CSW Industrials (CSWI): Exploring Valuation After Fresh Analyst Optimism on Growth and Earnings Outlook

CSW Industrials (CSW) has caught the attention of many investors after a wave of positive analyst sentiment focused on the company’s strong growth trajectory and upward earnings revisions. With fresh recommendations highlighting CSW’s ability to deliver consistent earnings growth and generate strong cash flows, sentiment has taken a turn for the optimistic. This spotlight on the company’s earnings prospects comes just as markets are looking for clues on where quality, mid-cap industrials might find their edge in a competitive landscape.

Over the past year, the market has been reassessing CSW Industrials’ long-term story. While shares have seen double-digit declines in the past month and in 2025 so far, the bigger context shows a much longer trend of outperformance. CSW has more than doubled investors’ money over five years. The company’s continued focus on niche segments and leadership changes, including the recent appointment of a new principal accounting officer, add fresh context to the evolving narrative around execution and capital allocation. Forward momentum appears mixed in the short term but is underpinned by fundamentals that have piqued institutional interest.

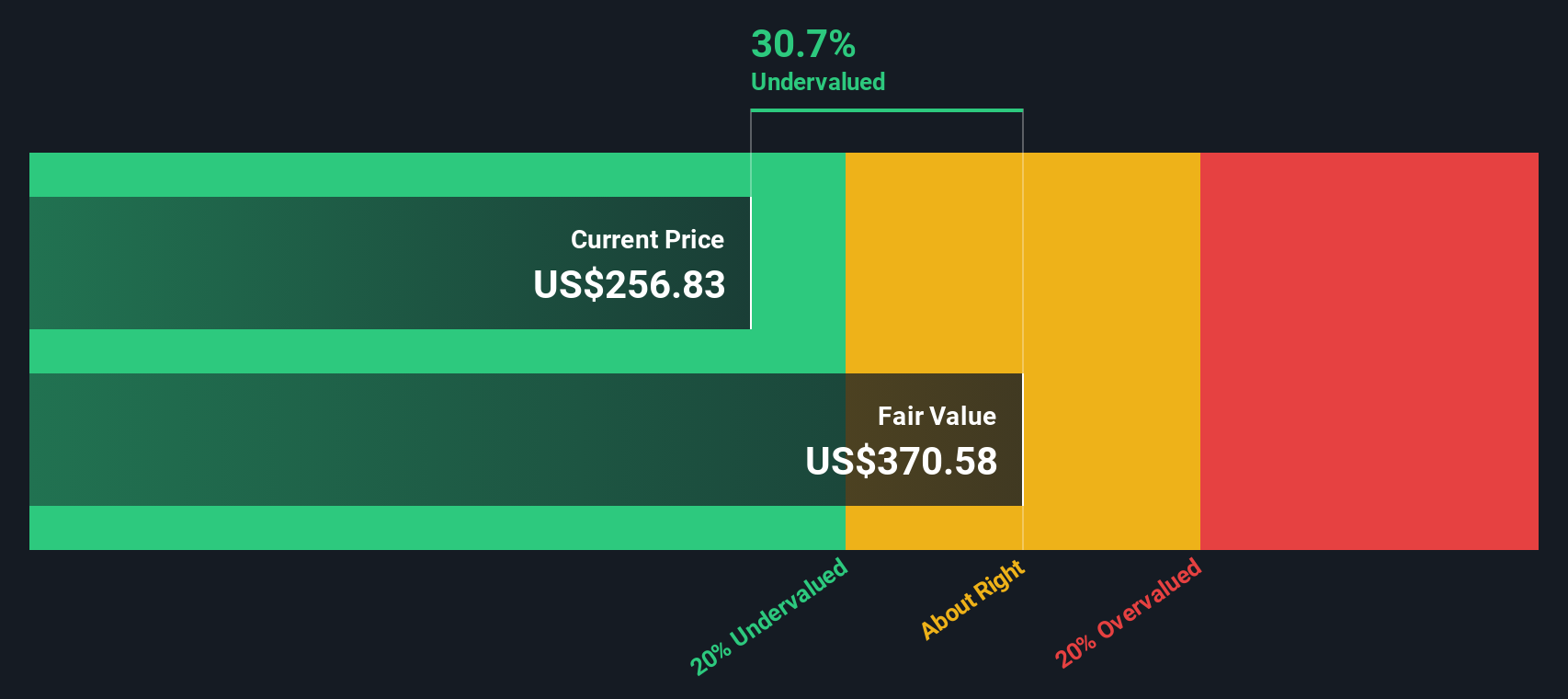

With the latest bout of analyst optimism and a pullback in share price, some investors may be considering whether there is now a buying opportunity, or if the market is already counting on future growth.

Most Popular Narrative: 15% Undervalued

According to the most widely followed analyst narrative, CSW Industrials is currently undervalued by 15% based on a blend of future earnings growth, profit margins, and risk considerations.

Sustained US infrastructure upgrading and urbanization continue to expand the base of aging buildings needing renovation and maintenance. This underpins long-lived, recurring demand for CSW's consumables and specialty construction products, creating a stable and expanding revenue base with visibility for long-term earnings growth.

Want to know what’s fueling analysts’ calls for a higher fair value? The case rests on outsized long-term growth assumptions and a premium earnings multiple rarely seen outside top-tier sectors. Surprised to find out which business trends and a powerful bottom-line forecast make this valuation stand out? The key numbers are more ambitious than you might think.

Result: Fair Value of $294.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing margin pressure from input costs or a slowdown in housing and construction demand could quickly challenge this positive outlook.

Find out about the key risks to this CSW Industrials narrative.Another View: Challenging the Fair Value Story

Looking at things from a different angle, our DCF model suggests CSW Industrials may actually be trading below its real worth. Are the market’s doubts overdone? Or does the long-term math tell another story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CSW Industrials Narrative

If these points do not quite align with your view, or if you would rather form your own insights, you can easily build a personalized narrative in under three minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding CSW Industrials.

Looking for more investment ideas?

Smart investors always look for fresh angles and emerging opportunities. Make your next great move before others by searching these standout themes everyone is talking about right now:

- Unlock growth by targeting up-and-coming companies with strong fundamentals with our selection of penny stocks with strong financials: penny stocks with strong financials.

- Catch the next wave of healthcare innovation by pinpointing promising businesses powered by artificial intelligence in healthcare: healthcare AI stocks.

- Maximize your income strategy by focusing on shares offering reliable payments with yields over 3%: dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal