Did Pediatrix Medical Group's (MD) Buyback and Raised Guidance Just Shift Its Investment Narrative?

- In the past month, Pediatrix Medical Group raised its adjusted EBITDA guidance for 2025 and launched a US$250 million share repurchase program, highlighting improved operational performance and cost management.

- An independent valuation suggests the company is priced below its estimated intrinsic value, though ongoing debt concerns and slower forecasted earnings growth compared to the broader market remain relevant for investors.

- We'll explore how the new share repurchase authorization could influence Pediatrix Medical Group's long-term earnings outlook and valuation narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Pediatrix Medical Group Investment Narrative Recap

For investors in Pediatrix Medical Group, the core proposition centers on the company's ability to drive sustainable growth from rising demand in neonatal and pediatric services, while effectively managing costs and addressing debt concerns. The recent increase in adjusted EBITDA guidance for 2025 and a US$250 million share repurchase program may support near-term shareholder returns; however, these developments do not eliminate the ongoing risk from slower forecasted earnings growth relative to the healthcare sector, nor do they fully address potential volatility from portfolio restructuring activity.

The newly authorized share repurchase program stands out as the most consequential recent announcement. While such buybacks signal corporate confidence and can contribute to EPS accretion, their longer-term impact depends on whether operational gains can consistently offset slower top-line growth and headwinds from debt service, especially as revenue growth forecasts remain below industry averages.

Yet, despite these advances, investors should still be mindful of how changes in hospital partner negotiations could affect revenue reliability if...

Read the full narrative on Pediatrix Medical Group (it's free!)

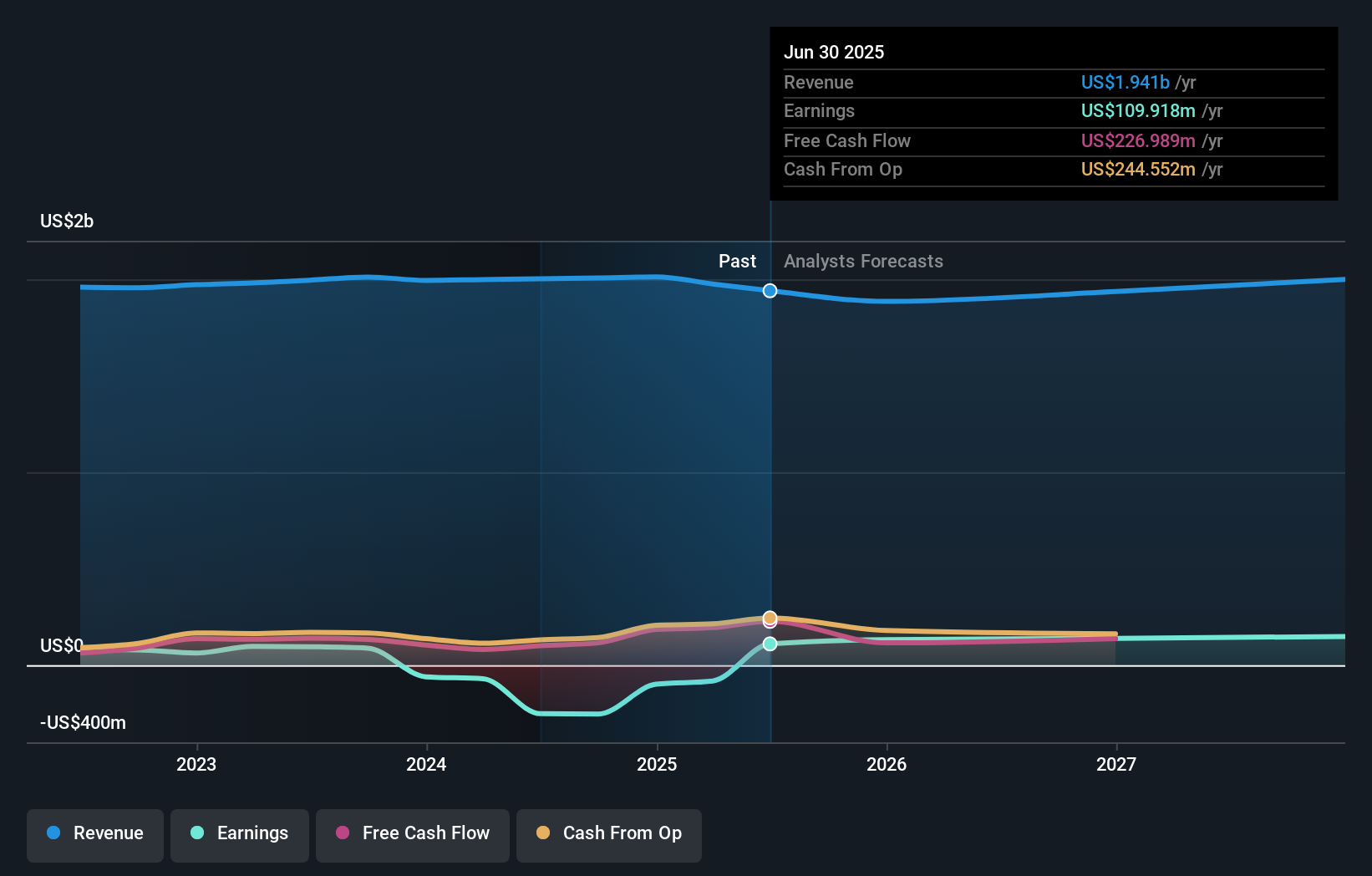

Pediatrix Medical Group's outlook anticipates $2.1 billion in revenue and $145.1 million in earnings by 2028. This is based on a forecast annual revenue growth rate of 2.5% and a $35.2 million increase in earnings from the current $109.9 million level.

Uncover how Pediatrix Medical Group's forecasts yield a $16.71 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from three Simply Wall St Community members range widely, from just US$0.16 to US$24.08 per share. With many watching the company’s ability to outpace challenging growth forecasts, your viewpoint on performance drivers could differ sharply from the next person’s.

Explore 3 other fair value estimates on Pediatrix Medical Group - why the stock might be worth less than half the current price!

Build Your Own Pediatrix Medical Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pediatrix Medical Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pediatrix Medical Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pediatrix Medical Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal