LyondellBasell Industries (LYB): Assessing Valuation After Major Shift in Capital Allocation Policy

Most Popular Narrative: 9.9% Undervalued

The most widely followed narrative sees LyondellBasell as undervalued, with its fair value estimated to be nearly 10% above the current share price.

"LyondellBasell's strategic investments in circular and advanced recycling (MoReTec-1 and plans for MoReTec-2, plus expanding renewable feedstock capacity in Europe) position the company to benefit from rising regulatory and consumer demand for recycled and sustainable plastics. This is expected to improve product mix and support higher net margins and long-term revenue growth."

What is the secret formula that fuels this bullish valuation? Analysts are betting on a powerful combination of rising earnings, better margins, and big changes in LyondellBasell’s operations. Want to know which numbers truly move the needle for this fair value? Dive deeper and uncover the quantitative levers that drive this forecast.

Result: Fair Value of $61.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, prolonged industry downturns or delays in major growth investments could undermine these bullish expectations and challenge LyondellBasell’s ability to meet future targets.

Find out about the key risks to this LyondellBasell Industries narrative.Another View: Market-Based Valuation Signals a Different Story

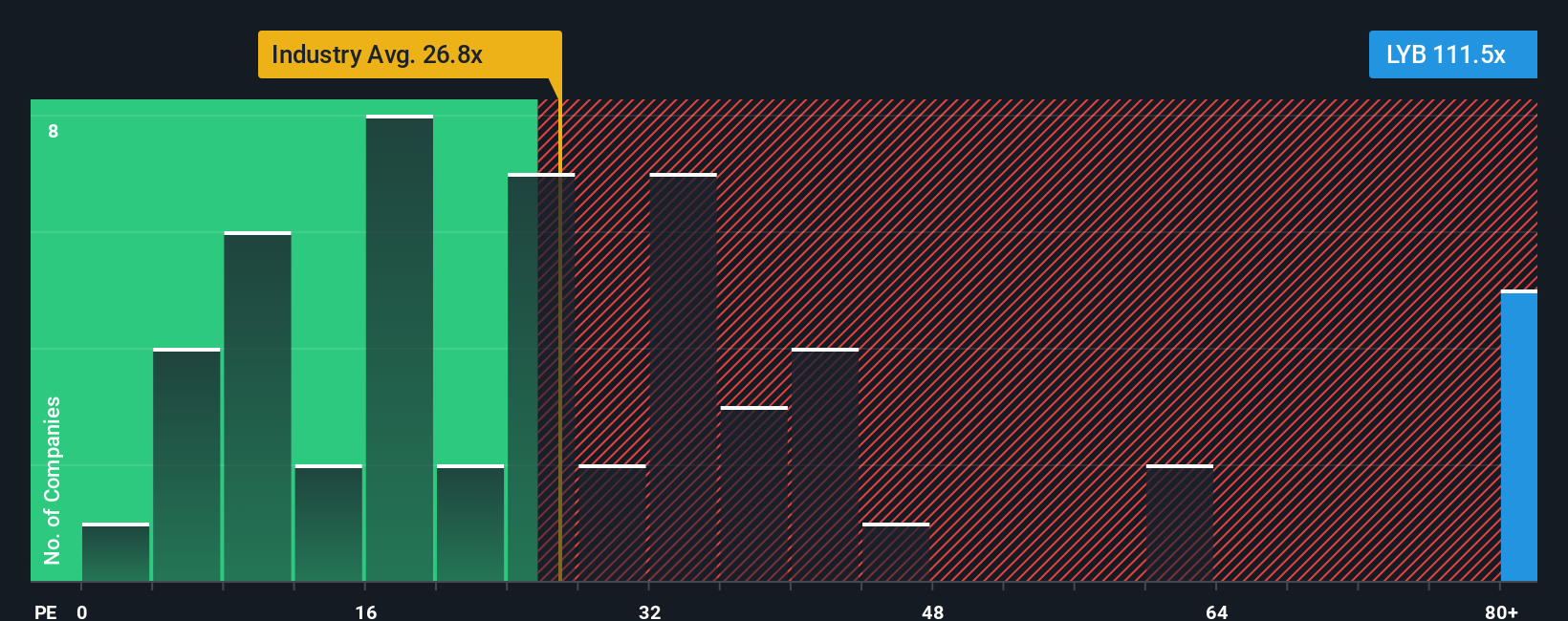

While fair value estimates look attractive, a glance at market pricing metrics tells another story. Compared to the industry, LyondellBasell appears expensive on earnings. This raises a new question: is the optimism overdone, or does the market see risks others miss?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LyondellBasell Industries Narrative

If you see the story differently or want to dive into the numbers yourself, you can build your own perspective in just a few minutes. Do it your way.

A great starting point for your LyondellBasell Industries research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

You don't want to let great ideas slip by. Give yourself an edge by expanding your watchlist with other compelling opportunities hand-picked for investors who want more from their portfolio.

- Power up your returns by targeting companies delivering steady income and strong balance sheets through dividend stocks with yields > 3%.

- Spot tomorrow’s disruptors by checking out emerging innovators with AI penny stocks.

- Capitalize on untapped value by browsing well-priced stocks showing real growth potential via undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal