Fortive (FTV): Assessing Valuation After Management’s Strategic Update at Morgan Stanley Conference

Fortive (FTV) made headlines after its management offered a confident update at Morgan Stanley's annual Laguna Conference, sparking a 3.3% jump in the share price. The real focus was on the company’s balanced capital allocation plan, which management expects will drive shareholder returns through a steady mix of share buybacks, dividends, and selective acquisitions. By reaffirming their commitment to 2026-2027 financial goals and spotlighting stronger AI-driven customer insights, Fortive’s leadership signaled steady hands at the wheel, especially as the company reports easing challenges in its healthcare and government business lines.

This recent bounce follows a turbulent stretch for Fortive, as the stock is still down 12% over the past year and more than 34% year-to-date. The past few months have seen momentum ebb and flow, shaped by sector headwinds and shifts in investor sentiment. Even so, management’s commitment to integrating advanced technologies and pushing forward with strategic deals could have laid fresh groundwork for renewed growth, particularly as market anxieties start to cool.

With a jump in price after months of underperformance, investors now face a familiar question: is Fortive undervalued, or is the market already baking in its future ambitions?

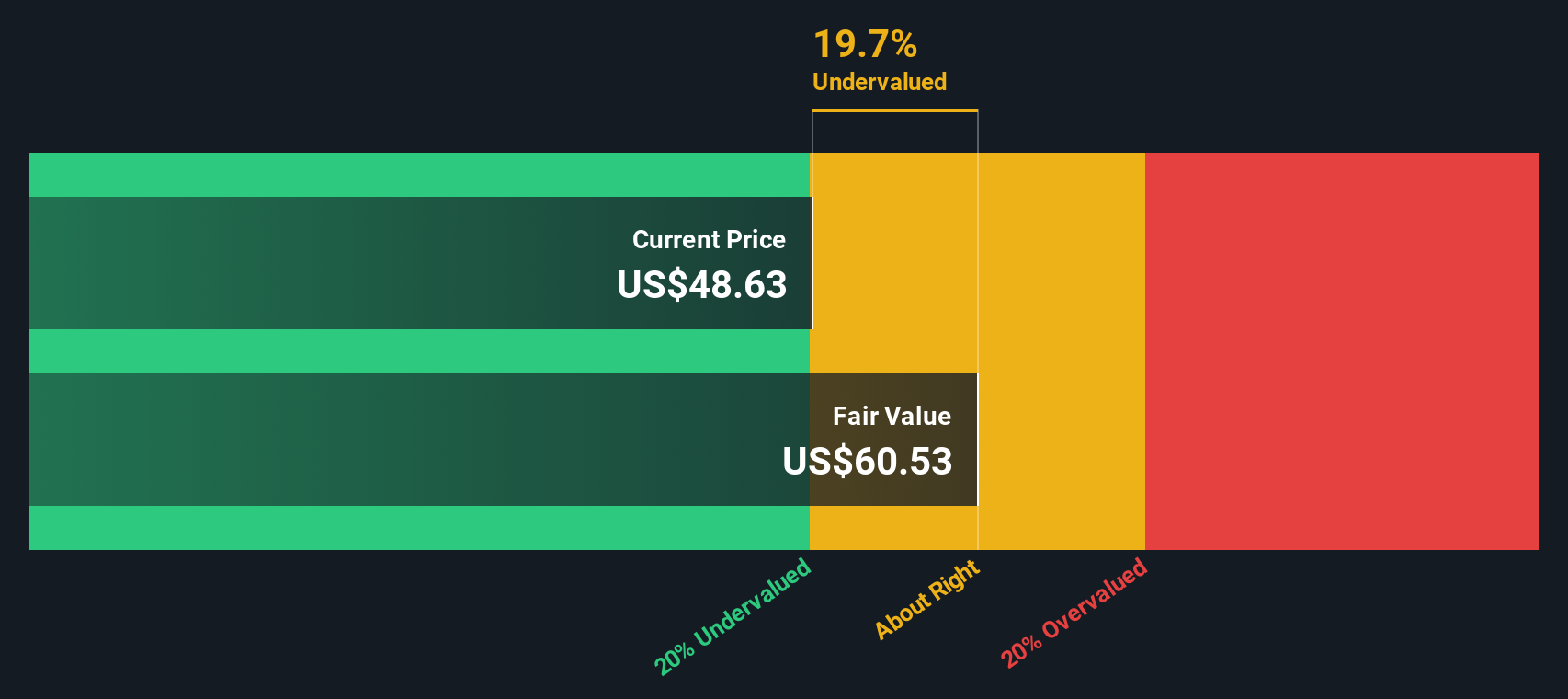

Most Popular Narrative: 19% Undervalued

According to the current most widely followed narrative, Fortive is valued at a notable discount to its fair value. This suggests meaningful upside potential for investors even as the company faces sector-specific uncertainty and market skepticism about its recovery following its spin-off.

Fortive's increasing mix of recurring revenues, now at 50 percent, through expansion of software, services, and subscription models, including double-digit ARR growth at key brands like Fluke and SaaS momentum at AHS, is expected to drive improved revenue visibility and margin expansion in future periods. This supports both top-line growth and higher net margins.

Want to uncover why analysts believe this stock could defy the recent downturn? The make-or-break scenario hinges on relentless growth targets, ambitious future profit margins, and a valuation usually reserved for fast-moving innovators. Are these bold assumptions achievable? Dive deeper and discover what really drives today’s eye-catching fair value.

Result: Fair Value of $60.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent tariff uncertainties and healthcare reimbursement pressures could derail Fortive’s recovery outlook. These factors may challenge the bullish undervaluation thesis if conditions don’t improve.

Find out about the key risks to this Fortive narrative.Another View

Taking a step back, our DCF model also sees Fortive trading below its estimated fair value, much like the current market view. But does the cash flow outlook reveal the full story, or is something still missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fortive Narrative

If you see things differently or want to dig into the numbers firsthand, you can easily craft your own view in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Fortive.

Looking for more investment ideas?

Great investing never stands still. Give yourself an edge by checking out other compelling trends and opportunities shaping tomorrow’s market leaders with the Simply Wall Street Screener.

- Capitalize on emerging trends by searching for AI-powered businesses set to redefine industries with our AI penny stocks.

- Seize potential bargains by targeting companies whose prices appear out of sync with their financial strength using our undervalued stocks based on cash flows.

- Boost your income game by scanning high-yielding opportunities in equities offering reliable payouts through our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal