A Look at OSI Systems's Valuation Following Major $26 Million Security Division Contract

OSI Systems (OSIS) just landed a major $26 million contract for its Security division, and investors are already taking notice. The company will be supplying radio frequency based systems, which are built to detect and prevent threats against public safety and infrastructure. This announcement is not just a headline; it signals a real customer commitment to OSI’s threat detection technology and suggests more institutions may be ready to follow suit as security needs evolve.

Following the announcement, shares of OSI Systems jumped 3.5%, expanding gains from earlier this year. Over the past year, the stock surged 62%, and since January it is up 42%. Longer-term investors have also seen substantial returns, with nearly double the value over five years. While the Security division’s latest win drew attention this week, these numbers show OSI’s momentum has been building for some time, fueled by broader demand for security and healthcare technology.

After a steady run and this new contract in hand, is OSI Systems now trading at an attractive price, or is the market already anticipating even bigger wins ahead?

Most Popular Narrative: 5.9% Undervalued

According to the most widely followed analysis, OSI Systems appears to be moderately undervalued, with the current share price offering a discount compared to the projected fair value. This is based on expectations for future earnings growth, profit margins, and industry conditions.

Significant, multi-year funding from recent U.S. government legislation for border, port, infrastructure, and large-scale event security (including the "Big Beautiful Bill" and Golden Dome program) is expected to drive a sustained increase in demand for advanced security screening systems and RF/radar technologies. This positions OSI for higher long-term revenue growth and expansion of its addressable market.

Curious why analysts see untapped upside? There is a set of bold financial projections behind this valuation, but it all hinges on strong momentum, expanding margins, and a forward-looking profit multiple. Want to know what growth signals are fueling this optimism? The details might surprise you in the full narrative break-down.

Result: Fair Value of $249.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy dependence on government contracts and delayed payments from sovereign customers could expose OSI Systems to unpredictable fluctuations in revenue and cash flow.

Find out about the key risks to this OSI Systems narrative.Another View: Valuation Through a Different Lens

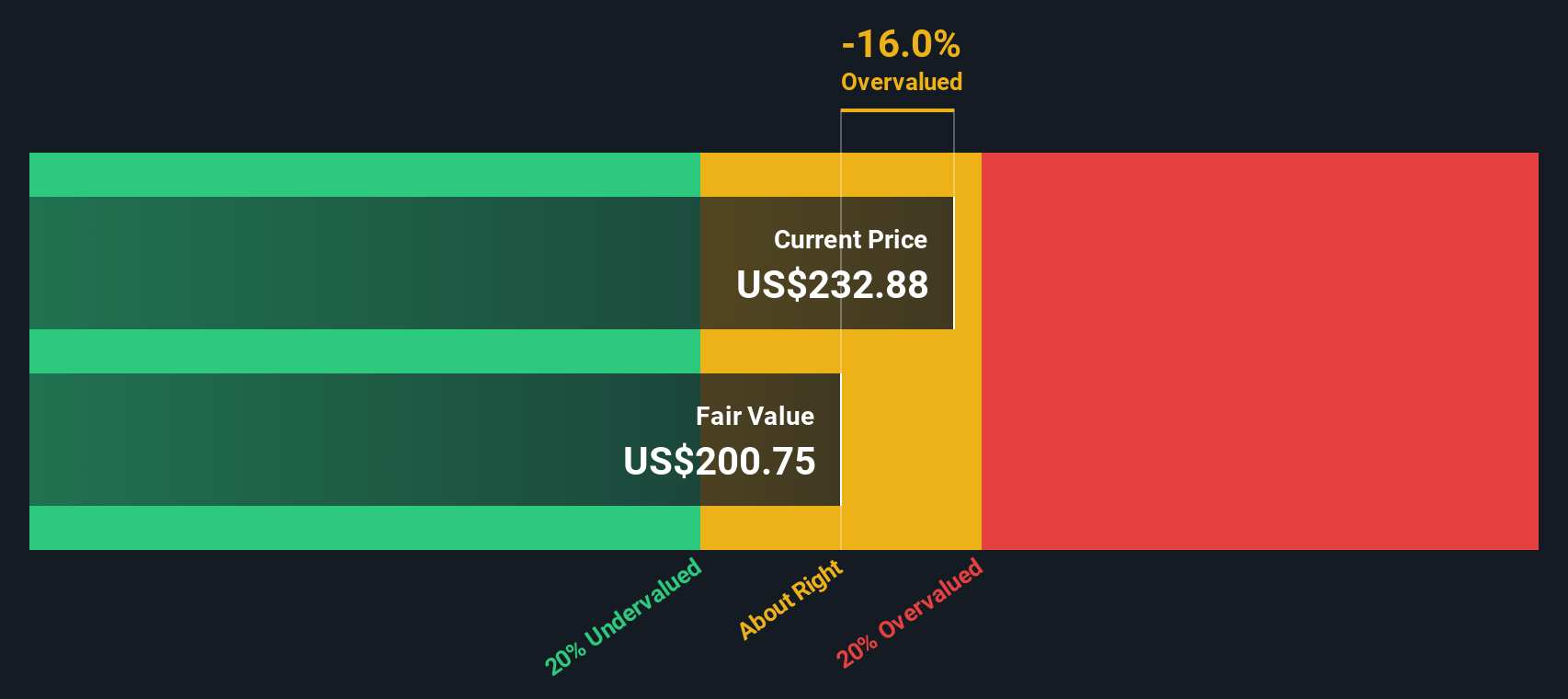

While analyst forecasts suggest OSI Systems is moderately undervalued, our SWS DCF model tells a different story. It indicates the shares are actually trading above their estimated intrinsic value. Does this signal a gap in market expectations?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own OSI Systems Narrative

If you want a different perspective on OSI Systems or enjoy doing a bit of research yourself, it’s quick and easy to build your own narrative in just a few minutes. Do it your way

A great starting point for your OSI Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Transform your investing strategy and discover opportunities beyond OSI Systems. These carefully curated lists will help you stay ahead and uncover the next big mover.

- Capture value right now by targeting stocks that look undervalued versus their true potential. Use our undervalued stocks based on cash flows to spot hidden gems in the market.

- Supercharge your watchlist with companies shaping healthcare’s digital future, all highlighted in our exclusive healthcare AI stocks.

- Lock in reliable income streams by checking out picks featuring impressive yields with our handpicked selection of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal