New Oriental (NYSE:EDU) Valuation After Strong Q4 and Strategic Expansion into AI and Non-Tutoring Services

If you’ve been watching New Oriental Education & Technology Group (NYSE:EDU), the company’s recent fourth quarter report has probably caught your attention. The education services provider posted strong results, revealing a sharpened focus on growth outside traditional tutoring. By putting more weight behind non-academic services and pushing forward with AI-driven educational innovations, New Oriental is signaling a commitment to repositioning its business for a new era.

These strategic moves appear to be resonating with investors when you look at recent price movements. In just the past month, shares have risen 11%, and the past three months show a gain over 12%. However, despite these recent advances, the stock remains around 10% lower over the past year. Long-term shareholders have seen dramatic swings, including a remarkable three-year gain of 122%, but with a challenging five-year result. Amid this, annual financial results do show improving revenue and net income growth.

After this mix of volatility and renewed growth focus, the big question stands: does the market fully appreciate New Oriental’s future potential, or is there an opportunity for investors to buy in before the next chapter of growth is priced in?

Most Popular Narrative: 6.6% Undervalued

The prevailing analyst narrative sees New Oriental Education & Technology Group as undervalued, projecting notable headroom above its current market price when factoring in future growth and profitability assumptions.

Continued investment and rollout of omnichannel online-merge-offline (OMO) and AI-driven systems are enabling operating leverage, cost reductions, and higher efficiency in delivery. This is already resulting in improved operating margins (410bps YoY in core business), supporting future earnings growth through both topline expansion and margin expansion.

Curious about what’s fueling this optimistic target? The calculation hinges on some surprisingly ambitious forecasts about revenue, margins, and what the company will be worth in just a few years. Find out which bold assumptions are behind the analysts’ sense that there’s more value waiting to be realized.

Result: Fair Value of $57.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, still, macroeconomic headwinds and intensifying competition could weigh on revenues or dampen the expected pace of margin improvement, which may challenge the optimistic outlook.

Find out about the key risks to this New Oriental Education & Technology Group narrative.Another View: Comparing To Industry

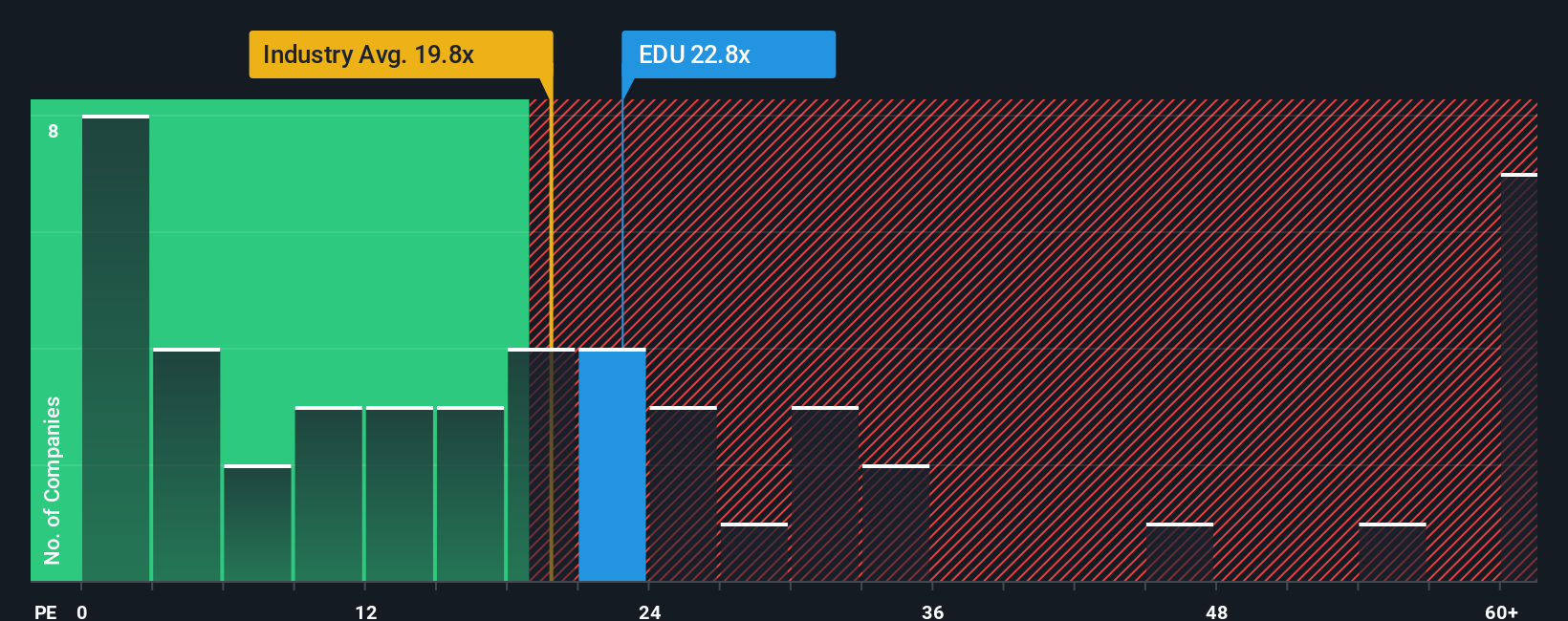

Looking from a different angle, the company actually appears expensive compared to similar names in its industry. This approach relies on market averages rather than growth assumptions, providing a different method to assess fair value. Which perspective will prove more accurate as market conditions shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New Oriental Education & Technology Group Narrative

If you’d like to dive into the figures on your own terms or have a different perspective, crafting your own outlook takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding New Oriental Education & Technology Group.

Looking for more investment ideas?

Smart investors seize every opportunity to get ahead. Don’t limit your watchlist to just one company. Unlock other promising investment themes with these handpicked ideas sure to spark your next market move:

- Boost your portfolio potential by tapping into value-focused stocks with strong cash flows using our undervalued stocks based on cash flows.

- Ride the innovation wave and uncover future giants among emerging tech disruptors through our exclusive AI penny stocks.

- Strengthen your income strategy by targeting reliable, high-yield opportunities with our popular dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal