How Investors Are Reacting To Korn Ferry (KFY) Q1 Earnings Beat and Shareholder Return Initiatives

- Korn Ferry recently reported first quarter fiscal 2026 earnings, revealing year-over-year increases in both revenue (US$715.54 million) and net income (US$66.64 million), alongside new second quarter guidance, ongoing share repurchases, and a dividend affirmation.

- These combined actions highlight Korn Ferry's focus on returning value to shareholders while maintaining business growth momentum through big organizational consulting mandates and technology investments.

- We'll now explore how the company's updated earnings guidance and business momentum may influence its future investment outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Korn Ferry Investment Narrative Recap

To be a Korn Ferry shareholder, you need confidence in the company's ability to convert new large-scale consulting mandates into steady revenue, despite ongoing macroeconomic pressures facing the professional services sector. The recent Q1 results and Q2 guidance reinforce short-term stability around earnings, but do not materially alter the most important near-term catalyst: how quickly Korn Ferry can turn major transformation wins into recognized revenue. The biggest risk remains the potential for slower project conversion timelines, which could delay revenue recognition and impact cash flow.

Among the recent announcements, Korn Ferry’s new guidance for second quarter fiscal 2026, projecting fee revenue between US$690 million and US$710 million alongside diluted EPS of US$1.10 to US$1.16, is most relevant. This guidance provides a benchmark for evaluating if current business momentum will translate into ongoing earnings growth, directly tying into concerns around new project implementation speeds and underlying demand trends.

However, with longer project implementation timeframes still a risk to sustained quarterly growth, investors should be aware that...

Read the full narrative on Korn Ferry (it's free!)

Korn Ferry's narrative projects $3.1 billion in revenue and $331.4 million in earnings by 2028. This requires 4.3% yearly revenue growth and a $88.6 million earnings increase from the current $242.8 million.

Uncover how Korn Ferry's forecasts yield a $83.75 fair value, a 16% upside to its current price.

Exploring Other Perspectives

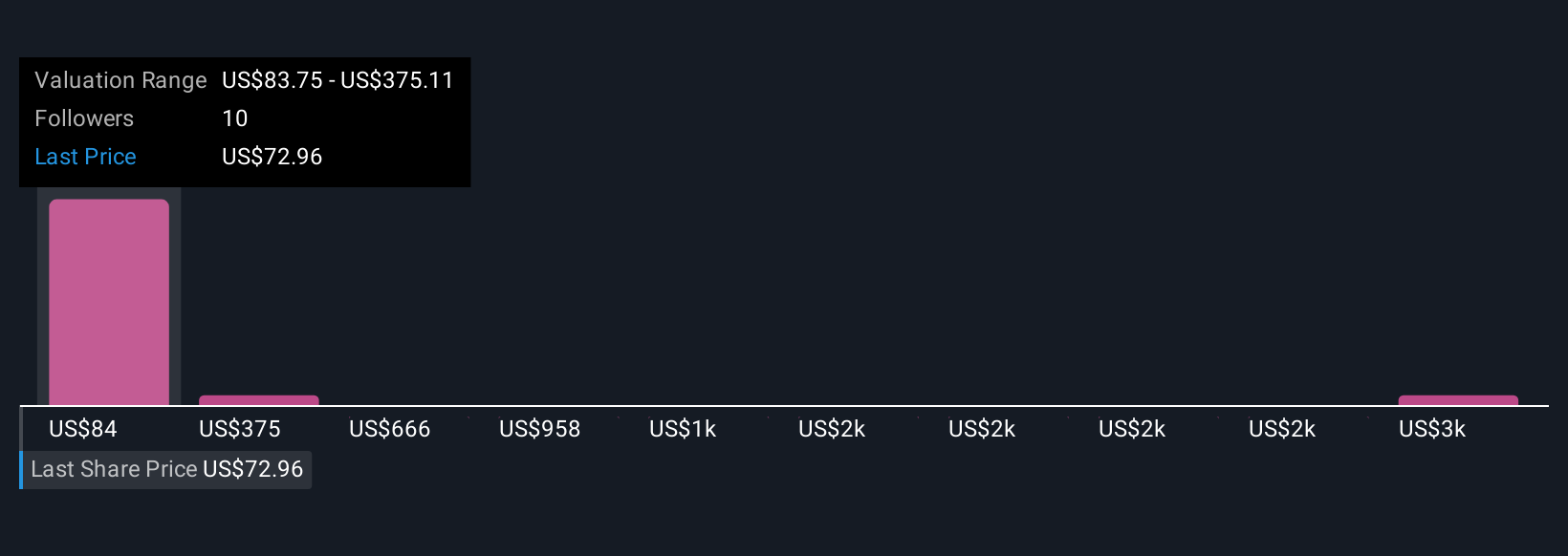

Simply Wall St Community members offered 4 separate fair value estimates for Korn Ferry, ranging from US$83.75 to US$2,997.37. With macroeconomic uncertainty still a key risk to revenue growth, you can compare these diverse views before forming your own outlook.

Explore 4 other fair value estimates on Korn Ferry - why the stock might be a potential multi-bagger!

Build Your Own Korn Ferry Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Korn Ferry research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Korn Ferry research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Korn Ferry's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal