Fed Rate Cut Expectations Might Change The Case For Investing In Ziff Davis (ZD)

- In the past week, Ziff Davis experienced meaningful share price changes as investors reacted to softer-than-expected Consumer and Producer Price Index readings, which raised market expectations for potential Federal Reserve interest rate cuts by year-end.

- This shift in monetary policy expectations has drawn heightened attention to digital media companies like Ziff Davis, as lower interest rates are often viewed as supportive for growth-oriented sectors.

- We’ll explore how increased expectations for Federal Reserve rate cuts may influence Ziff Davis’s outlook for digital content and advertising growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Ziff Davis Investment Narrative Recap

Ziff Davis appeals to investors who believe in the continued rise of digital content, advertising, and subscription services, fueled by data-driven marketing and recurring revenue. The recent soft inflation data and speculation around Federal Reserve rate cuts may provide a short-term sentiment boost for growth-focused companies, but it does not fundamentally change the biggest catalyst, digital ad and SaaS expansion, or reduce ongoing risks from digital advertising headwinds and heavy reliance on acquisitions.

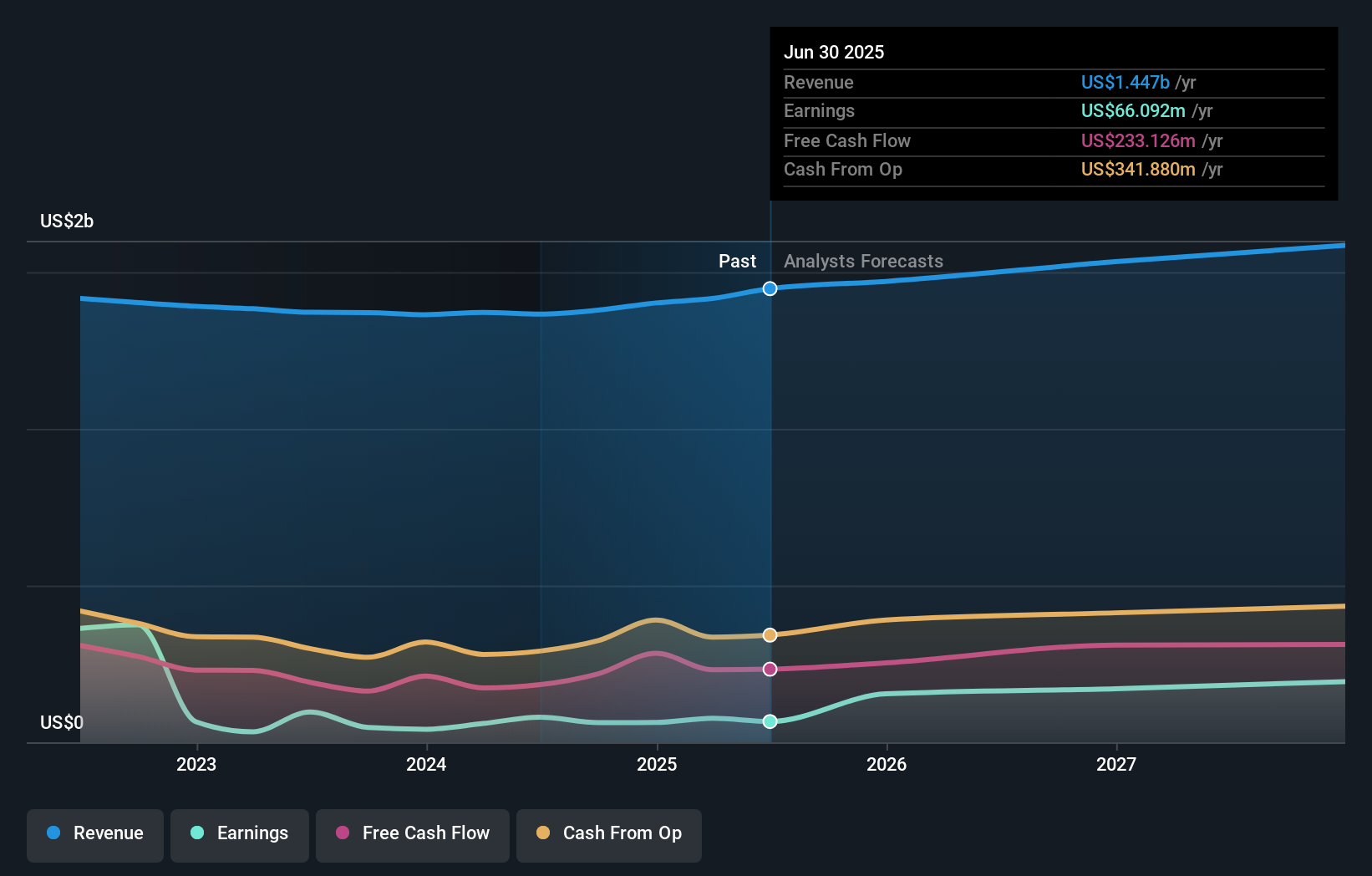

Among recent company announcements, Ziff Davis reaffirmed its 2025 revenue guidance, projecting US$1,442 million to US$1,502 million in sales. This continued confidence in top-line growth remains central as investors weigh the influence of shifting monetary policy against the persistent challenge of digital advertising margin pressure.

However, investors should also be aware that while the macro outlook creates opportunities, risks from increased adoption of privacy regulations still...

Read the full narrative on Ziff Davis (it's free!)

Ziff Davis is projected to reach $1.6 billion in revenue and $235.9 million in earnings by 2028. This outlook relies on analysts' expectations for 3.9% annual revenue growth and a $169.8 million increase in earnings from the current $66.1 million.

Uncover how Ziff Davis' forecasts yield a $45.29 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Ziff Davis range from US$45.29 to US$110.24, based on two unique perspectives. With digital ad headwinds still relevant, you can explore how different investor forecasts weigh structural industry challenges.

Explore 2 other fair value estimates on Ziff Davis - why the stock might be worth over 3x more than the current price!

Build Your Own Ziff Davis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ziff Davis research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ziff Davis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ziff Davis' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal