What UniFirst (UNF)'s AI Audiometric Testing Partnership Means for Shareholders

- In September 2025, UniFirst First Aid + Safety and Soundtrace announced a partnership to provide on-site, AI-powered audiometric testing services to help U.S. employers comply with OSHA hearing conservation standards and protect workers from hearing loss.

- This collaboration directly addresses long-standing compliance and safety challenges faced by businesses exposed to hazardous noise, offering improved efficiency and proactive risk management for workforce health.

- We'll explore how this new service offering strengthens UniFirst's value proposition in occupational health solutions and influences its investment outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

UniFirst Investment Narrative Recap

To believe in UniFirst as a shareholder, you need confidence that consistent operational execution, technology investment, and new service offerings like the partnership with Soundtrace will protect and grow recurring revenues in a competitive sector. While this AI-powered on-site audiometric testing service strengthens UniFirst’s appeal to employers navigating workplace safety requirements, its impact on near-term earnings is likely not material compared to core drivers such as net wearer levels and margin management. The more immediate risk remains any sustained decline in net wearer levels, which would directly affect future revenues.

Among UniFirst’s recent news, the announcement of the $28 million expansion of its Owensboro, Kentucky Distribution and Fulfillment Center stands out as especially relevant. This operational upgrade aims to boost efficiency and supports the company’s continued focus on servicing customers, a key factor as UniFirst introduces compliance-focused solutions like on-site audiometric testing to its First Aid + Safety division.

However, even with new services, investors should not lose sight of customer retention pressure, which can impact future growth…

Read the full narrative on UniFirst (it's free!)

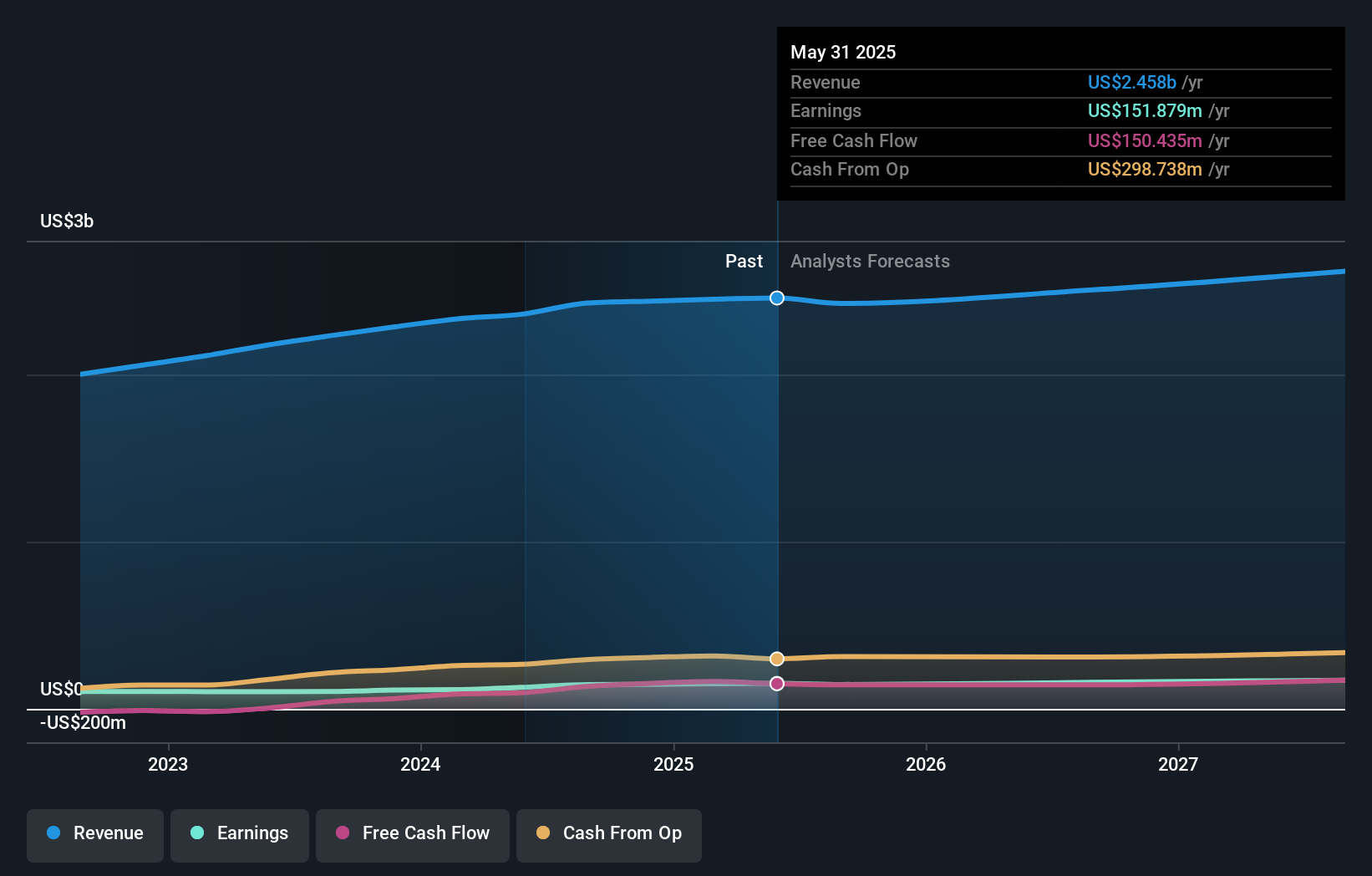

UniFirst's narrative projects $2.7 billion revenue and $179.2 million earnings by 2028. This requires 2.7% yearly revenue growth and a $27.3 million earnings increase from $151.9 million.

Uncover how UniFirst's forecasts yield a $178.25 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community pegs UniFirst’s worth at US$178.25 per share. With net wearer levels a current risk for revenue, assess how your outlook compares to this viewpoint.

Explore another fair value estimate on UniFirst - why the stock might be worth just $178.25!

Build Your Own UniFirst Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UniFirst research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free UniFirst research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UniFirst's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal