3 Stocks That May Be Trading Below Their Estimated Intrinsic Values

As the U.S. stock market experiences record highs with the Nasdaq and S&P 500 leading the charge, investors are closely watching upcoming Federal Reserve decisions that could influence borrowing costs. In this environment, identifying stocks that may be trading below their estimated intrinsic values can offer opportunities for those seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Phibro Animal Health (PAHC) | $39.62 | $77.67 | 49% |

| Peapack-Gladstone Financial (PGC) | $29.29 | $56.54 | 48.2% |

| Northwest Bancshares (NWBI) | $12.52 | $24.41 | 48.7% |

| Niagen Bioscience (NAGE) | $9.61 | $18.68 | 48.6% |

| Metropolitan Bank Holding (MCB) | $77.45 | $150.26 | 48.5% |

| McGraw Hill (MH) | $14.83 | $28.60 | 48.1% |

| Investar Holding (ISTR) | $22.67 | $44.88 | 49.5% |

| Horizon Bancorp (HBNC) | $16.25 | $31.81 | 48.9% |

| Glaukos (GKOS) | $82.76 | $161.26 | 48.7% |

| AGNC Investment (AGNC) | $10.18 | $20.18 | 49.6% |

Here's a peek at a few of the choices from the screener.

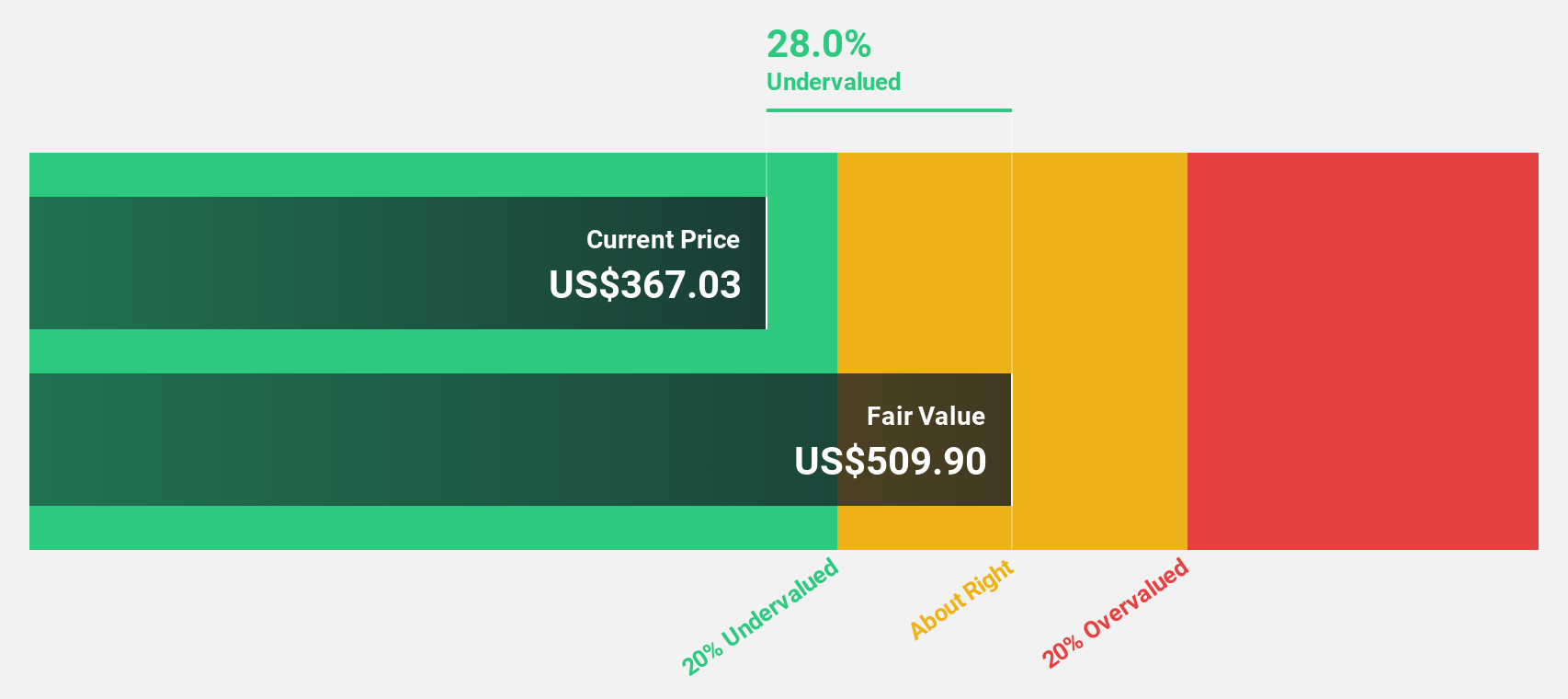

LPL Financial Holdings (LPLA)

Overview: LPL Financial Holdings Inc. offers a comprehensive platform of brokerage and investment advisory services to independent financial advisors and institutional financial advisors in the United States, with a market cap of approximately $28.05 billion.

Operations: The company's revenue primarily stems from its brokerage segment, which generated approximately $13.78 billion.

Estimated Discount To Fair Value: 29.6%

LPL Financial Holdings is trading at US$350.64, significantly below its estimated fair value of US$497.96, suggesting potential undervaluation based on cash flows. Despite slower revenue growth forecasts of 14.4% annually, earnings are expected to grow at 18.1%, outpacing the broader U.S. market's growth rate of 15.4%. Recent onboarding of $12 billion in assets from First Horizon Bank and strategic acquisitions bolster its institutional services platform and future cash flow potential.

- According our earnings growth report, there's an indication that LPL Financial Holdings might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of LPL Financial Holdings.

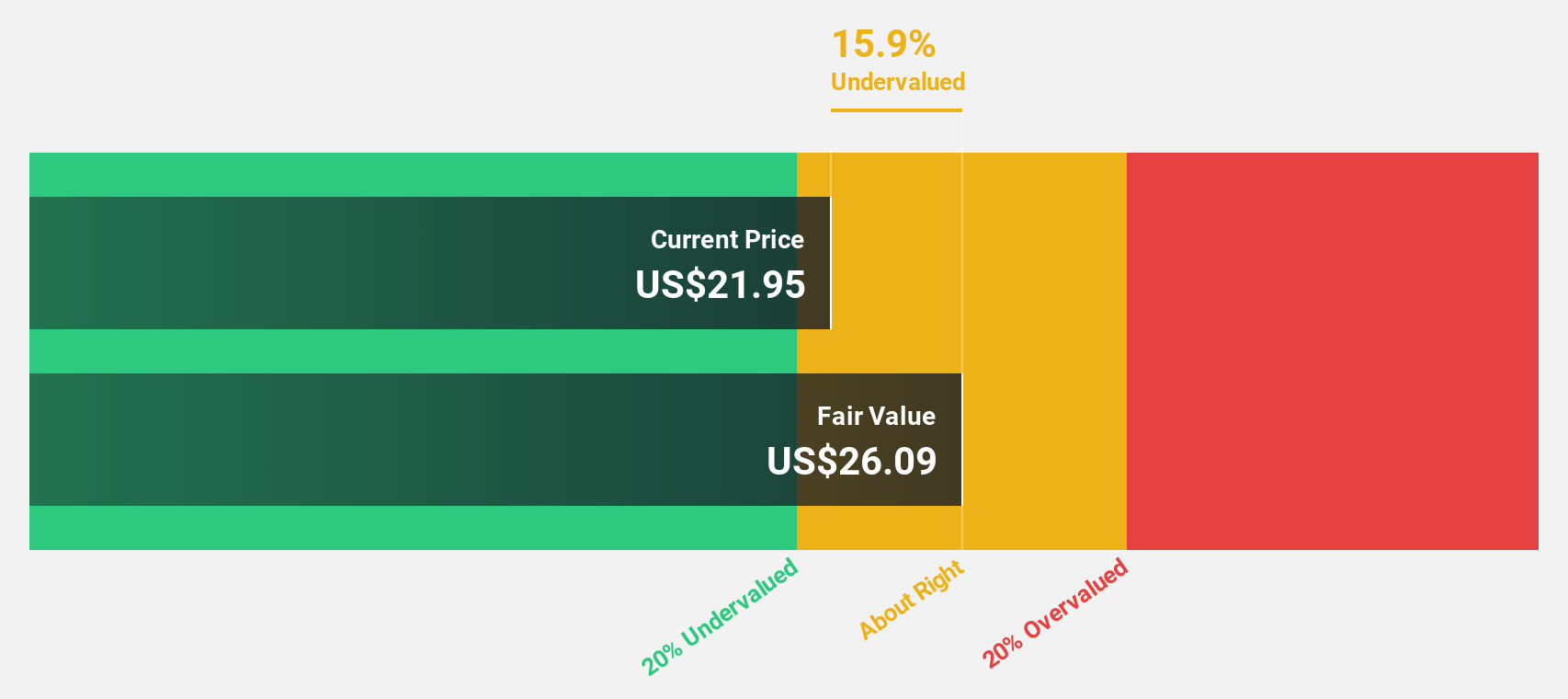

Bloom Energy (BE)

Overview: Bloom Energy Corporation designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation both in the United States and internationally, with a market cap of approximately $15.74 billion.

Operations: The company generates revenue primarily through its electric equipment segment, which accounted for $1.63 billion.

Estimated Discount To Fair Value: 28.6%

Bloom Energy is trading at US$67.26, significantly below its estimated fair value of US$94.19, highlighting undervaluation based on cash flows. Despite recent volatility and insider selling, the company has turned profitable with earnings projected to grow 44.23% annually, surpassing the U.S. market average of 15.4%. Revenue growth is forecasted at 17% per year, supported by strategic partnerships and expansions in data center power solutions like those with Oracle Cloud Infrastructure.

- Our comprehensive growth report raises the possibility that Bloom Energy is poised for substantial financial growth.

- Get an in-depth perspective on Bloom Energy's balance sheet by reading our health report here.

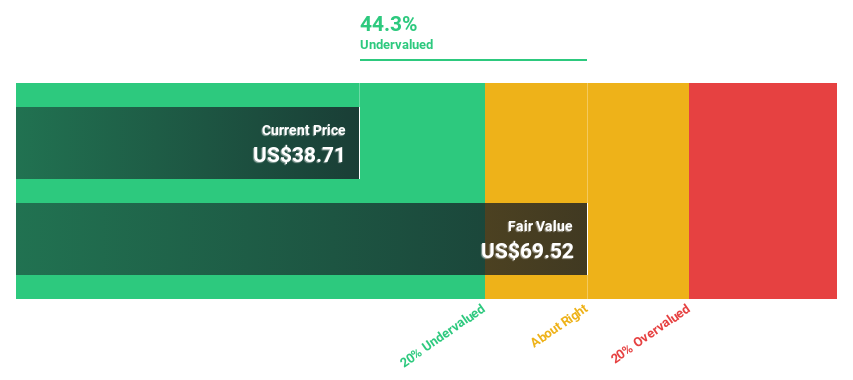

Citizens Financial Group (CFG)

Overview: Citizens Financial Group, Inc. is a bank holding company that offers retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States with a market cap of $22.35 billion.

Operations: The company's revenue is primarily derived from Consumer Banking, which contributes $5.65 billion, and Commercial Banking, which adds $2.37 billion.

Estimated Discount To Fair Value: 11.4%

Citizens Financial Group, trading at US$51.82, is undervalued relative to its estimated fair value of US$58.51 based on cash flow analysis. The company reported a net income increase to US$436 million for Q2 2025 and forecasts earnings growth of 22.1% annually, outpacing the U.S. market average of 15.4%. Recent preferred stock buybacks and executive appointments may positively influence financial stability and strategic direction moving forward.

- Our earnings growth report unveils the potential for significant increases in Citizens Financial Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Citizens Financial Group.

Next Steps

- Reveal the 191 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal