The Market Doesn't Like What It Sees From Bioceres Crop Solutions Corp.'s (NASDAQ:BIOX) Revenues Yet As Shares Tumble 31%

Unfortunately for some shareholders, the Bioceres Crop Solutions Corp. (NASDAQ:BIOX) share price has dived 31% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 76% share price decline.

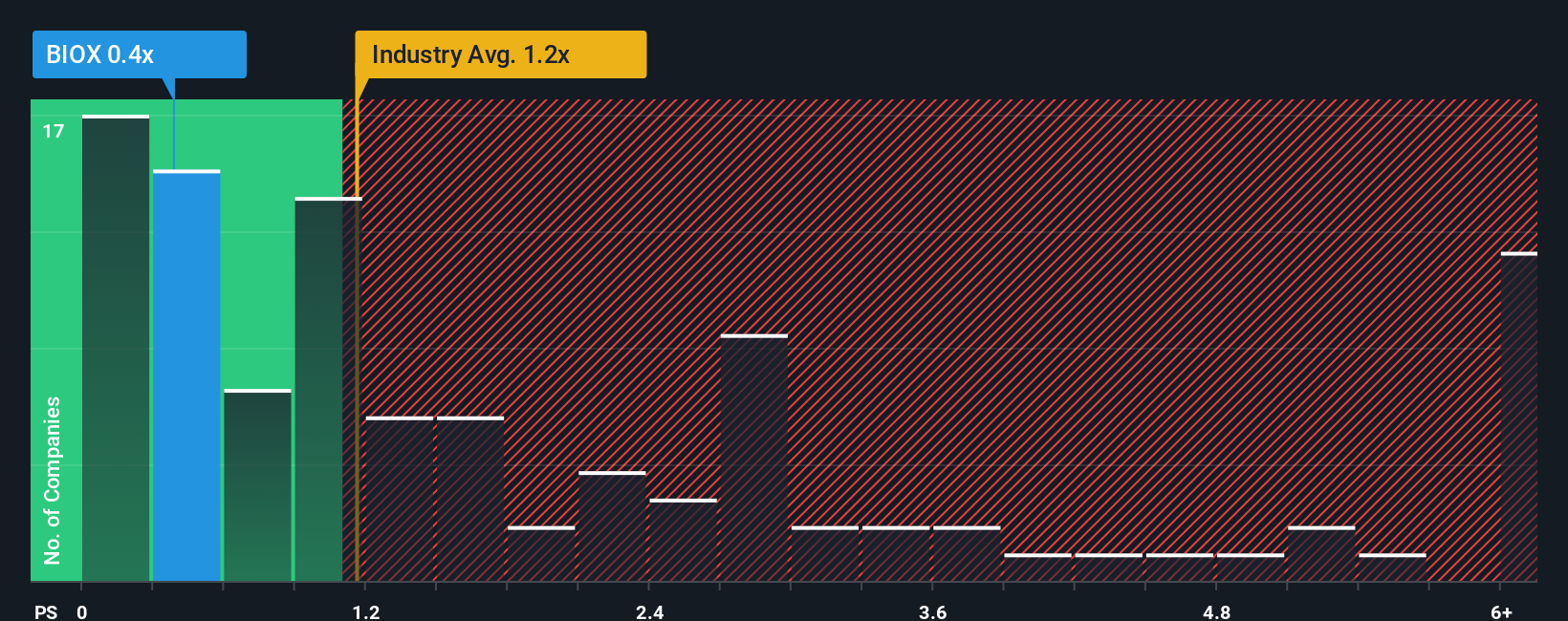

After such a large drop in price, when close to half the companies operating in the United States' Chemicals industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Bioceres Crop Solutions as an enticing stock to check out with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Bioceres Crop Solutions

What Does Bioceres Crop Solutions' P/S Mean For Shareholders?

Bioceres Crop Solutions could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Bioceres Crop Solutions will help you uncover what's on the horizon.How Is Bioceres Crop Solutions' Revenue Growth Trending?

Bioceres Crop Solutions' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 4.7% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 11%, which is noticeably more attractive.

With this in consideration, its clear as to why Bioceres Crop Solutions' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Bioceres Crop Solutions' P/S

Bioceres Crop Solutions' recently weak share price has pulled its P/S back below other Chemicals companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Bioceres Crop Solutions maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Bioceres Crop Solutions you should know about.

If these risks are making you reconsider your opinion on Bioceres Crop Solutions, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal