Does Carlisle Companies’ (CSL) New Buyback Reflect Strategic Conviction or Limited Reinvestment Options?

- Earlier this month, Carlisle Companies announced a new share repurchase program authorized by its Board, permitting the buyback of up to 7.5 million shares, and presented at industry conferences in both California and Massachusetts.

- This significant buyback authorization highlights management's confidence in Carlisle's outlook and aligns with ongoing efforts to boost shareholder value and engage with investors at key industry events.

- We will assess how the announcement of Carlisle's major share repurchase initiative could influence its investment narrative and future prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Carlisle Companies Investment Narrative Recap

To own shares of Carlisle Companies, investors need to believe in the resilience of the commercial reroofing market and the company’s ability to drive margin improvement amid end-market headwinds. While the recent buyback announcement signals management’s ongoing commitment to shareholder returns, it does not materially alter the key short-term catalyst, the market’s recovery, or address the current primary risk of persistent softness in new construction and limited pricing power, underscored by downgraded revenue and margin expectations for 2025.

Among recent developments, the 10% increase in Carlisle’s quarterly dividend announced on September 3, 2025, stands out for its relevance to shareholder value. Paired with the buyback initiative, these actions emphasize Carlisle’s intent to return capital to investors even as the company faces margin and revenue pressures, a move that intersects with ongoing uncertainties tied to broader construction trends and demand.

However, investors should also be aware that if new construction remains weak and pricing pressures persist, even robust capital returns may not fully insulate against...

Read the full narrative on Carlisle Companies (it's free!)

Carlisle Companies is projected to reach $5.8 billion in revenue and $997.0 million in earnings by 2028. This outlook implies a 4.9% annual revenue growth and a $193.1 million increase in earnings from the current $803.9 million.

Uncover how Carlisle Companies' forecasts yield a $425.57 fair value, a 16% upside to its current price.

Exploring Other Perspectives

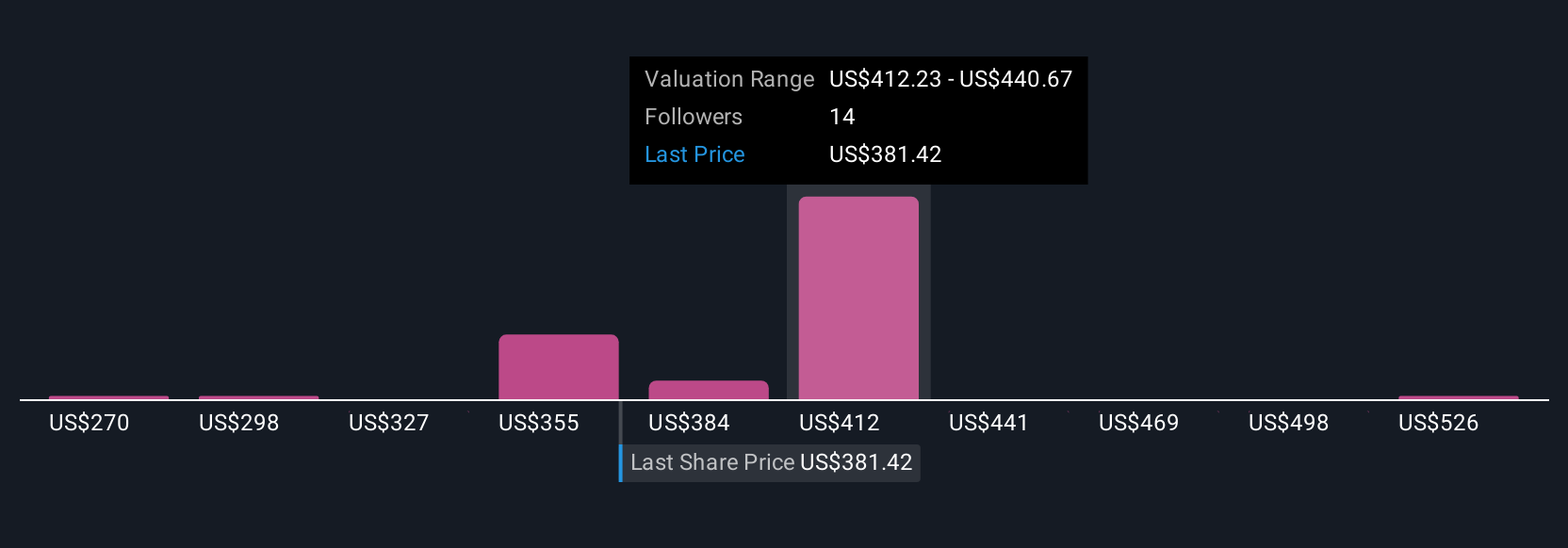

Seven private investors in the Simply Wall St Community have shared fair value estimates for Carlisle ranging from US$270 to US$554.45 per share. While opinions strongly differ, many are weighing the impact of Carlisle’s dependence on the commercial reroofing market and the potential effects if cyclical or structural shifts reduce recurring revenues.

Explore 7 other fair value estimates on Carlisle Companies - why the stock might be worth as much as 52% more than the current price!

Build Your Own Carlisle Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carlisle Companies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carlisle Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carlisle Companies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal