Quanta Services (PWR): Evaluating Valuation After Analyst Upgrades and Strong 2025 Growth Outlook

Most Popular Narrative: 8.8% Undervalued

The most widely followed narrative sees Quanta Services trading below its fair value, thanks to stronger growth expectations and a more optimistic outlook on future profit margins.

Ongoing expansion into renewables EPC services, as well as strategic investments and acquisitions like Dynamic Systems and Bell Lumber & Pole, are broadening Quanta's service offering. These efforts are creating cross-selling opportunities and increasing exposure to high-growth markets, which are expected to drive above-average top-line growth and synergistic margin improvement.

Curious what aggressive growth forecasts and ambitious margin expansion really mean for Quanta's valuation? The bold assumptions behind this narrative point to rapid earnings improvement and a valuation multiple that's usually reserved for high-flying industries. Want to know just how optimistic the projections get, and what key factors must fall into place to support this higher price? The full narrative lays out the blueprint.

Result: Fair Value of $419.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued labor shortages or delays from complex transmission projects could quickly challenge these bullish assumptions and put pressure on future earnings growth.

Find out about the key risks to this Quanta Services narrative.Another View: Market Ratios Tell a Different Story

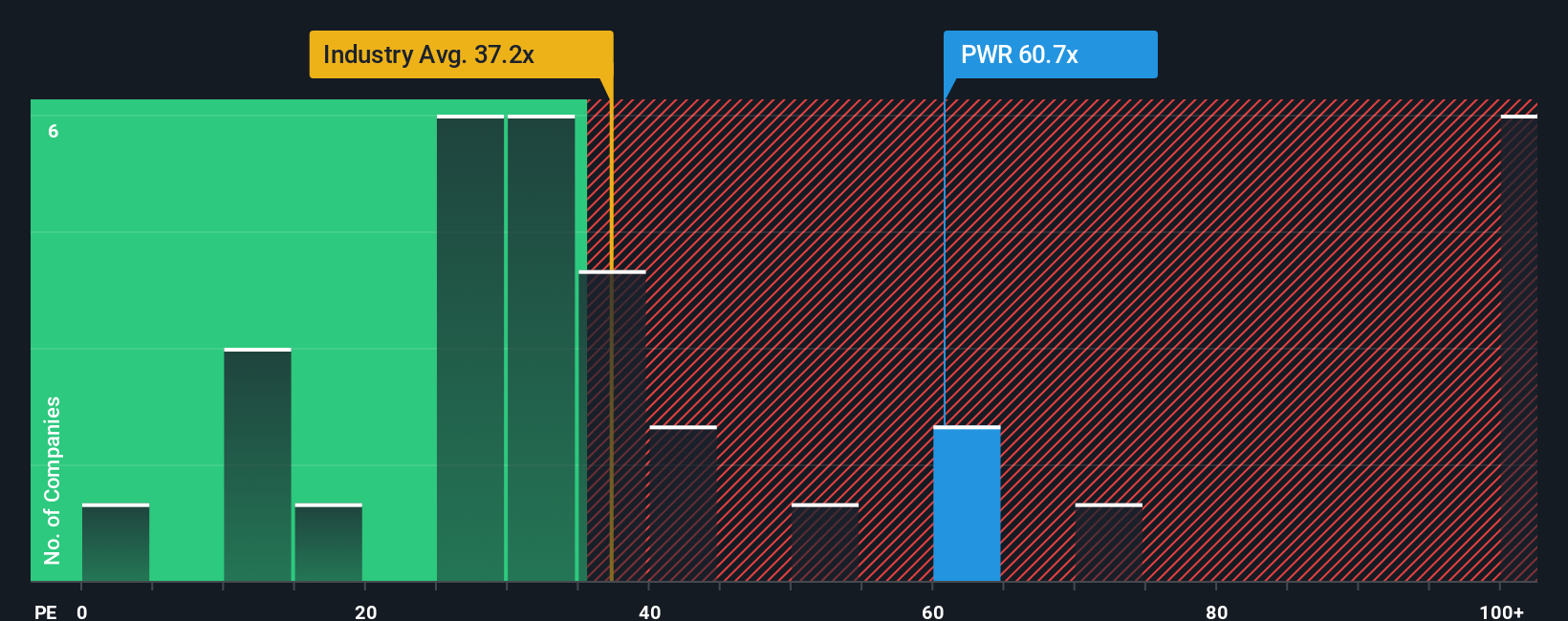

Looking through a market lens, Quanta Services appears pricey compared to industry norms. This raises questions about whether optimism might be running too hot. Could expectations be a step ahead of fundamentals here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Quanta Services Narrative

If you see things differently or prefer digging into the numbers on your own, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Give your portfolio an edge by seeking out stocks that stand out for value, innovation, and growth potential. Let these proven shortcuts guide your next move before others catch on.

- Uncover low-priced companies with strong balance sheets by checking out the latest opportunities among penny stocks with strong financials.

- Capture future returns in artificial intelligence by tapping into the top movers highlighted in AI penny stocks.

- Target attractive bargains that the market may have overlooked using our powerful shortcut to undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal