Are Rising Short Bets and Insider Sales Hinting at Shifts in Wingstop’s (WING) Growth Narrative?

- Wingstop recently launched its limited-time Smoky Chipotle Rub flavor, inspired by smoky BBQ with fire-roasted peppers, and ran a special game day promotion that included free wings for qualifying orders in early September 2025.

- At the same time, recent trends such as elevated short interest and insider stock sales have drawn investor attention, highlighting concerns about confidence in the company’s near-term prospects.

- We’ll examine how increasing short interest and insider activity may affect the outlook for Wingstop’s evolving business narrative.

These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Wingstop Investment Narrative Recap

To be a Wingstop shareholder right now is to believe that expanding digital infrastructure, operational efficiency improvements, and ongoing menu innovation will drive sustainable growth and margin improvement, even as consumer demand shows some softness. The launch of the Smoky Chipotle Rub and recent high-profile game day promotions signal a continued focus on engaging core customers, but the sharp rise in short interest and insider selling have increased attention on near-term risk, particularly around demand stability and confidence in near-term performance. These news events, while indicative of heightened investor scrutiny, do not materially alter the most significant risk: that ongoing weakness in consumer spending, despite new promotions, could hinder a recovery in revenue or same-store sales growth over the coming quarters.

Among recent announcements, Wingstop’s systemwide rollout of the Smoky Chipotle Rub stands out, especially when paired with the free wing promotion, as it highlights the company’s ongoing push to attract value-conscious consumers and maintain relevance through flavor innovation. This aligns closely with the company’s reliance on new product introductions to support sales and guest traffic, serving as a reminder that maintaining menu excitement is essential to offsetting the risk of consumer fatigue and muted demand.

Yet, while promotions may spark short-term sales, it’s the persistent pressure from rising insider sales and short interest that investors should not ignore, especially if...

Read the full narrative on Wingstop (it's free!)

Wingstop's narrative projects $1.1 billion revenue and $200.9 million earnings by 2028. This requires 18.9% yearly revenue growth and a $29.4 million earnings increase from $171.5 million today.

Uncover how Wingstop's forecasts yield a $398.55 fair value, a 50% upside to its current price.

Exploring Other Perspectives

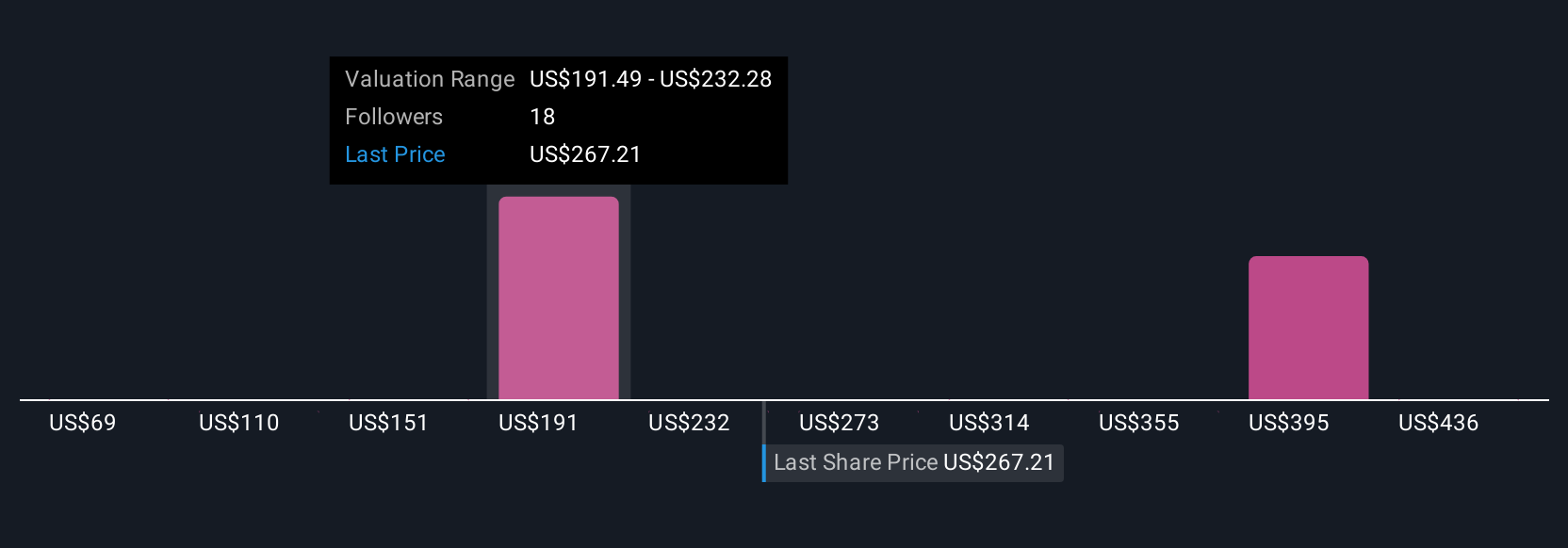

Simply Wall St Community members provided 8 fair value estimates for Wingstop shares, ranging from US$69.13 to US$477. These diverging opinions come as concerns grow about consumer demand softness and whether value-focused promotions can sustain growth in a shifting market, inviting you to explore multiple viewpoints on Wingstop’s path forward.

Explore 8 other fair value estimates on Wingstop - why the stock might be worth as much as 79% more than the current price!

Build Your Own Wingstop Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wingstop research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Wingstop research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wingstop's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal