United Rentals (URI): Assessing Valuation Ahead of Management’s Presentation at Morgan Stanley’s Laguna Conference

United Rentals (URI) has caught the market’s eye this week as anticipation builds ahead of management’s scheduled appearance at Morgan Stanley’s 13th Annual Laguna Conference. These kinds of conferences might not always spark headlines, but they often serve as a window into how a company views its future and where its priorities lie. Whether you’re holding URI shares or watching from the sidelines, it’s worth considering what kinds of updates or outlooks might shift market expectations for this equipment rental leader.

The focus around the upcoming presentation comes after a year marked by substantial gains for United Rentals. The stock is up 25% over the past year, with a nearly 39% run from the start of the year that has dramatically outpaced the broader industrial sector. Momentum was especially strong over the past three months, with shares rising 37%. This suggests investors are warming to the company’s growth story even before any conference insights land. Along the way, moderate revenue and net income growth have reinforced a narrative of steady operational performance.

With investor interest surging and management set to address the market this week, the key question is whether United Rentals is trading at a bargain or if investors are already factoring its growth outlook into the price.

Most Popular Narrative: 3.7% Overvalued

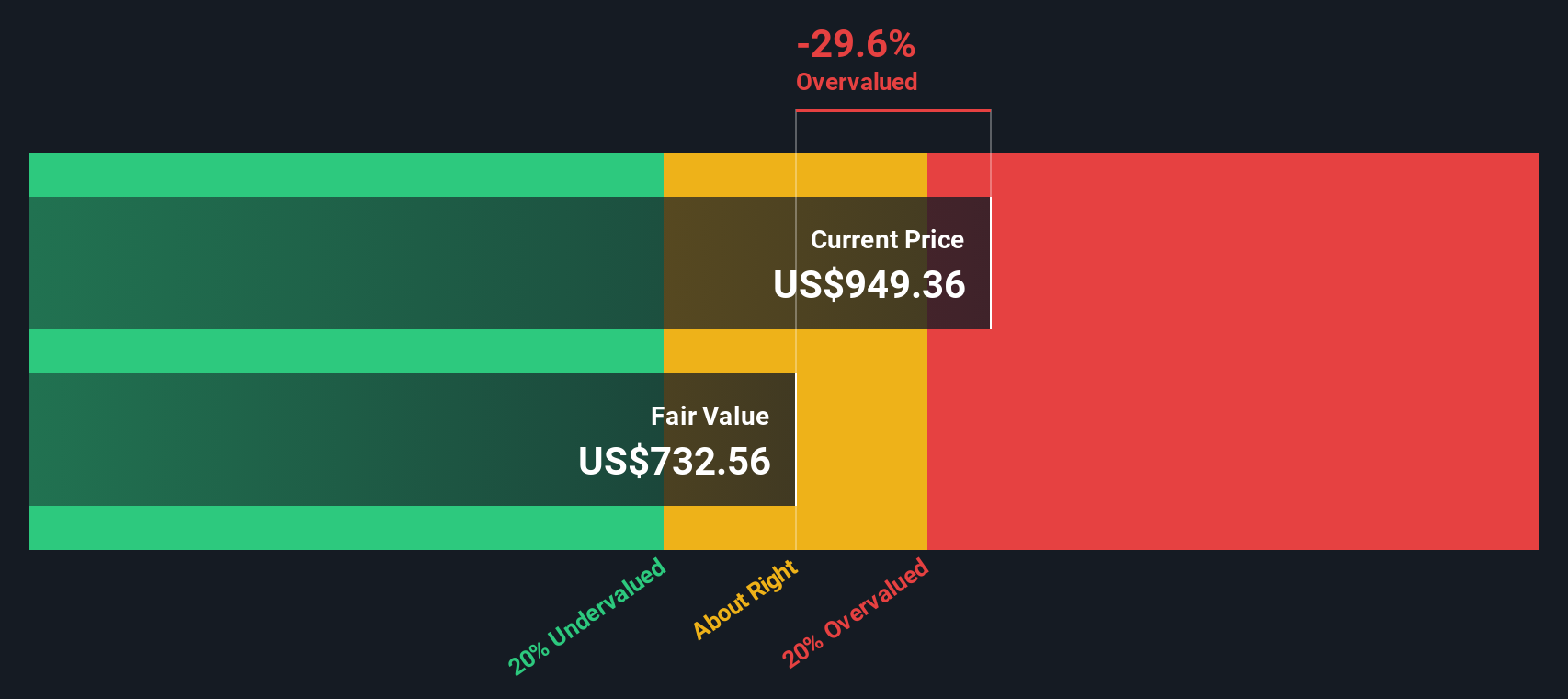

United Rentals is considered slightly overvalued based on the most widely followed narrative, with current prices trading about 3.7% above analysts’ consensus fair value. The valuation synthesizes forecasts for future growth, profitability, and sector dynamics into an updated price target.

Favorable macroeconomic developments, including lower interest rates, supportive legislative changes like 100% bonus depreciation, and potential tariff relief, are seen as catalysts for increased customer project activity. Upward biases to sector earnings estimates and the likelihood of positive EPS revisions are fueling multiple expansion and institutional optimism for the shares.

Craving the inside scoop on why United Rentals commands such a premium? The narrative’s value calculation rests on a bullish combination of future earnings momentum and ambitious growth assumptions. Wondering just how much blue-sky optimism is built in? There is one key financial lever that could make or break this valuation story. Find out what it is by diving into the full analysis.

Result: Fair Value of $924.70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain. United Rentals’ reliance on big projects and potential margin pressure from higher costs could challenge even the most optimistic forecasts.

Find out about the key risks to this United Rentals narrative.Another View: SWS DCF Model Weighs In

Looking at United Rentals through the SWS DCF model, we see a picture that differs from the earlier fair value estimate. This approach suggests the stock is overvalued. Could this signal an overly optimistic narrative?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own United Rentals Narrative

Feel free to dig into the numbers yourself. If you see things differently or want to build your perspective, you can put together your own view in just a couple of minutes. Do it your way

A great starting point for your United Rentals research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t leave potential gains on the table. Use Simply Wall Street’s powerful screener to spot tomorrow’s winning trends and companies most investors overlook.

- Discover hidden value by exploring undervalued stocks with strong earnings momentum and consistent cash flows through this screen: undervalued stocks based on cash flows

- Explore the future of medicine by finding advancements and growth potential among pioneers driving AI innovation in healthcare: healthcare AI stocks

- Identify the next market breakthrough by focusing on companies transforming our world with quantum technologies: quantum computing stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal