A Look at Celanese (CE) Valuation Following Stronger-Than-Expected Q2 Earnings and Upbeat Guidance

Most Popular Narrative: 16.6% Undervalued

Celanese is currently viewed as undervalued by the most popular narrative, suggesting the stock has significant upside potential relative to its fair value estimate.

Celanese's investments in green chemistry and downstream product diversification position it to capture share as demand accelerates for sustainable materials. This trend is driven by both tightening environmental regulation and increased consumer focus on circular solutions, which supports long-term top-line and margin expansion.

Curious why analysts are so bullish? The foundation of this narrative is a set of aggressive growth and profitability assumptions that you might not expect from a legacy chemicals company. Wondering which surprising levers could drive Celanese's comeback? The underlying math points to a future valuation more often seen in faster-growing industries.

Result: Fair Value of $54.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, prolonged weak demand or persistent overcapacity in Celanese’s core markets could undermine the optimistic outlook and delay any sustained earnings recovery.

Find out about the key risks to this Celanese narrative.Another View: Sizing Up a Different Valuation Model

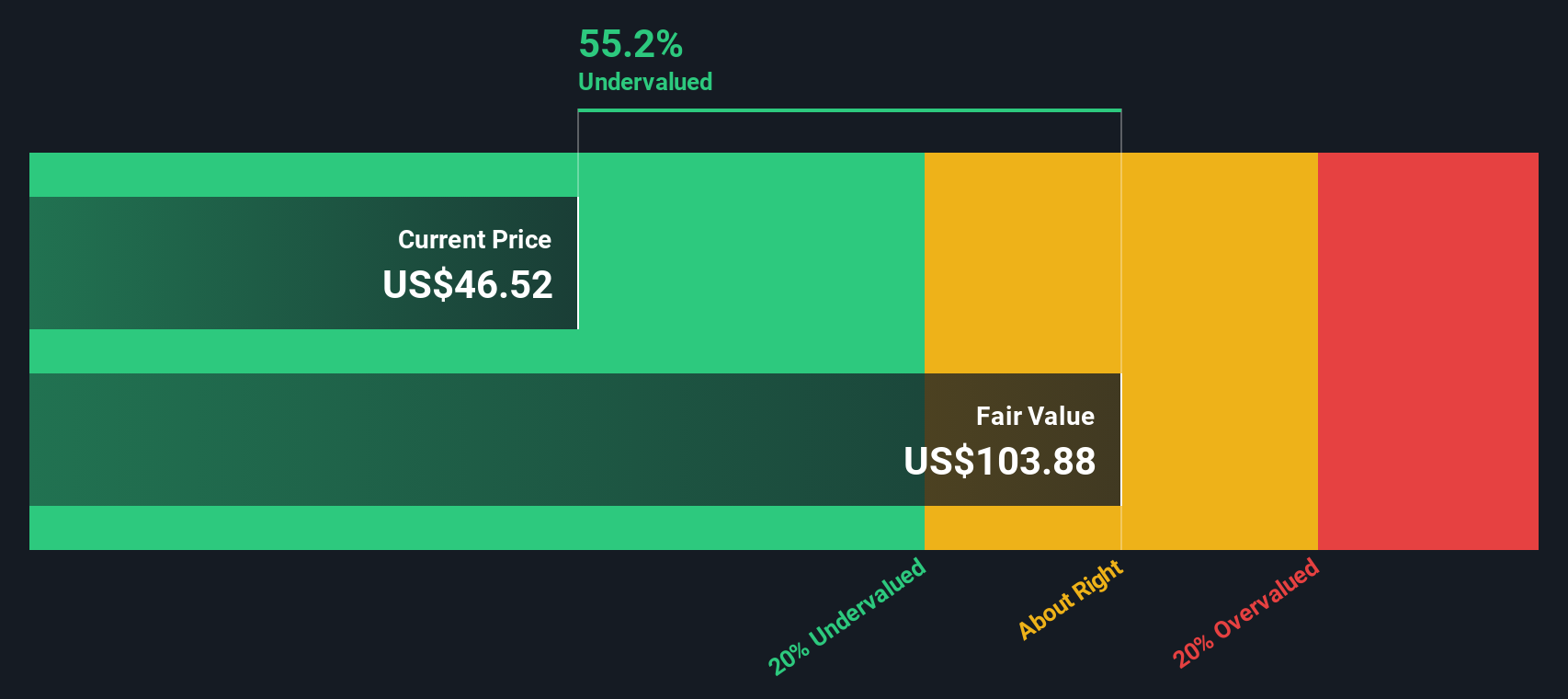

A separate take comes from our DCF model, which also sees Celanese as undervalued. This method weighs the company’s future cash flows rather than recent earnings or sales multiples. Will both models prove right, or could the market have missed something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Celanese Narrative

If you see things differently or want to dig deeper into the numbers, you can craft a personalized Celanese story in just a few minutes. Do it your way.

A great starting point for your Celanese research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Take the next step and seize the chance to uncover stand-out stocks tailored to your goals. Don’t miss out on these handpicked ideas that could help power your portfolio forward.

- Capture superior yields by scanning the market for leading companies offering substantial dividend returns with the help of dividend stocks with yields > 3%.

- Jump into the fast lane by targeting next-generation breakthroughs with AI penny stocks fueling AI-driven innovation.

- Uncover bargains before the crowd by using undervalued stocks based on cash flows to spot quality stocks trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal