A Fresh Look at Strategic Education (STRA) Valuation Following Analyst Buy Calls and Sophia Learning Growth

Most Popular Narrative: 19.3% Undervalued

According to the most widely followed narrative, Strategic Education is currently viewed as significantly undervalued by analysts, who believe its price does not fully account for future profit and margin improvements.

Strategic Education is benefiting from strong enrollment growth, particularly through its corporate partnerships. This could drive continued revenue growth as employer-affiliated enrollment increased by 16% in 2024. The Education Technology Services segment is experiencing significant growth, with revenue increasing by more than 30% in 2024, primarily through the Sophia Learning direct-to-consumer portal and expanding corporate partnerships. This expansion has the potential to boost earnings.

Curious why the market might be missing the big picture? The narrative points to bold growth assumptions and a future profit profile that is usually seen in high-flyers. The real surprise is that analyst models bank on improvements that, if achieved, could transform the company's valuation story.

Result: Fair Value of $102.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, such as regulatory shifts in Australia or rising costs in education technology. These factors could challenge the bullish case for Strategic Education.

Find out about the key risks to this Strategic Education narrative.Another View: What Does the SWS DCF Model Say?

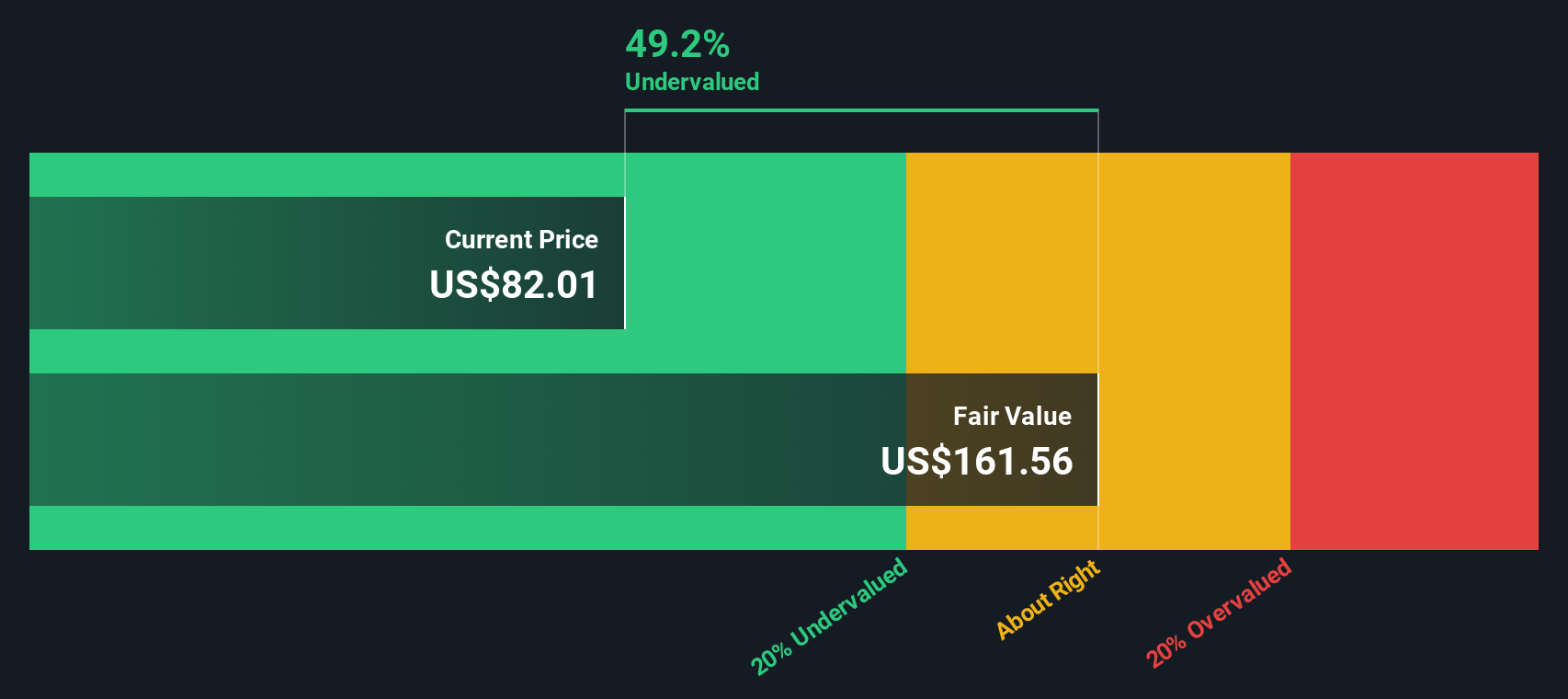

Taking a different angle, our SWS DCF model also points to undervaluation, adding weight to the idea that Strategic Education could be trading below its true worth. However, does this approach capture everything?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Strategic Education Narrative

If you have a different perspective or want to dive deeper, you can quickly build your own view on the data in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Strategic Education.

Looking for More Investment Opportunities?

Don't just stop at one stock. Broaden your horizon and seize opportunities across other sectors with tools designed to give you an edge before the crowd catches on.

- Spot undervalued gems positioned for a breakout with our undervalued stocks based on cash flows, a tool that highlights companies trading below their estimated worth.

- Unlock the ongoing evolution in healthcare by checking out healthcare AI stocks. This resource showcases artificial intelligence driving life-saving advances and industry transformation.

- Tap into high-yield potential and build income strength with dividend stocks with yields > 3%, focusing on stocks offering attractive dividend payouts above market averages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal