Valmont Industries (VMI): Gauging Valuation After Earnings Momentum and New AI Data Center Tailwinds

If you’ve been watching Valmont Industries (VMI), you know the company just crossed another major milestone. Investors are buzzing as shares recently notched a new 52-week high, fueled by upbeat earnings and steady revenue growth. The most interesting part is that Valmont’s long history of exceeding earnings expectations is now amplified by its central role in supplying infrastructure for the booming AI data center market, a space that has everyone in tech and industrials talking.

Stepping back, Valmont’s stock has been climbing decisively in the past year, outpacing both its industry and sector peers. The company has managed to post over 37% total return in the last twelve months, and its upward momentum over the past three months continues to strengthen that trajectory. Recent quarters have also brought a streak of consistent earnings surprises, giving bulls more reasons to hang on for the ride.

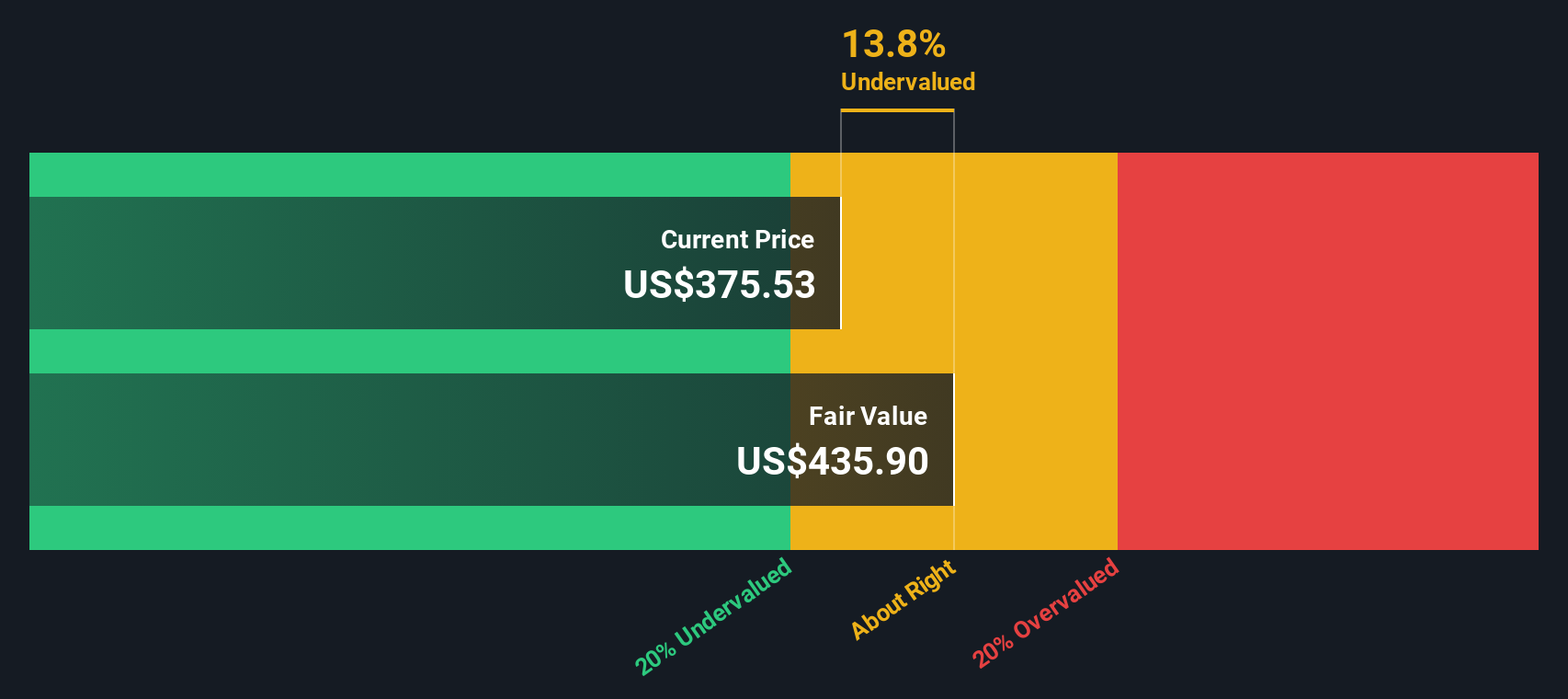

But with so much optimism in play, is the current price simply reflecting all that future growth, or is there more runway ahead for investors looking for value? Let’s unpack the numbers.

Most Popular Narrative: 5% Undervalued

The prevailing narrative sees Valmont Industries as being undervalued by about 5%, anchored in ambitious growth projections and industry-tailored catalysts.

Infrastructure investment and the accelerating energy transition are driving unprecedented demand in utility and transmission, supported by record customer backlogs and industry-wide capacity constraints. Valmont's advanced investments in capacity, automation, and AI are expected to unlock $350 to $400 million in incremental annual revenue and support higher earnings and margins as this multi-year cycle unfolds.

Want to know what fuels this bullish view? The secret sauce includes bold assumptions about Valmont’s future performance, spotlighting top-line growth and rising margins on the back of digital and energy tailwinds. Curious which levers are being pulled to land on that target price? There are some surprising numbers baked into the narrative that could reshape how you see its upside.

Result: Fair Value of $393.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, investors should keep in mind that Valmont’s growth story faces real risks, including volatile infrastructure spending and exposure to fluctuating material costs.

Find out about the key risks to this Valmont Industries narrative.Another View: The DCF Perspective

While analysts see room for modest upside, our SWS DCF model suggests Valmont Industries may be trading well below its intrinsic value. This method factors in long-term cash flows instead of relying on market optimism. Could the market be overlooking deeper value here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Valmont Industries Narrative

Of course, if the consensus doesn’t quite resonate with your own outlook or you want to dive deeper into the numbers, you can shape your own narrative in just minutes. Do it your way.

A great starting point for your Valmont Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let standout opportunities slip by. You can target unique trends and powerful growth stories tailored to your watchlist. There’s always a smarter place for your capital.

- Uncover potential in overlooked companies showing remarkable financial strength by scanning penny stocks with strong financials. These companies could be shaping tomorrow’s market leaders.

- Pinpoint stocks set to benefit from the artificial intelligence surge by checking out AI penny stocks. These companies are driving innovation in today’s digital economy.

- Find attractive companies trading below their fair value as you browse undervalued stocks based on cash flows. This can point you toward genuine value plays ready for the next move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal