A Fresh Look at DRDGOLD (NYSE:DRD) Valuation After Earnings Upgrade and Sector-Beating Performance

If you have been watching DRDGOLD (NYSE:DRD), the latest headlines may have caught your attention. A recent upgrade to a Zacks Rank #1, signaling a strong bullish case according to the research provider, has put the stock in the spotlight. Add to that an 80% jump in full-year earnings estimates in the past quarter, and you have a recipe for heightened investor interest, especially from those laser-focused on growth and profitability trends.

This surge comes as DRDGOLD has outshined its Basic Materials peers by a substantial margin year-to-date, delivering returns above 165%. The rally over the past month and quarter is hard to ignore, and the stock’s long-term performance has also outpaced many sector rivals. This suggests that momentum is currently building rather than fading. Investors have taken note of DRDGOLD’s reliable revenue growth while the broader sector has remained more subdued.

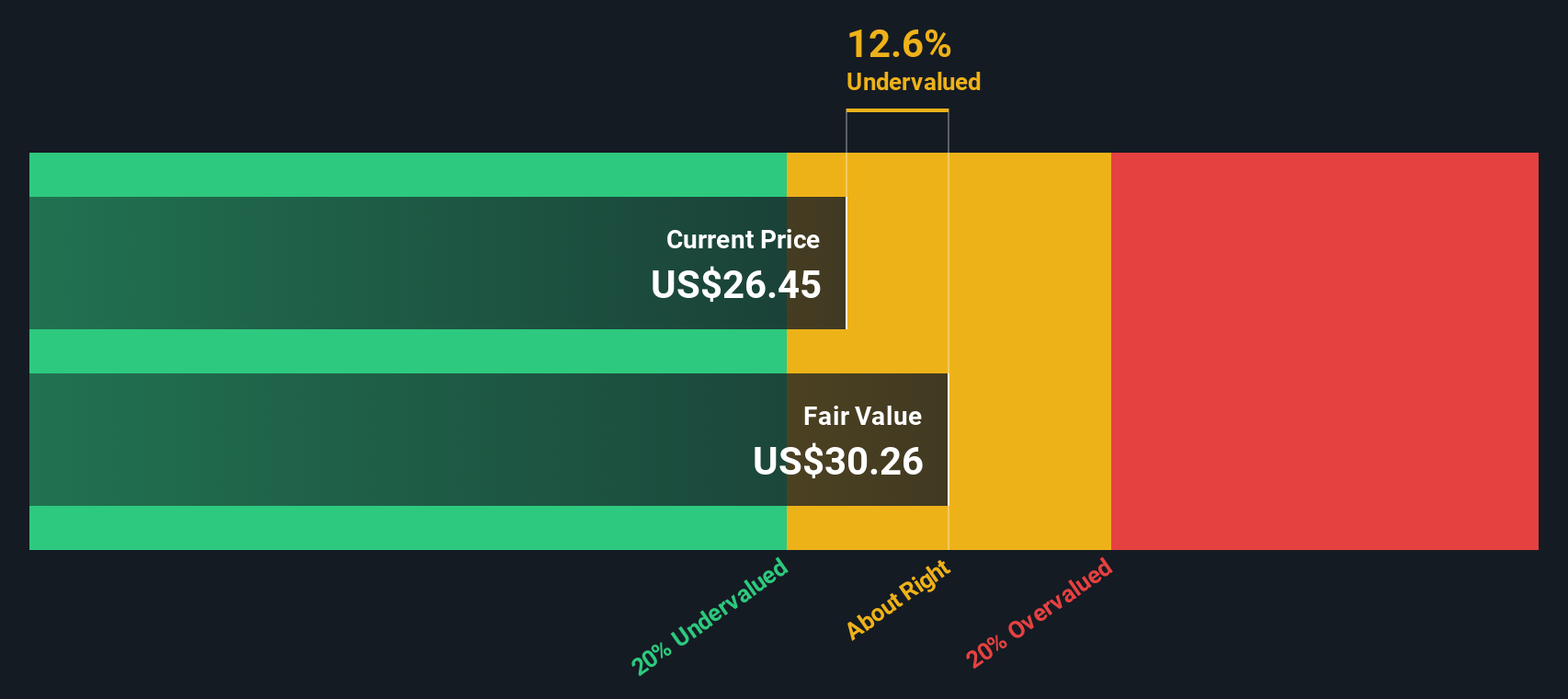

With such a significant run-up and improving forecasts, the key question now is whether DRDGOLD is still trading at a compelling value or if today’s price already reflects all the upside that recent earnings momentum suggests.

Price-to-Earnings of 15x: Is it justified?

Based on the price-to-earnings (P/E) ratio, DRDGOLD is considered undervalued compared to both the broader US market and its industry peers. The company's P/E multiple stands at 15x, which is below the US market average and the Metals and Mining industry average.

The price-to-earnings ratio measures how much investors are willing to pay per dollar of earnings. It is a widely used metric for comparing valuation across companies and sectors. In capital-intensive industries like mining, a lower P/E can indicate either perceived risk or untapped growth potential.

This relatively low multiple suggests the market may be underestimating DRDGOLD's earnings strength, especially given its outperformance in key profitability measures and growth metrics. The company’s robust earnings growth and improving profit margins further support the notion that the current valuation is justified and may present a compelling opportunity for investors seeking value in the sector.

Result: Fair Value of $22.42 (ABOUT RIGHT)

See our latest analysis for DRDGOLD.However, analyst price targets currently sit below the latest close. Any slowdown in revenue growth could quickly challenge the prevailing bullish momentum.

Find out about the key risks to this DRDGOLD narrative.Another View: The SWS DCF Model Weighs In

While multiples indicate that DRDGOLD appears attractive, our DCF model offers a more cautious perspective. The model suggests the stock is trading above what fundamental cash flows might support. Which method will be more accurate in the long run?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DRDGOLD Narrative

If you want to take a different angle or dig deeper on the data, you can create your own narrative. It only takes a few minutes. Do it your way

A great starting point for your DRDGOLD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your portfolio to just one opportunity. Unlock potential in other sectors and themes with these hand-picked ideas that could shape your next big investing move.

- Uncover opportunities in companies harnessing the power of artificial intelligence with our AI penny stocks. Tap into the future of innovation.

- Target market-beating returns by focusing on stocks trading below their fair value through our undervalued stocks based on cash flows. Give your portfolio a value-focused edge.

- Secure consistent income streams by finding businesses offering high yields with our dividend stocks with yields > 3%. Boost your cash flow for the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal