Bright Horizons Family Solutions (BFAM): Assessing Valuation Following Standout Multi-Year Earnings Growth

Most Popular Narrative: 19.6% Undervalued

According to the most widely followed analyst consensus, Bright Horizons Family Solutions is currently trading at a notable discount to its calculated fair value. This suggests market skepticism may be overstating the near-term risks or underestimating future growth opportunities for the company.

"Global market expansion, particularly in the U.K., is yielding sustained enrollment and margin gains. Progress toward breakeven and beyond in the U.K. segment, supported by expanded government funding, is expected to diversify revenue streams and reduce exposure to U.S.-centric risks. This could provide a more robust earnings base and support international growth."

Curious why analysts think this stock is still flying under the radar? The full narrative hints at bold profit margin improvements, ambitious worldwide growth plans and financial assumptions that could surprise even the most optimistic investor. Want to discover the numbers and projections that shape this undervalued call? The details behind this thesis might just surprise you.

Result: Fair Value of $140.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent low enrollment or continued operational challenges could limit revenue growth and put pressure on profit margins. This could potentially shift the outlook ahead.

Find out about the key risks to this Bright Horizons Family Solutions narrative.Another View: Market Compares Differently

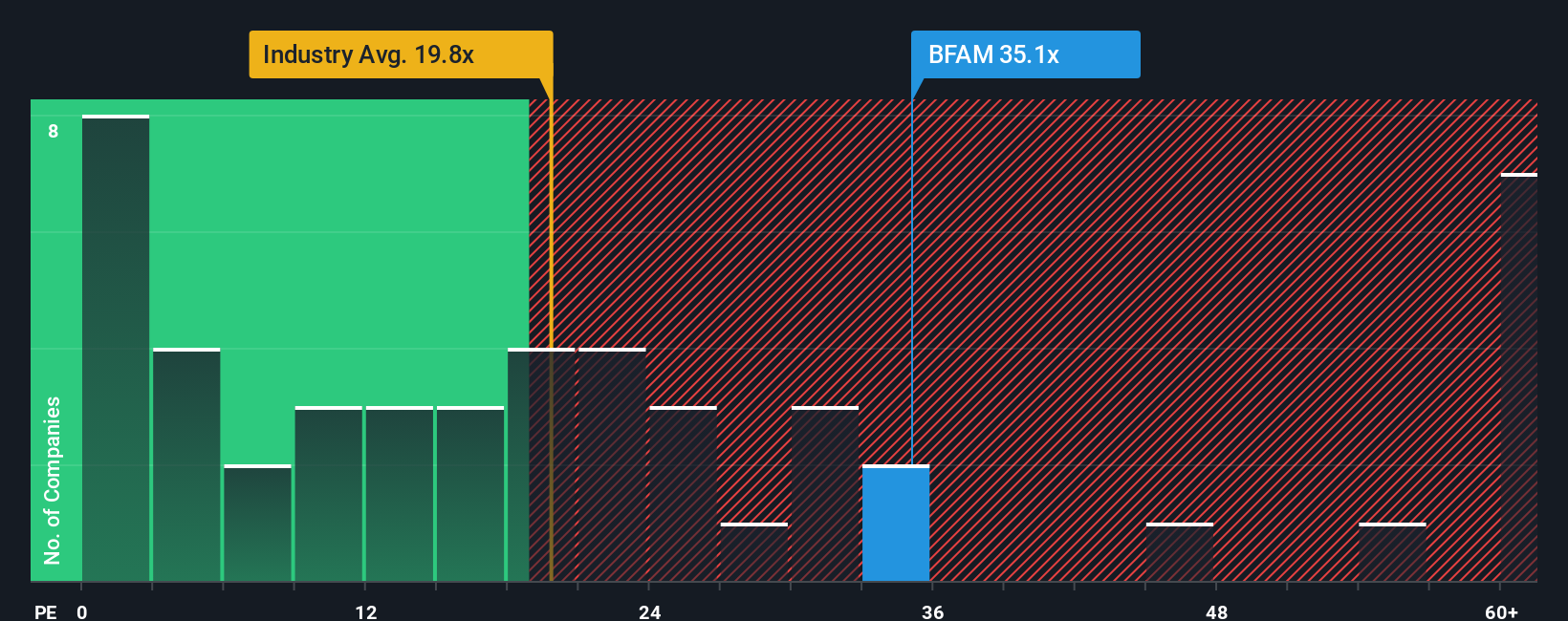

While analyst forecasts suggest Bright Horizons Family Solutions is undervalued based on forward-looking growth, a look at its current price-to-earnings ratio tells another story. The company appears expensive compared to the industry. Which perspective best reflects reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bright Horizons Family Solutions Narrative

If you want to dive deeper or have a different perspective, it’s easy to look at the numbers yourself and draft your own narrative in just a few minutes. Do it your way

A great starting point for your Bright Horizons Family Solutions research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't stop at just one opportunity. Seize the chance to broaden your horizons and power up your portfolio with fresh, data-driven stock picks right now. You’ll want to see what else is waiting for savvy investors who take that next step.

- Amplify your returns by targeting overlooked bargains with strong fundamentals using our tool for undervalued stocks based on cash flows.

- Tap into the potential of tomorrow’s healthcare breakthroughs with companies trailblazing in medical innovation through our resource for healthcare AI stocks.

- Uncover hidden gems at the intersection of finance and decentralization with top picks from our hub for cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal