Is Ashland’s (ASH) Earnings Miss and Outlook Revision Reshaping Its Long-Term Growth Narrative?

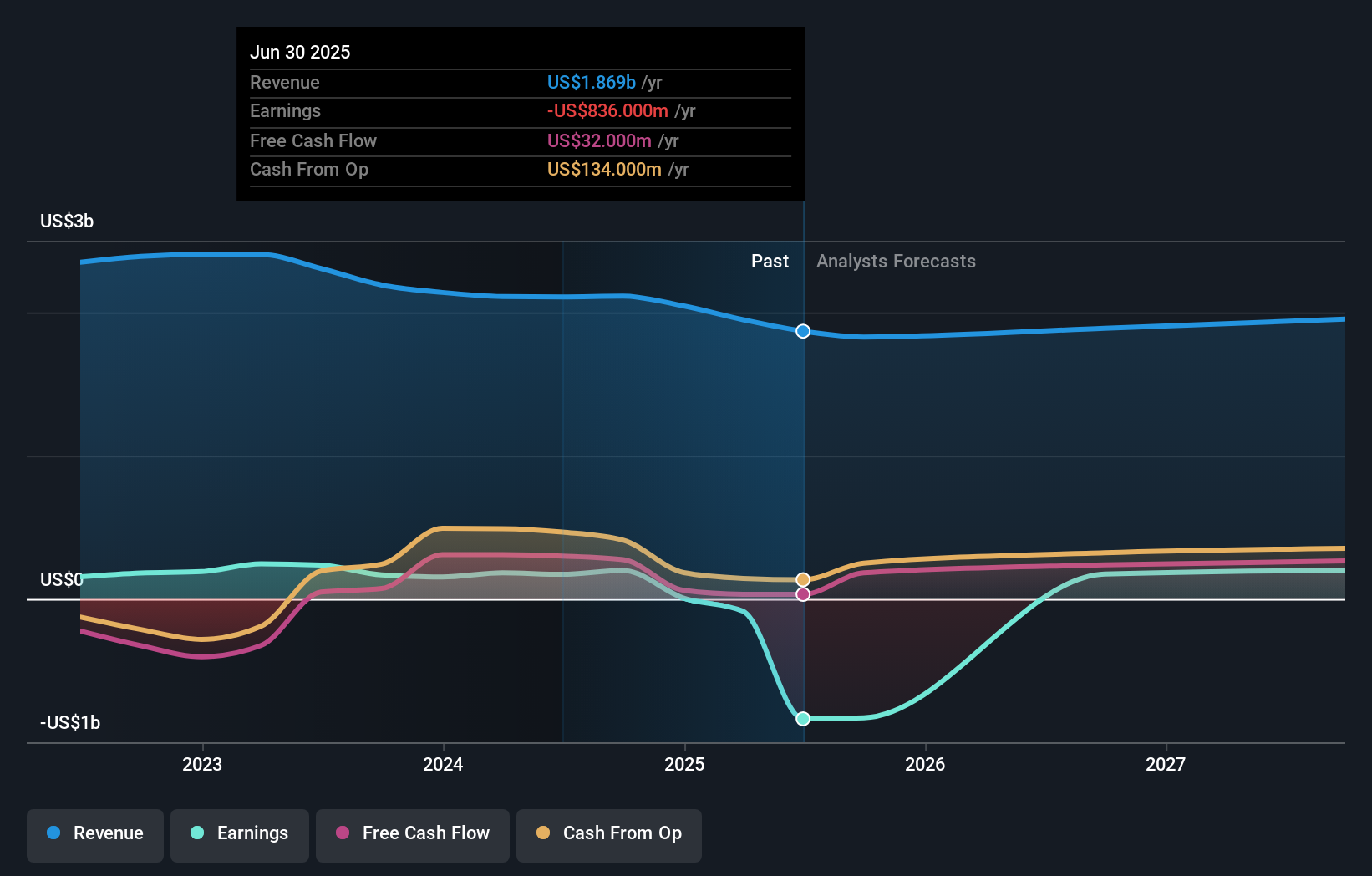

- Ashland Inc. recently reported its fiscal third quarter 2025 results, missing earnings estimates for a second consecutive quarter as sales declined 15% year-over-year due to portfolio optimization efforts and weaker demand across all segments.

- Following the announcement, the company updated its full-year outlook to reflect a stable but subdued macroeconomic environment with ongoing pressures in Specialty Additives and Intermediates, prompting analysts to lower their earnings forecasts.

- We'll examine how the ongoing demand weakness in key business segments could shift Ashland's longer-term investment narrative and growth assumptions.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ashland Investment Narrative Recap

Being a shareholder in Ashland means believing that its pivot toward higher-margin, specialty chemicals can eventually deliver resilient growth and margin expansion, particularly through sustainability, innovation, and end-market stability. The recent disappointing earnings report, driven by broad-based demand weakness and steep sales declines, casts doubt on the near-term rebound and amplifies the key risk that persistent softness in Specialty Additives and Intermediates could linger, overshadowing any immediate gains from ongoing cost savings or portfolio changes. This miss is material for the stock’s short-term outlook, as it directly impacts investor confidence in the company’s ability to deliver sustained topline and earnings recovery.

Of the recent company actions, the large $706 million non-cash goodwill impairment stands out as most relevant to the earnings shock, reinforcing skepticism around Ashland’s sustainable profit trajectory and future returns on capital. This charge, prompted by valuation compression and weak market performance, feeds into the ongoing debate around whether recent restructuring and portfolio pruning can drive more than cost relief, or if deeper, structural demand and innovation challenges need to be addressed for Ashland to reclaim momentum.

By contrast, the extent of lingering volume weakness, especially in structurally challenged segments, raises a host of issues that investors should be aware of, including whether...

Read the full narrative on Ashland (it's free!)

Ashland's narrative projects $2.0 billion in revenue and $347.1 million in earnings by 2028. This requires 1.9% yearly revenue growth and a $1,183.1 million increase in earnings from the current level of -$836.0 million.

Uncover how Ashland's forecasts yield a $64.70 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Community contributors at Simply Wall St set fair value targets on Ashland ranging from US$64.70 to US$119.72, reflecting just 2 distinct outlooks. While some see deep undervaluation, many are watching closely to see if persistent demand softness in core segments signals a more structural challenge for long-term growth. Explore several viewpoints to shape your own understanding.

Explore 2 other fair value estimates on Ashland - why the stock might be worth over 2x more than the current price!

Build Your Own Ashland Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ashland research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ashland research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ashland's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal