Does UnitedHealth's Positive Update Shift the Managed Care Outlook for Molina Healthcare (MOH)?

- In the past week, Molina Healthcare saw increased investor interest after UnitedHealth reported strong business operations, leading to a rise in sector confidence for managed healthcare companies.

- This surge reflects how updates from key industry leaders can influence perceptions of stability and future prospects for the entire healthcare insurance sector, including Molina.

- We'll explore how renewed optimism across managed healthcare, spurred by UnitedHealth's positive business update, may influence Molina Healthcare's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Molina Healthcare Investment Narrative Recap

Shareholders in Molina Healthcare generally need to believe in the resilience of government-sponsored healthcare programs like Medicaid and the company's ability to grow through contract wins and disciplined cost control. Although the recent sector rally, triggered by UnitedHealth's business update, boosted near-term sentiment, it does not materially alter Molina's most important catalyst, ongoing contract wins, or its biggest current risk in potential Medicaid funding cuts or program changes.

Among recent announcements, Molina’s contract award to manage Wisconsin Medicaid stands out as directly connected to the business drivers highlighted by the UnitedHealth news. This expansion supports the company’s strategy of growing premium revenue through new Medicaid contract wins, which remains central to its investment case and its ability to offset sector risks.

Yet, in sharp contrast, investors should bear in mind that Medicaid program changes or funding reductions could...

Read the full narrative on Molina Healthcare (it's free!)

Molina Healthcare's outlook anticipates $50.7 billion in revenue and $1.3 billion in earnings by 2028. This is based on a 6.8% annual revenue growth rate and a $0.2 billion increase in earnings from the current $1.1 billion.

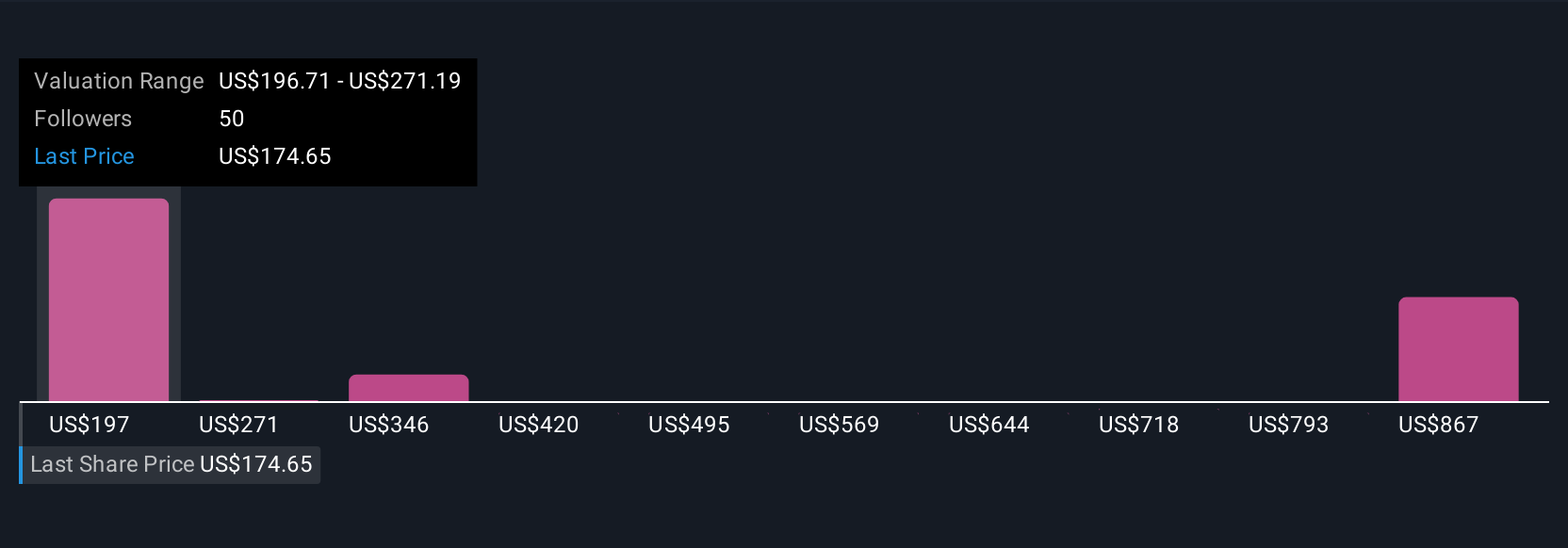

Uncover how Molina Healthcare's forecasts yield a $196.71 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Twelve members of the Simply Wall St Community place Molina’s fair value as low as US$196.71 and as high as US$941.48 per share. While contract wins are supporting revenue growth, opinions on future performance are far from aligned, consider reading further to see how these perspectives stack up against possible changes in Medicaid funding.

Explore 12 other fair value estimates on Molina Healthcare - why the stock might be worth just $196.71!

Build Your Own Molina Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Molina Healthcare research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Molina Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Molina Healthcare's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal