Chemed (CHE): Evaluating Valuation as Earnings Dip and Growth Prospects Face Scrutiny

Chemed (CHE) is back on investors’ radar due to recent coverage highlighting its elevated price-to-earnings ratio, particularly as the company contends with a dip in earnings and subdued growth forecasts. The central issue is whether the current share price accurately reflects Chemed’s prospects or is running ahead of itself. With the discussion now centered on valuation and performance, investors are understandably pausing to reassess their next move.

Reviewing the data, Chemed’s stock has faced pressure for most of this year, and its one-year return remains in negative territory. Over the past three months, the stock has not shown signs of a rebound, as concerns about earnings and sustainability persist. Although the past week saw a modest uptick, it has not been substantial enough to change the broader outlook, especially when recent company updates have not indicated an imminent turnaround.

With a year characterized by more skepticism than optimism, the key consideration is whether Chemed’s valuation reflects a potential entry point or if the market is anticipating growth that may not occur.

Most Popular Narrative: 23% Undervalued

The most widely followed narrative points to Chemed being undervalued by a notable margin, with strong future earnings and margin recovery at the core of the case.

The ramp-up of new Certificate of Need (CON) locations in underserved Florida counties (for example, Pinellas and Marion) is expected to materially expand VITAS's service footprint. This aligns with the continued aging U.S. population and the shift toward home-based care, both key drivers of higher patient volumes and long-term top-line revenue growth.

What is the real driver behind such a bullish fair value? There is an ambitious blueprint for margin rebounds, careful cost resets, and a bet on robust future cash flows. However, how aggressive are the assumptions about growth, patient volumes, and future multiples supporting this target? Find out what the narrative is projecting and see if the bold math holds up under scrutiny.

Result: Fair Value of $582.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing Medicare reimbursement pressures and continued weak residential revenue at Roto-Rooter could challenge these positive expectations for Chemed’s long-term growth.

Find out about the key risks to this Chemed narrative.Another View: What Does the Market Multiple Say?

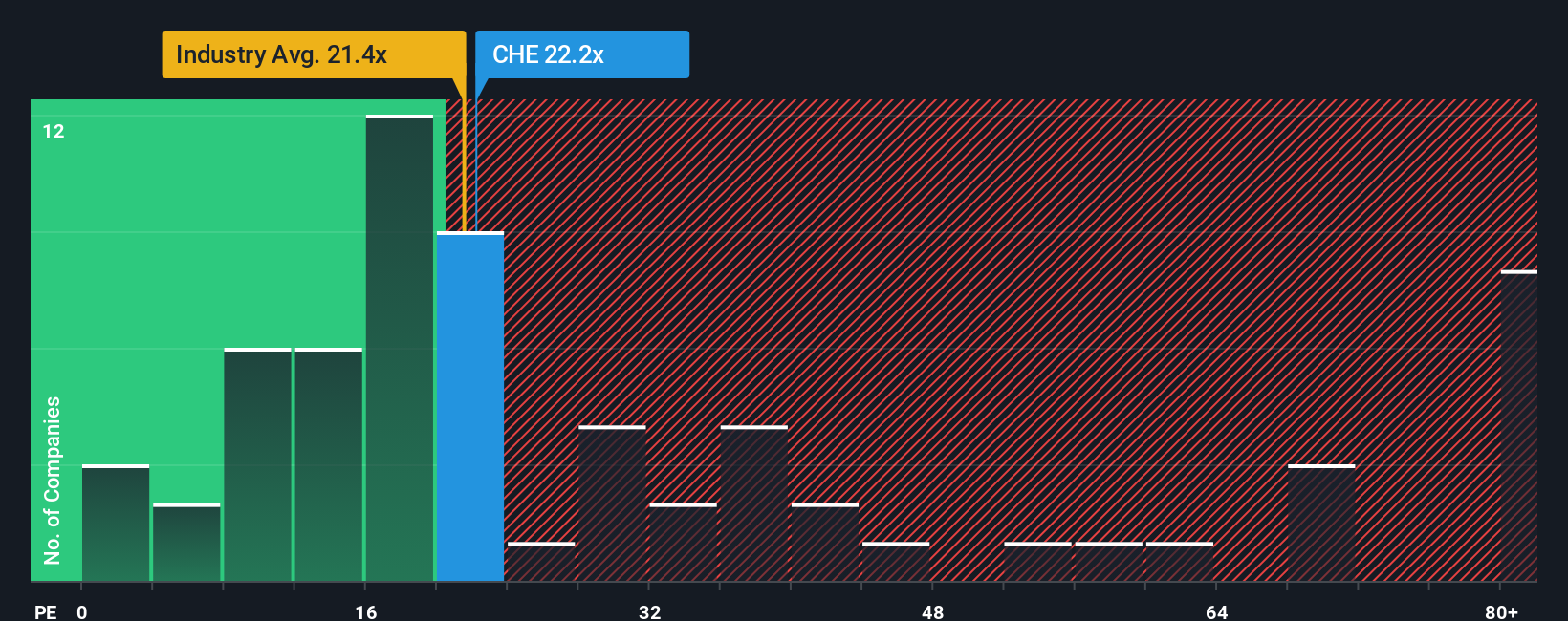

Looking from a different angle, Chemed’s share price appears expensive compared to the broader sector on this basis. This raises the bigger question: does the market have the story right, or is it missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chemed Narrative

If these perspectives do not fully align with your own, you can dive into the numbers and piece together your own view in just a few minutes, Do it your way.

A great starting point for your Chemed research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Uncover your next standout opportunity with these powerful tools that spotlight companies shaking up their industries and rewarding shareholders. You will not want to miss what these stock lists reveal.

- Unlock the potential of high-yield opportunities by checking out companies that excel at paying reliable income with dividend stocks with yields > 3%.

- Stay ahead of trends by targeting innovators at the forefront of tomorrow’s AI breakthroughs through the lens of AI penny stocks.

- Spot companies trading below their true worth and seize overlooked growth with the help of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal