Ziff Davis (ZD): Evaluating Valuation After Strong Q2 Results and Insider Share Buy

If you’re holding Ziff Davis (ZD) or considering a move, it’s been an eye-catching few weeks. The company just posted second quarter financial results that landed above expectations for both earnings and revenue, quickly followed by director Sarah Ann Fay purchasing 1,354 shares on September 15. These back-to-back developments have not only sparked brighter sentiment but also sent a clear signal that insiders may see value beneath the surface, prompting investors to reassess their outlook on the stock.

These new results and the insider buy come as the stock has been regaining ground after a challenging stretch. Over the past three months, Ziff Davis shares have climbed more than 20%, reversing a portion of last year’s slide. Year-to-date, however, the stock is still down and longer-term holders are yet to see a sustained recovery. Momentum is picking up after several quarters dominated by operational headwinds and sluggish performance, with recent financials acting as a possible catalyst for renewed interest.

With the price rally and signals of inside confidence now in focus, the big question is whether Ziff Davis is trading at a discount or if recent optimism has already baked in next year’s growth.

Most Popular Narrative: 15.5% Undervalued

The most widely followed narrative suggests that Ziff Davis is trading below its estimated fair value, positioning the stock as undervalued relative to its expected future performance.

Ziff Davis is benefiting from the growing demand for digital content, cloud-based solutions, and recurring subscription services. This is demonstrated by double-digit organic growth across Health & Wellness and Connectivity, as well as strong SaaS uptake. These factors support sustained revenue and margin expansion from recurring business models.

Looking to uncover why analysts think Ziff Davis has room to run? The story behind this rating hinges on bold growth assumptions and profit margin expansion. The real surprises are in the way future earnings could reshape its valuation. What are the key financial trends analysts say could set Ziff Davis apart from the crowd? The full narrative breaks down the numbers that drive this bullish calculation.

Result: Fair Value of $45.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on acquisitions and shifting digital advertising trends could challenge long-term profitability, which poses real risks to the bullish outlook.

Find out about the key risks to this Ziff Davis narrative.Another View: Industry Comparison

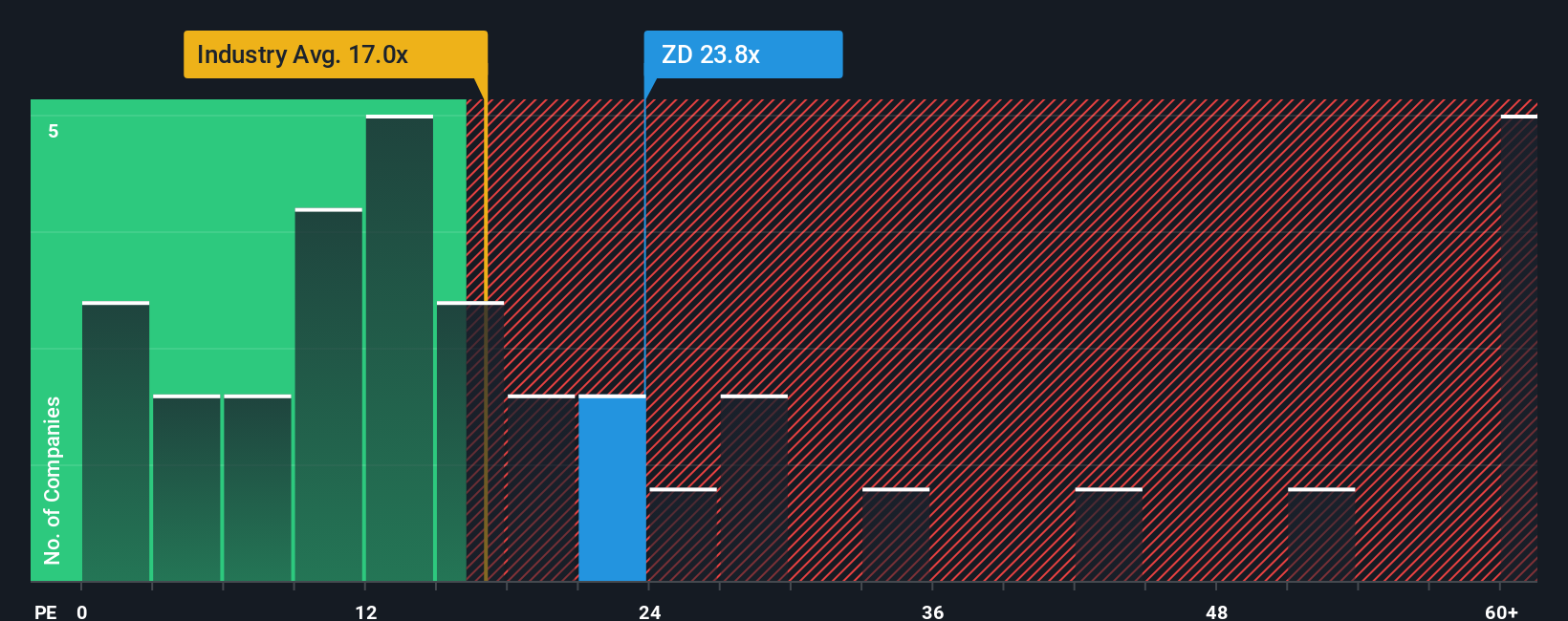

While analysts see Ziff Davis as undervalued on future growth, a look at its valuation against the broader industry tells a different story. Is the market pricing in too much optimism, or is potential still overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ziff Davis Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can assemble your own perspective in under three minutes with Do it your way.

A great starting point for your Ziff Davis research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Seeking More Smart Investment Opportunities?

Don't let your next great stock idea slip by. The Simply Wall Street Screener spotlights opportunities you might not have considered. Get ahead by exploring these standout themes:

- Unlock steady income potential and shield your portfolio from volatility by checking out dividend powerhouses offering dividend stocks with yields > 3%.

- Surf the tech trend and fuel your portfolio's growth by targeting companies leading the charge in artificial intelligence. Start with AI penny stocks.

- Tap into long-term value with stocks currently undervalued by the market, and see what's possible through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal