Yum! Brands (YUM): Assessing Valuation Following Major Leadership Changes and Strategic Growth Focus

What Recent Leadership Changes Signal for Yum! Brands Stock

If you are watching Yum! Brands (YUM) and wondering if now is the time to buy, the company’s latest C-suite shakeup definitely deserves your attention. This month, Yum! Brands announced Chris Turner will take over as CEO on October 1, capping a decades-long tenure for outgoing chief David Gibbs. Alongside Turner, Ranjith Roy is stepping into the CFO position, with Sean Tresvant and Jim Dausch elevated to new roles focused on consumer strategy and digital transformation, respectively. That kind of multi-pronged leadership transition is rare, and it sends a clear message about the company’s intent to double down on consumer engagement, digital growth, and franchise expansion across global brands like Taco Bell, Pizza Hut, KFC, and others.

This wave of appointments appears to have caught the market’s interest, as shares have edged up nearly 1% this month and are up over 14% for the past year. Yum! Brands’ stock has also seen momentum build since the spring, with a steady 12% year-to-date gain and an impressive 37% return over the last three years. Investors have seen the company deliver consistent revenue and profit growth, and leadership’s track record of embracing technology and consumer trends has only added to the upbeat sentiment.

As shares continue to climb on the back of these strategic moves, is the market underestimating Yum! Brands’ next phase, or is all the future growth already factored into the price?

Most Popular Narrative: 5.7% Undervalued

The prevailing narrative suggests Yum! Brands is modestly undervalued, driven by bullish assumptions for digital transformation and ambitious global expansion over the next several years.

The rapid acceleration and global rollout of Yum!'s Byte digital platform, including AI-driven marketing, operational automation, and proprietary ordering/delivery solutions, positions the company to capture higher transaction volumes, expand check sizes, and enhance customer loyalty. This is expected to drive both top-line revenue growth and improve net margins over the long term.

Want to know what’s fueling this optimism? There is a bold forecast at play, one that hinges on rising profitability, better margins, and growth rates, as well as a premium market valuation more often seen in high-flying sectors. Curious about the real numbers and assumptions pushing this target above the current share price? The underlying math might surprise you.

Result: Fair Value of $158.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing softness in core regions and heavy up-front digital investments could slow revenue growth and delay expected margin improvement for Yum! Brands.

Find out about the key risks to this Yum! Brands narrative.Another View: The Market’s Pricing Test

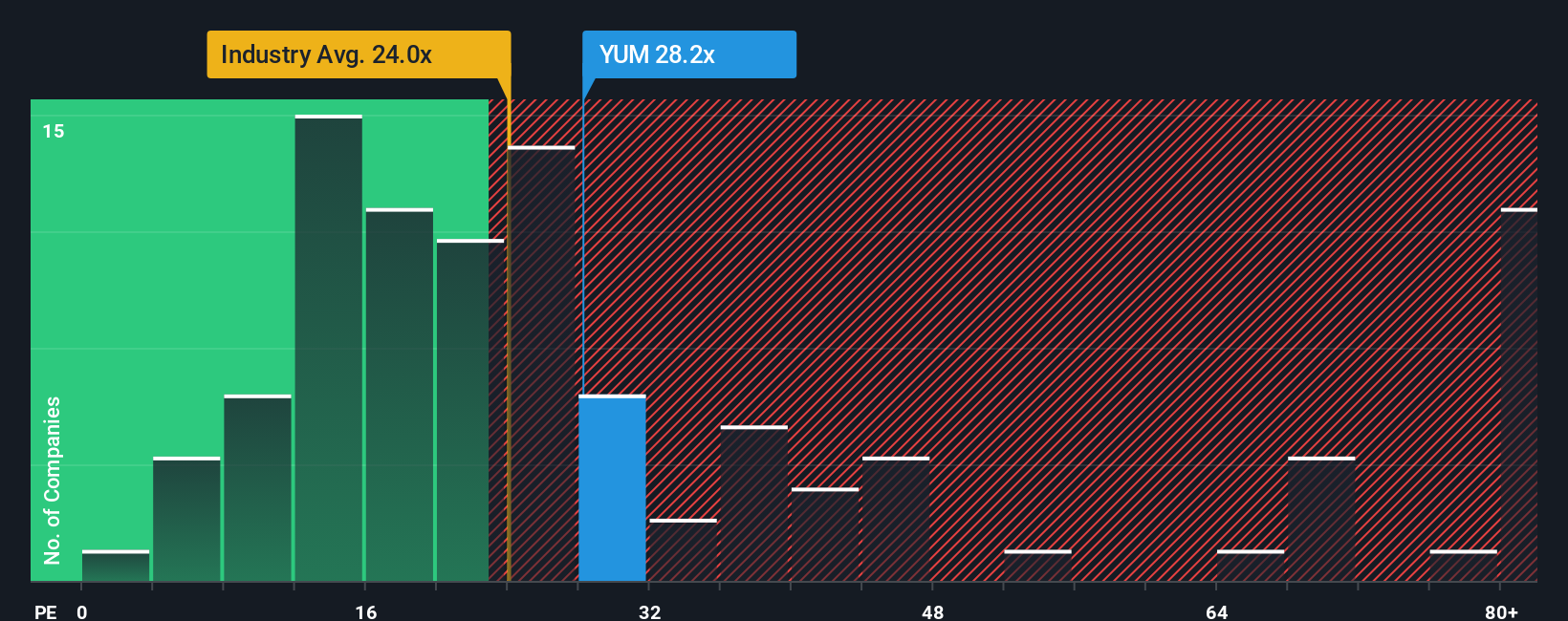

Looking at a different angle, Yum! Brands trades at a higher price compared to the industry average for similar companies. This method questions whether recent positive catalysts are already reflected in today’s share price. Could the stock be less of a bargain than it seems?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yum! Brands Narrative

If you want to see the full picture or have your own take on Yum! Brands, you can dive into the data and assemble your own perspective in just a few minutes. Do it your way.

A great starting point for your Yum! Brands research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Great opportunities don’t wait around. If you’re serious about staying ahead in the market, check out these powerful investing strategies today. Your future portfolio will thank you.

- Supercharge your potential gains by targeting penny stocks with strong financials using our penny stocks with strong financials. Spot the next big movers before they hit the headlines.

- Tap into the unstoppable growth of digital health by searching for healthcare AI stocks through our healthcare AI stocks. Position yourself where innovation meets medicine.

- Maximize your income and find stability with dividend stocks featuring yields over 3 percent via our dividend stocks with yields > 3%. Build a portfolio that pays you back.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal