Expanded Credit Facility and Lower Rates Could Be a Game Changer for Enova International (ENVA)

- On August 28, 2025, Enova International and its subsidiaries amended their secured asset-backed revolving credit facility with Bank of Montreal, increasing the total commitment from US$665 million to US$825 million, extending the maturity to August 2029, and reducing applicable interest rates.

- This enhanced credit facility is designed to improve Enova's financial flexibility and reduce its cost of capital, which can be an important driver for future growth and funding stability.

- We will now examine how Enova's increased borrowing capacity and extended loan terms could influence its investment outlook and growth potential.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Enova International Investment Narrative Recap

To be a shareholder in Enova International, you need to believe in its ability to drive profitable growth by capitalizing on digital lending demand, executing disciplined credit risk management, and tapping into stable funding sources. The recently expanded and extended credit facility meaningfully strengthens Enova’s access to capital, reducing near-term funding risks and supporting its ambition to grow, though regulatory scrutiny remains the most important risk for the business, particularly regarding evolving consumer lending laws.

One recent announcement relevant to this improved credit line is Enova’s robust earnings report for Q2 2025, which showed marked growth in revenue and net income. These results, reflecting strong originations and efficient risk management, highlight how access to additional low-cost capital could support further expansion, although it does not lessen the importance of monitoring regulatory developments as a potential headwind.

Yet, despite these positive funding changes, investors should be aware that heightened regulatory scrutiny in US consumer lending could...

Read the full narrative on Enova International (it's free!)

Enova International's outlook projects $5.7 billion in revenue and $426.8 million in earnings by 2028. This implies a 60.7% annual revenue growth and an earnings increase of $170.6 million from current earnings of $256.2 million.

Uncover how Enova International's forecasts yield a $131.12 fair value, a 14% upside to its current price.

Exploring Other Perspectives

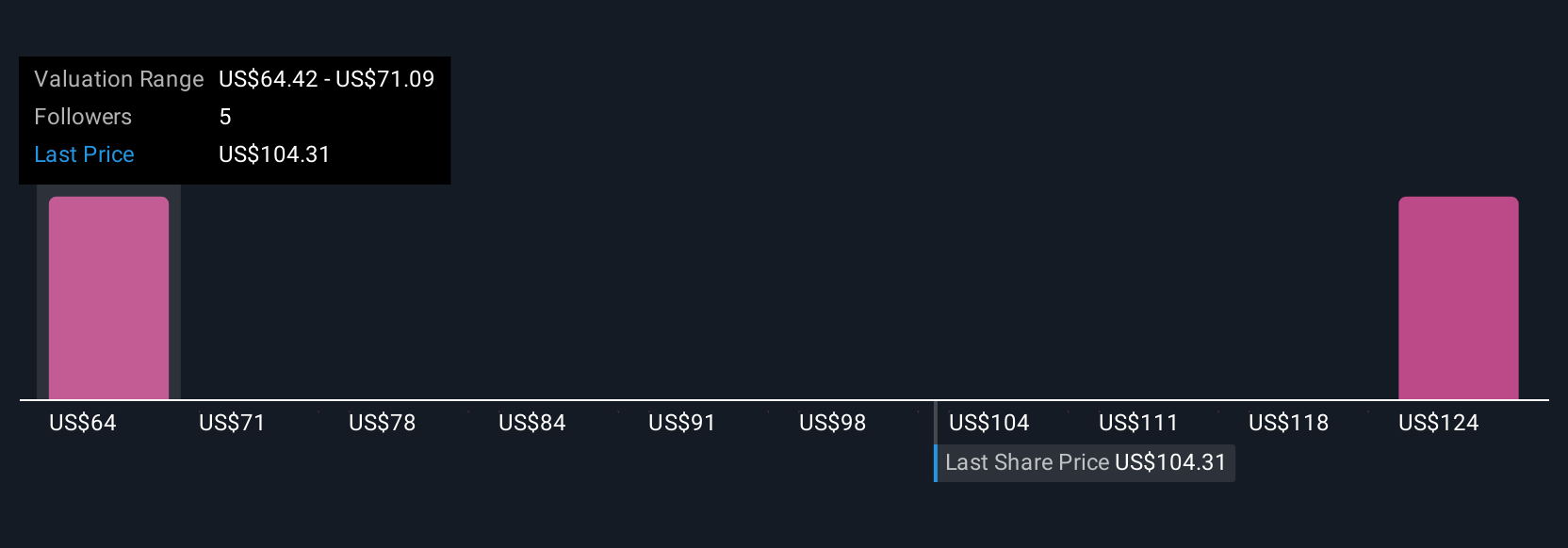

Three Simply Wall St Community members valued Enova from US$64.42 to US$131.13 per share, marking a wide spectrum of fair value views. While expectations for robust digital lending demand remain a key catalyst, differing projections underline the benefit of examining a range of approaches when assessing potential risks and opportunities in Enova’s outlook.

Explore 3 other fair value estimates on Enova International - why the stock might be worth 44% less than the current price!

Build Your Own Enova International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enova International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enova International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enova International's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal