Graham Holdings (GHC): Valuation Insights Following Strong Earnings Beat and Dividend Reaffirmation

Graham Holdings (NYSE:GHC) just delivered a one-two punch that’s caught investors’ attention: not only did the company report second-quarter earnings that blew past analyst expectations, but it also reaffirmed its regular quarterly dividend of $1.80 per share. This latest earnings beat was not a small outperformance either, as profits surpassed estimates by a wide margin. This gives fresh evidence that management’s strategy is working and strengthens the company’s reputation for reliability. The steady dividend is a clear signal that Graham Holdings remains focused on rewarding shareholders while also fueling future growth.

These positive developments have added momentum to an already impressive run for Graham Holdings over the past year. After climbing to an all-time high, the stock is up over 53% in the past twelve months, with a particularly strong 23% gain in the past three months alone. This upward move follows a string of strong quarters and reflects increasing investor confidence, especially as the company’s earnings improvements show up in both the bottom line and continued dividend payments. Looking back, the company’s approach of reinvesting profits for growth while maintaining a dividend streak of more than a decade appears to be paying off in a way the market is now recognizing.

With this kind of share price momentum and better-than-expected results, the real question is whether Graham Holdings is still undervalued, or if the recent rally already reflects the company’s future growth potential. What do you think?

Price-to-Earnings of 7.6x: Is it justified?

Graham Holdings is trading at a Price-to-Earnings (P/E) ratio of 7.6 times, which is notably lower than the US Consumer Services industry average of 19.6 times. This indicates that, based on this metric, the company appears undervalued compared to its peers.

The P/E ratio is a widely used measure that compares a company's current share price to its earnings per share. In the consumer services sector, it offers a useful gauge for assessing whether investors are paying a premium or discount for a company's recent profits. This is particularly relevant in terms of future growth expectations or current profitability trends.

A lower P/E can indicate that the market may be underpricing Graham Holdings' earnings, possibly due to skepticism about future growth or sector risks. It could also reflect overlooked strengths relative to more expensive rivals, suggesting there may be more value in the stock than meets the eye.

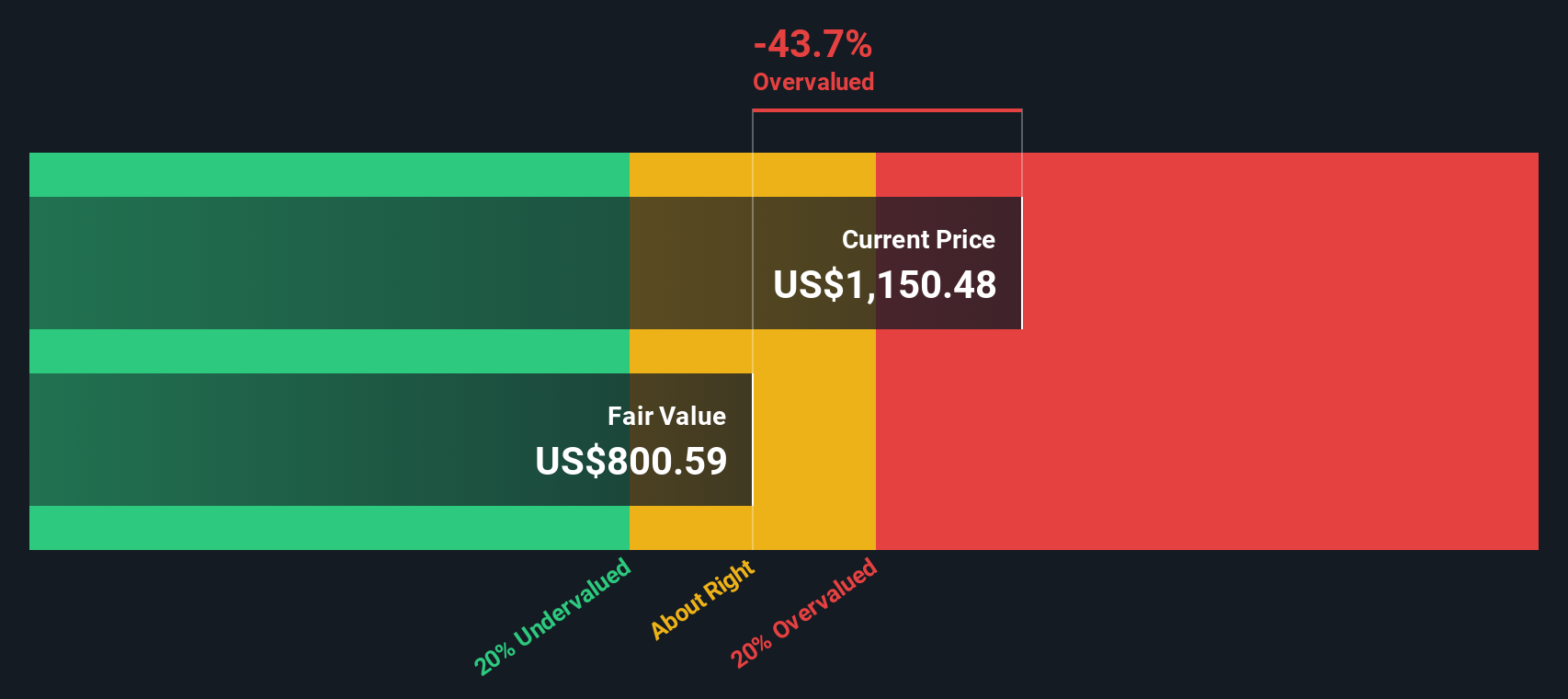

Result: Fair Value of $806.21 (OVERVALUED)

See our latest analysis for Graham Holdings.However, slower revenue growth and a significant discount to analyst price targets may signal caution for investors, even though there has been recent momentum.

Find out about the key risks to this Graham Holdings narrative.Another View: Discounted Cash Flow Perspective

While the earnings multiple puts Graham Holdings in a favorable light, our DCF model tells a different story. This approach suggests the shares might not be as cheap as they first appear. Which approach will prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Graham Holdings Narrative

If you have your own viewpoint or want to dig deeper into the numbers, you can easily put together your own analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Graham Holdings.

Looking for more investment ideas?

Smart investors do more than focus on one stock. Unlock fresh opportunities and fuel your next move with some of our most exciting stock lists below.

- Spot income opportunities and target solid yields by checking out dividend stocks with yields > 3% for companies returning over 3% annually.

- Get ahead of the AI revolution and power up your watchlist with standout innovators by using AI penny stocks.

- Zero in on undervalued gems that the market is missing by scanning undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal