How Investors May Respond To Kulicke and Soffa Industries (KLIC) Launching AI-Driven ACELON Precision Platform

- Kulicke and Soffa Industries recently announced the launch of ACELON™, a next-generation precision dispensing platform for semiconductor, SMT, and automotive assembly, featuring sub-20um accuracy, expanded working area, and AI-driven process optimization.

- This advanced system directly addresses the increasing complexity of high-reliability manufacturing, offering greater throughput and flexibility for evolving substrate sizes and component density requirements.

- We'll explore how ACELON™'s AI-powered auto parameter tuning reinforces Kulicke and Soffa's investment narrative amid ongoing technology demands.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Kulicke and Soffa Industries' Investment Narrative?

For Kulicke and Soffa Industries, the big-picture investment story hinges on staying at the forefront of advanced packaging and process automation in semiconductors. The unveiling of ACELON™ brings AI-driven precision to complex assembly needs, arriving as the company works through a stretch of recent sales declines and one-off losses. While Kulicke and Soffa’s ability to introduce technology that targets emerging substrate sizes and high reliability could support investor confidence, it is worth noting that near-term catalysts, such as a rebound in orders, margin expansion, and execution on new product ramps, may be influenced by how quickly and successfully ACELON™ is adopted. The market did not react with significant volatility post-announcement, suggesting the news is seen as part of the existing innovation pipeline rather than an immediate game-changer. However, ACELON™’s AI integration could gradually alter risk factors, particularly around margin recovery and the speed at which new technology converts into revenue. As always, the main risks remain around cyclical end-market demand, high R&D costs, and pricing power in an increasingly competitive segment. On the flipside, investors should keep in mind the impact of cyclical swings on near-term results.

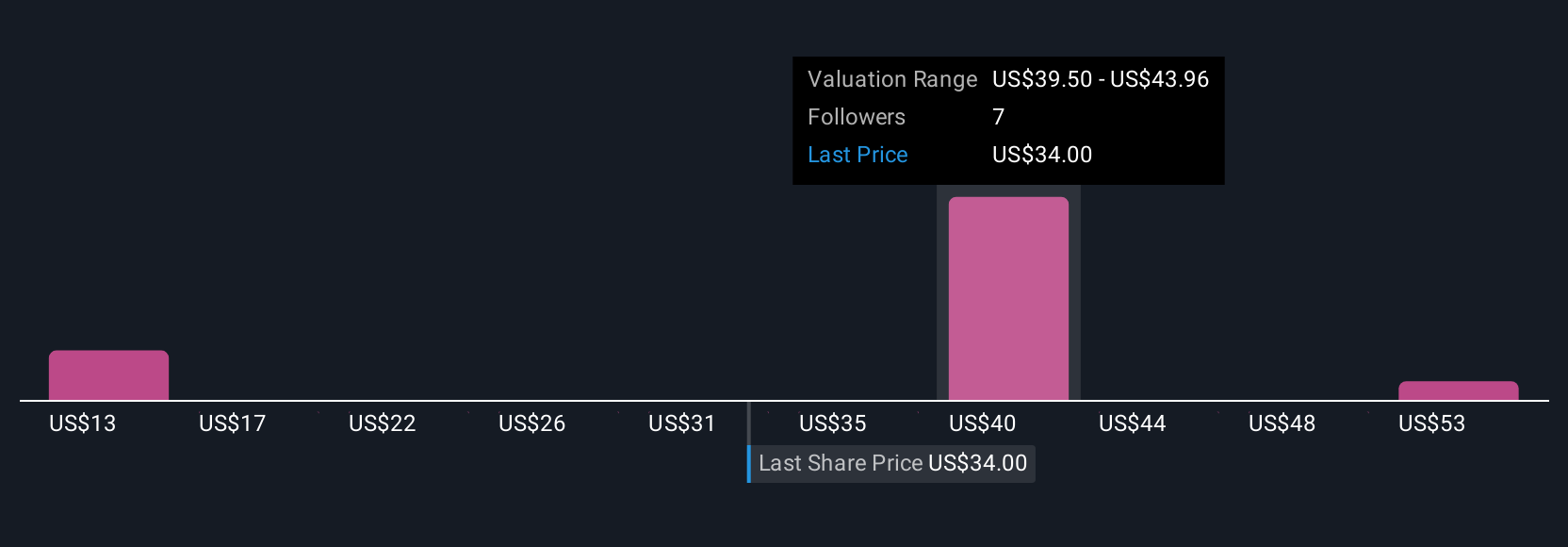

Kulicke and Soffa Industries' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Kulicke and Soffa Industries - why the stock might be worth less than half the current price!

Build Your Own Kulicke and Soffa Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kulicke and Soffa Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kulicke and Soffa Industries' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal