Does Extending Mount Milligan's Mine Life Reinforce Royal Gold’s Cash Flow Story for RGLD?

- Centerra Gold Inc. recently announced a 10-year extension to the Mount Milligan mine's life, highlighting increased gold and copper reserves along with an improved production outlook based on a new pre-feasibility study.

- This extension further secures Mount Milligan as Royal Gold’s largest stream interest, supporting the company's asset base and enhancing long-term value visibility for stakeholders.

- We’ll consider how extending Mount Milligan’s mine life could impact Royal Gold’s outlook for revenue stability and long-term cash flow strength.

Find companies with promising cash flow potential yet trading below their fair value.

Royal Gold Investment Narrative Recap

To be a shareholder in Royal Gold, you need to believe in the resilience of the gold streaming model and continued demand for precious metals. The Mount Milligan mine life extension shores up a major revenue source for Royal Gold, lessening near-term uncertainty around production underperformance at key assets, though downside risk from broader gold market trends remains a central concern.

One of the company's most relevant recent updates is its extended revolving credit facility to US$1.4 billion, which increases Royal Gold’s financial flexibility. This aligns with management's efforts to diversify the asset base and help offset concentration risk at major mines like Mount Milligan, supporting the company’s stated catalysts for long-term growth and more stable cash flows.

But on the other hand, investors should be aware that if gold’s global appeal as a hedge fades or prices slide for an extended period, then…

Read the full narrative on Royal Gold (it's free!)

Royal Gold's narrative projects $1.4 billion in revenue and $877.9 million in earnings by 2028. This requires 21.4% yearly revenue growth and an increase in earnings of $428.4 million from the current $449.5 million.

Uncover how Royal Gold's forecasts yield a $220.75 fair value, a 17% upside to its current price.

Exploring Other Perspectives

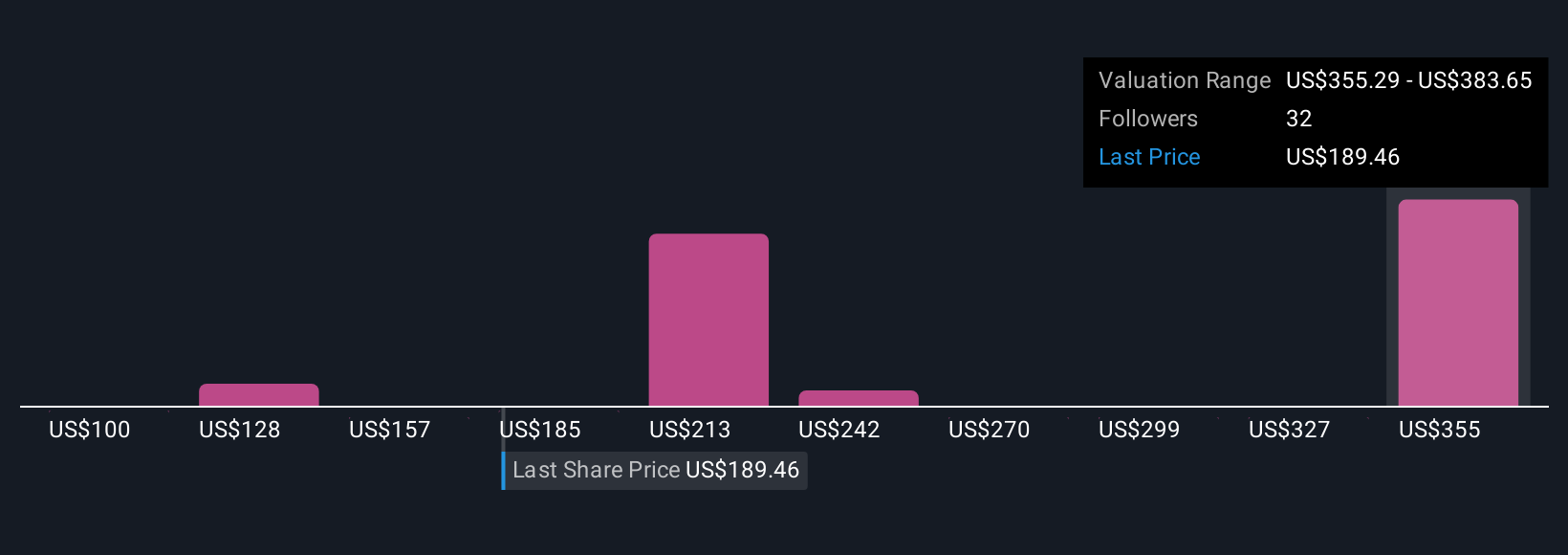

Fifteen members of the Simply Wall St Community offered fair values for Royal Gold ranging widely from US$100 to US$381, with several viewing it as extremely undervalued. These varied assessments highlight how broader gold market risks can create big differences in performance outlook, so explore differing views to inform your own understanding.

Explore 15 other fair value estimates on Royal Gold - why the stock might be worth 47% less than the current price!

Build Your Own Royal Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Gold research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Royal Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Gold's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal