How Investors May Respond To Reliance (RS) Analyst Upgrade and Expanded Asset-Backed Securities Issuance

- In the past week, Reliance Industries saw a boost in market valuation as JP Morgan initiated coverage with a positive outlook and the company expanded its asset-backed securities issuance to Rs 21,000 crore due to strong investor demand.

- This combination of increased analyst confidence and robust capital-raising activity highlights rising market trust in Reliance's financial strategy and growth prospects.

- We'll examine how elevated analyst sentiment and Reliance's expanded funding efforts shape its broader investment narrative moving forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Reliance Investment Narrative Recap

Being a Reliance shareholder often means believing in sustained demand for its specialty steels and engineered materials, underpinned by infrastructure and electrification projects. Recent bullish coverage from JP Morgan and heightened investor interest in Reliance’s expanded Rs 21,000 crore asset-backed securities issuance signal short-term analyst optimism and ample funding access, but do not fundamentally alter the importance of customer demand stability or the risk of persistent pricing pressures from tariff and supply chain volatility.

Among this week’s announcements, the upsize of Reliance's asset-backed securities issuance stands out, reinforcing the market’s willingness to support Reliance’s funding needs even as margin management amid cost inflation remains a central challenge.

By contrast, investors should be aware that strong fundraising and analyst sentiment mean little if trade policy uncertainty and weaker demand continue to squeeze margins and threaten earnings stability...

Read the full narrative on Reliance (it's free!)

Reliance's outlook anticipates $15.3 billion in revenue and $1.0 billion in earnings by 2028. This implies a 3.7% annual revenue growth rate and a $262 million earnings increase from current earnings of $737.9 million.

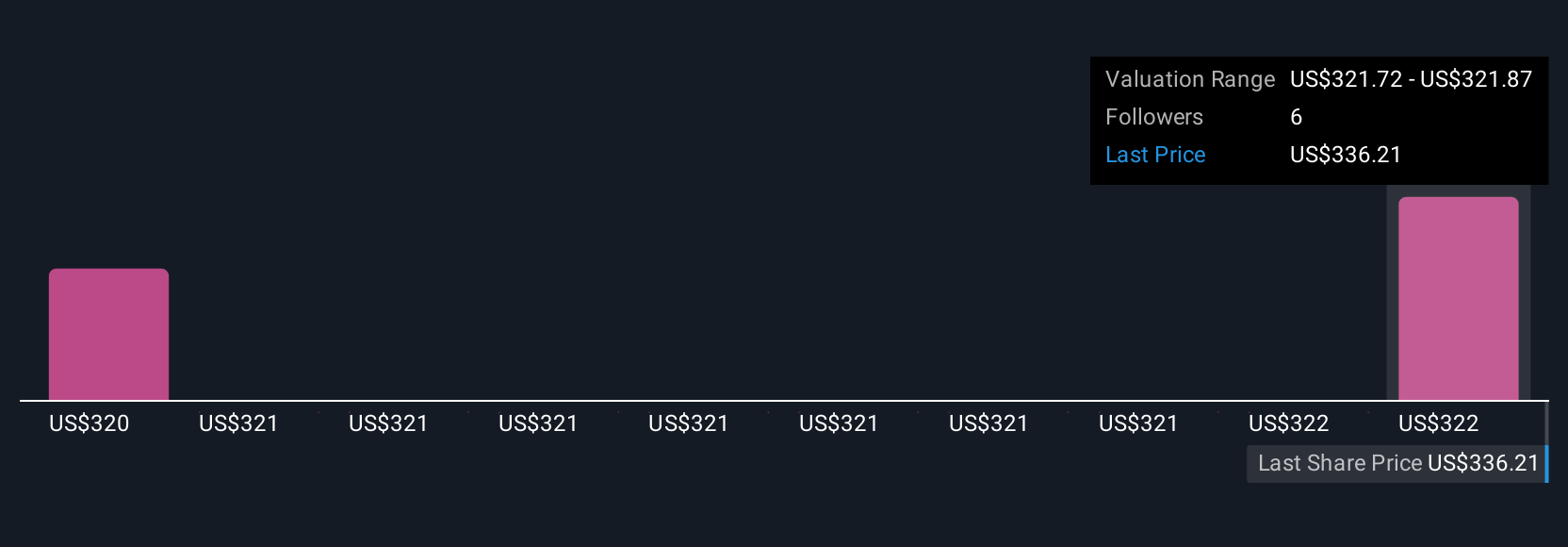

Uncover how Reliance's forecasts yield a $329.12 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Reliance's fair value between US$234 and US$329 per share, with two distinct viewpoints reflected. While funding capacity appears strong for now, opinions differ widely if weaker end market demand could still cap the company’s long-term upside.

Explore 2 other fair value estimates on Reliance - why the stock might be worth as much as 13% more than the current price!

Build Your Own Reliance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reliance research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Reliance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reliance's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal