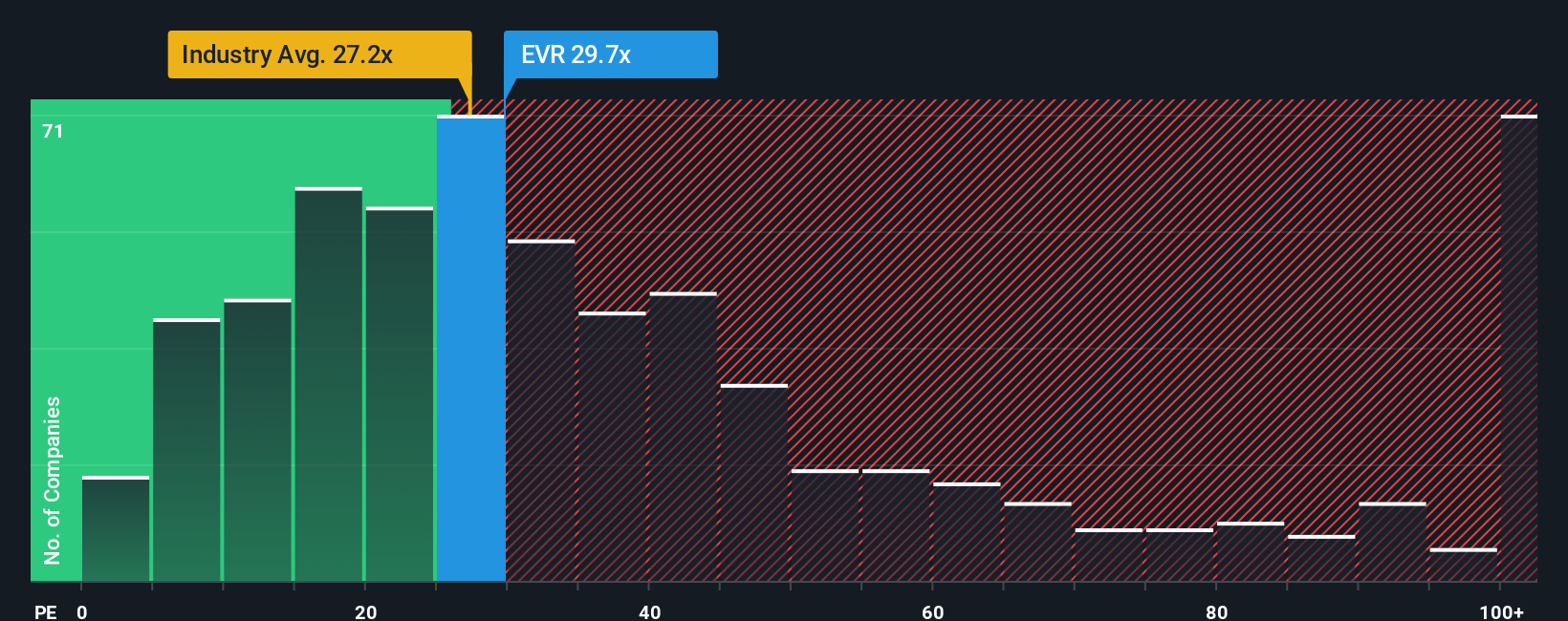

While analysts see potential upside, traditional valuation ratios tell a more cautious story. By comparing Evercore’s earnings multiple to the industry average, the stock could actually be seen as expensive rather than a bargain. Does this perspective challenge the bullish case?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Evercore Narrative

If you prefer diving into the numbers yourself and building your own perspective, it takes just a few minutes to map out your own scenario, Do it your way.

A great starting point for your Evercore research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Winning Opportunities?

Why stop at just one stock? Step up your investing game by checking out hand-picked ideas that could put you ahead of the crowd. Smart investors always look beyond headlines and tap into specialized strategies with real potential.

- Maximize income and stability by scanning for companies offering consistent payouts with dividend stocks with yields > 3%.

- Tap into emerging trends by spotting up-and-coming innovators shaking up the tech landscape through AI penny stocks.

- Benefit from sharp valuations by searching for promising opportunities where market prices trail business potential via undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal