Will Floor & Decor's (FND) Expansion Model Sustain Its Momentum as It Enters New Markets?

- Floor & Decor Holdings recently held the grand opening of a new warehouse-format store and design center in Lancaster, California, expanding its footprint to over 250 locations across 38 states with a local team of 33 associates.

- This expansion highlights the company's ongoing commitment to serving new markets and underscores its approach to nationwide growth in the hard-surface flooring retail sector.

- We'll explore how this latest store opening bolsters Floor & Decor's footprint and impacts the long-term growth outlook favored by analysts.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Floor & Decor Holdings Investment Narrative Recap

To be a shareholder in Floor & Decor Holdings, you need to believe that robust long-term demand for home renovation will persist, enabling the company’s aggressive store expansion to drive future growth and market share gains. The recent Lancaster warehouse opening boosts Floor & Decor’s physical presence, but is not likely to materially impact the most important near-term catalyst: a sustained recovery in housing activity, which remains the biggest variable. The main risk for the business continues to be exposure to cyclical housing trends and aggressive expansion plans potentially outpacing demand.

The grand opening of the company’s newest warehouse-format store in Antelope Valley is a clear example of its continued focus on store growth. Similar expansions in areas like Chandler and Chula Vista during recent months reinforce this trend, supporting management’s targets for new locations even as overall home improvement activity remains subdued. These moves are aligned with Floor & Decor’s strategy to capture growth when end markets eventually rebound.

However, in contrast, potential risks tied to adding more stores amid soft housing trends should be on your radar because...

Read the full narrative on Floor & Decor Holdings (it's free!)

Floor & Decor Holdings' narrative projects $6.0 billion in revenue and $296.9 million in earnings by 2028. This requires 9.0% yearly revenue growth and an $85.7 million earnings increase from current earnings of $211.2 million.

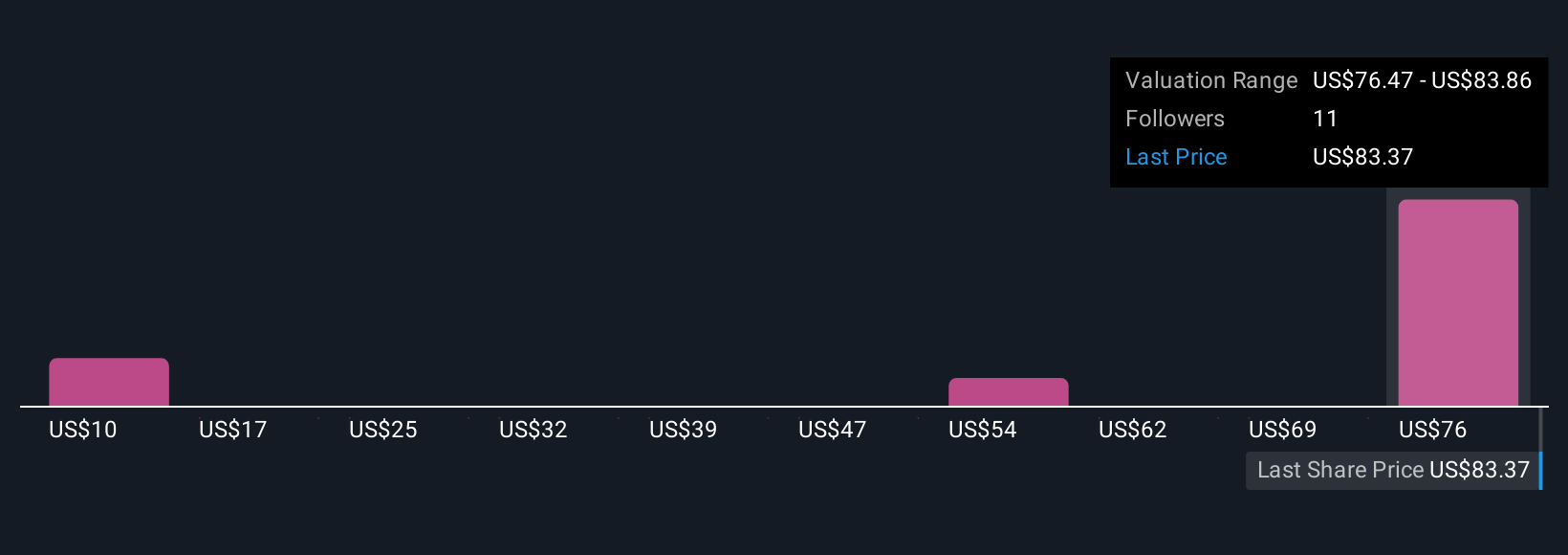

Uncover how Floor & Decor Holdings' forecasts yield a $83.86 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Fair value estimates from five members of the Simply Wall St Community range from US$14.90 to US$83.86 per share. While views differ significantly, many participants cite ongoing housing market headwinds as a key factor to watch for Floor & Decor’s performance.

Explore 5 other fair value estimates on Floor & Decor Holdings - why the stock might be worth as much as $83.86!

Build Your Own Floor & Decor Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Floor & Decor Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Floor & Decor Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Floor & Decor Holdings' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal