Will Teradyne's (TER) Robotics Leadership Shuffle Strengthen Its Competitive Edge in Automation?

- Teradyne, Inc. recently appointed Jean-Pierre ‘JP’ Hathout as Group President of its Robotics Group, following his previous roles as President of Universal Robots and Mobile Industrial Robots, with over twenty years of international management background and notable industry experience at Bosch.

- Hathout’s continued leadership at Universal Robots while leading Teradyne Robotics underscores the company’s emphasis on cross-business continuity and global expertise within its automation segment.

- We'll explore how Hathout’s robotics sector expertise may influence Teradyne’s investment narrative and future organizational direction.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Teradyne Investment Narrative Recap

Investors in Teradyne are generally buying into the belief that automation and robotics can drive meaningful long-term growth, particularly through advances in AI and semiconductor test. The appointment of JP Hathout as Robotics Group President signals a focus on continuity and expertise, but this executive change alone is not likely to materially alter the most pressing short-term concerns, including declining robotics revenues and limited near-term visibility due to geopolitical factors. The biggest risk remains weak end-market demand and unpredictable trade conditions.

The recent launch of the Magnum 7H high bandwidth memory (HBM) tester stands out as a key company announcement relevant to current catalysts, targeting growing needs in AI and cloud infrastructure. This development supports Teradyne’s goal to strengthen its semiconductor automation offerings, which could benefit from leadership stability across its robotics and automation businesses.

By contrast, investors should also pay attention to the persistent headwinds in robotics revenue, especially as...

Read the full narrative on Teradyne (it's free!)

Teradyne's outlook anticipates $4.1 billion in revenue and $952.0 million in earnings by 2028. This scenario assumes annual revenue growth of 13.2% and an earnings increase of $482.8 million from the current $469.2 million.

Uncover how Teradyne's forecasts yield a $116.06 fair value, a 3% upside to its current price.

Exploring Other Perspectives

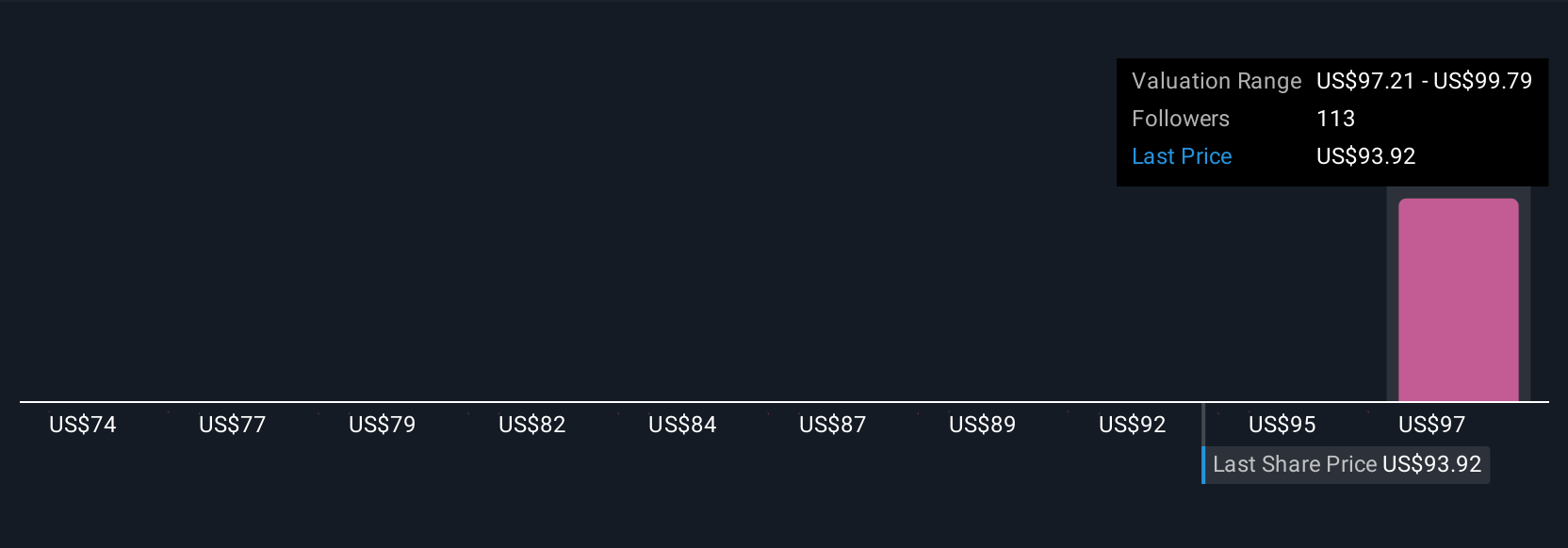

Six different fair value estimates from the Simply Wall St Community span US$91.14 to US$126.95 per share, illustrating a wide spread in opinions. While many expect industry trends like robotics and AI to provide a tailwind, recent declines in robotics revenue show how difficult it can be for performance to keep pace with expectations.

Explore 6 other fair value estimates on Teradyne - why the stock might be worth 19% less than the current price!

Build Your Own Teradyne Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradyne research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Teradyne research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradyne's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal