Should NetApp's (NTAP) StorageGRID 12.0 Release Prompt Investors to Rethink Its AI Strategy?

- NetApp recently announced the release of StorageGRID 12.0, a new version of its software-defined object storage solution aimed at unstructured data, introducing substantial advancements in scalability, AI workflow support, and security features.

- This launch addresses the accelerating demand for secure, high-performance object storage as organizations modernize data lakes and ramp up AI-driven workloads.

- We'll explore how StorageGRID 12.0's enhanced AI scalability and security measures could influence NetApp's investment outlook moving forward.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

NetApp Investment Narrative Recap

To own NetApp shares today, an investor needs to believe that enterprise adoption of AI and multi-cloud data infrastructure will drive sustained demand for high-performance, secure storage solutions, trends directly addressed by the launch of StorageGRID 12.0. While the product update supports key catalysts around AI workload support and resilient data management, it may not immediately offset the short-term risk of margin pressure from increasing competition with hyperscale cloud providers and the ongoing shift in client preferences to subscription-based models.

Of recent announcements, NetApp’s expanded integration with Amazon FSx for ONTAP stands out as particularly relevant, underscoring the company’s focus on strengthening its hybrid cloud storage offerings. This partnership not only complements the StorageGRID 12.0 enhancements targeting AI and unstructured data, but it also supports NetApp’s catalyst of expanding adoption in hybrid and multi-cloud enterprise environments.

However, investors should keep in mind that mounting hyperscaler competition could still impact NetApp’s pricing power and profit margins...

Read the full narrative on NetApp (it's free!)

NetApp's outlook anticipates $7.5 billion in revenue and $1.4 billion in earnings by 2028. This reflects a projected annual revenue growth rate of 4.3% and a $0.2 billion earnings increase from the current $1.2 billion.

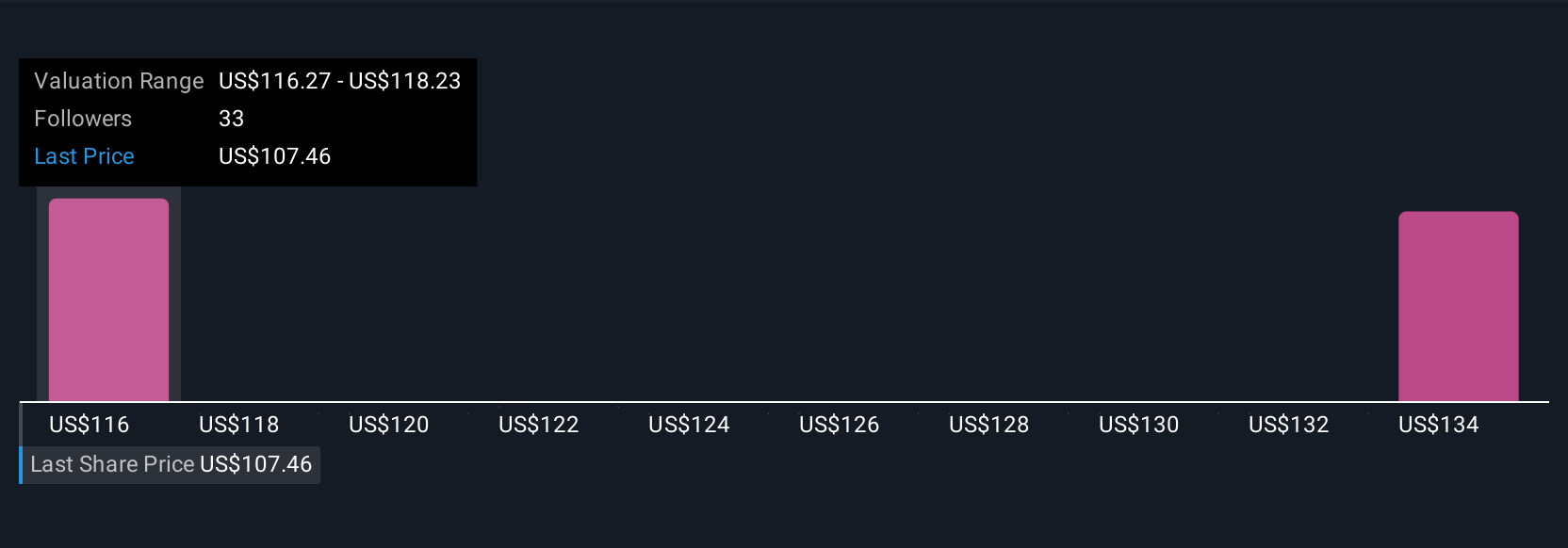

Uncover how NetApp's forecasts yield a $118.29 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members recently shared five separate fair value estimates for NetApp, ranging from US$118.29 to US$178.81 per share. With margin compression risk top of mind this quarter, many are weighing the impact of increasing cloud competition on future profitability, consider how these views might influence your confidence in the company’s growth prospects.

Explore 5 other fair value estimates on NetApp - why the stock might be worth as much as 44% more than the current price!

Build Your Own NetApp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NetApp research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free NetApp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NetApp's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal