Chewy (CHWY) Expands Into Fresh Dog Food Is This the Key to Revitalizing Margins?

- Chewy, Inc. recently announced Q2 2025 results showing net sales of US$3.10 billion, an 8.6% increase year over year, alongside the launch of Get Real, a new line of minimally processed fresh dog food exclusive to Chewy.

- Customer growth and expansion into fresh foods gave a boost to revenues, yet profit declined from the previous year, highlighting both new opportunities and continued operational challenges.

- We'll explore how Chewy's introduction of the Get Real dog food line could influence its outlook and investment narrative going forward.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Chewy Investment Narrative Recap

To be a Chewy shareholder, you need to believe the company can sustain growth in pet e-commerce while translating customer expansion and fresh food launches like Get Real into meaningful profit gains. Recent news of sales growth and product innovation supports the short-term catalyst of increased active customer numbers, but profit pressure and high expectations remain the biggest risks. So far, no material shift is evident in those underlying factors.

The raised full-year revenue guidance to US$12.5 billion to US$12.6 billion, reflecting a US$175 million bump to the midpoint, stands out as especially relevant. This update reflects management’s confidence that new offerings like the Get Real dog food line and continued customer engagement can support near-term growth targets, reinforcing the critical role of customer acquisition and retention in Chewy’s outlook.

Yet, with all this growth, investors need to keep an eye on the risk tied to Chewy's dependence on subscription-based Autoship orders if...

Read the full narrative on Chewy (it's free!)

Chewy's narrative projects $15.1 billion revenue and $467.3 million earnings by 2028. This requires 7.7% yearly revenue growth and a $79.1 million earnings increase from $388.2 million.

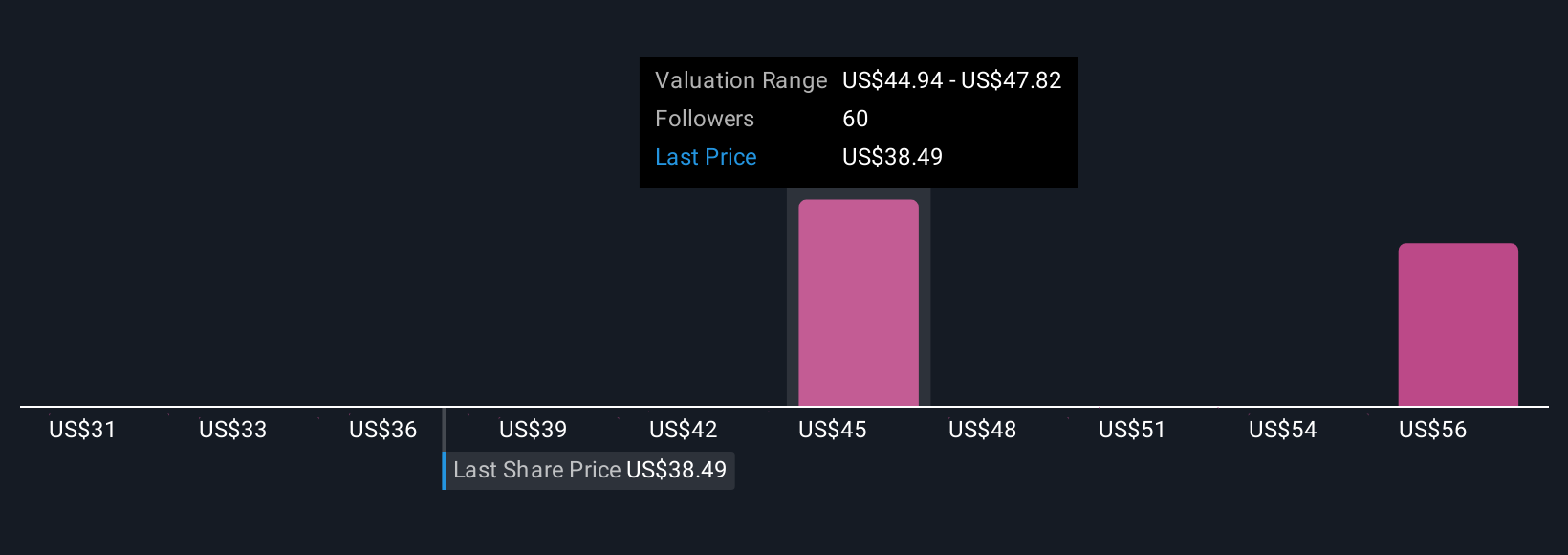

Uncover how Chewy's forecasts yield a $45.45 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Ten fair value estimates from the Simply Wall St Community range from US$30.53 to US$59.84 per share. With recent sales growth but ongoing profit challenges, consider how much weight you give to customer acquisition momentum when forming your view.

Explore 10 other fair value estimates on Chewy - why the stock might be worth 12% less than the current price!

Build Your Own Chewy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chewy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chewy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chewy's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal