A Look at ExlService Holdings’s Valuation After Its Strategic InsurTech Partnership with InsureMO

ExlService Holdings (EXLS) just made headlines by announcing a strategic partnership with InsureMO, a move that directly targets the urgent need for modernization in the insurance industry. This collaboration is set to provide insurers with faster, more flexible solutions for updating core systems, integrating AI, and accelerating their digital transformation journeys. By combining EXLS’s deep insurance expertise and AI know-how with InsureMO’s cloud-native middleware, the joint effort represents a meaningful leap toward helping insurers adapt quickly and with less risk of disruption.

This fresh alliance comes at a moment when momentum is starting to gather around EXLS, even as its stock has been mixed over the year. After a slight dip in recent months, shares have rebounded by nearly 3% over the past month, though they remain off the high-water marks seen earlier this year. Despite these short-term fluctuations, EXLS has delivered steady gains in the past year and strong long-term returns, suggesting that the market is weighing the company’s innovative moves against ongoing sector changes.

Does this step toward next-generation insurance technology signal an opening for investors, or is the market already capturing EXLS’s future growth potential in today’s price?

Most Popular Narrative: 19.5% Undervalued

The most widely followed narrative currently values EXLS as undervalued, with analysts seeing the company trading well below its fair value due to robust future growth expectations.

*The accelerated global adoption of AI and digital transformation in regulated industries is expanding the addressable market for ExlService, driving strong double-digit pipeline and growing annuity-like revenues. This trend supports sustained revenue growth and improved earnings visibility.*

Want to know what bullish assumptions are powering this price target? The analysis leans on ambitious forecasts for growth, margins, and future valuation multiples. Curious which financial levers the consensus expects EXLS to pull? The details behind this premium are surprising. See what could spark the next big move.

Result: Fair Value of $54.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising talent costs and increased regulatory complexity could challenge ExlService’s growth. These factors could potentially weigh on profitability and long-term expansion prospects.

Find out about the key risks to this ExlService Holdings narrative.Another View: Market Comparison Raises Questions

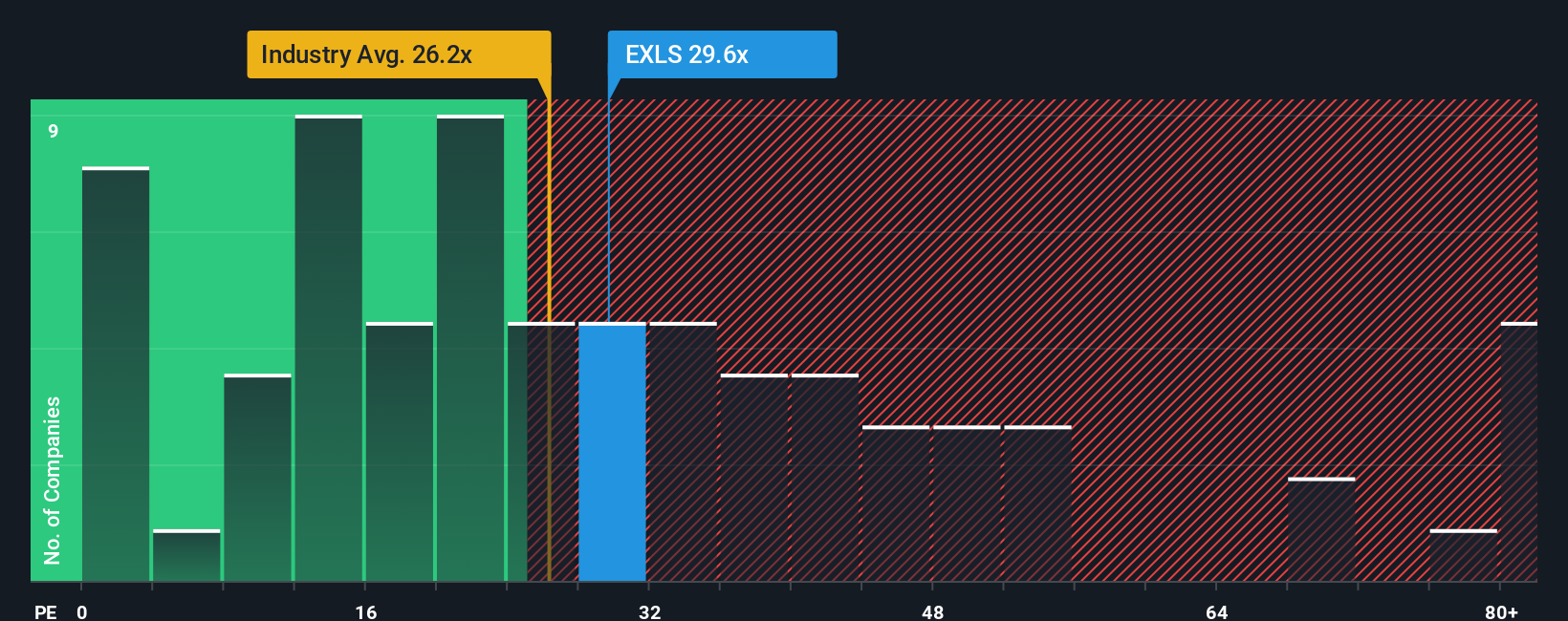

Looking from a different angle, some investors focus on how EXLS is valued compared to the broader US Professional Services industry. By this approach, the shares seem pricier than their sector peers, suggesting the stock may already reflect optimism about its future. Could this market premium mean expectations are overly high, or does it hint at something more durable?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ExlService Holdings Narrative

If you have a different perspective or prefer hands-on analysis, it's easy to quickly shape your own take using the data presented here. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ExlService Holdings.

Looking for More Investment Ideas?

Don’t wait to expand your portfolio. Some of the most exciting opportunities are right at your fingertips. Use these hand-picked tools to uncover what’s next, since others are already on the move.

- Spot companies redefining global tech as you browse the hottest AI penny stocks powering tomorrow’s breakthroughs.

- Boost your income potential by zeroing in on stable businesses offering dividend stocks with yields > 3% designed to reward shareholders consistently.

- Get ahead of market trends with a look at stocks trading below their intrinsic value, thanks to our tailored undervalued stocks based on cash flows resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal