Laureate Education (LAUR) Is Up 5.5% After Analysts Raise Earnings Estimates and Upgrade Momentum Ratings

- Upward revisions to earnings estimates and strong momentum ratings for Laureate Education in recent months have highlighted increased analyst optimism and positive business momentum for the company.

- Despite having significant liabilities, Laureate Education’s net cash position of US$75.9 million and improving earnings have eased concerns about its financial health and debt obligations.

- We’ll explore how these earnings estimate upgrades could shape Laureate Education’s investment narrative and future growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Laureate Education Investment Narrative Recap

Laureate Education’s investment story rests on belief in expanding Latin American higher education demand and effective delivery of both traditional and online learning. Recent upward revisions to earnings estimates and improved momentum ratings signal increased optimism, but they do not materially change the central short term catalyst: enrollment growth in Mexico and Peru. The most immediate risk remains concentrated exposure to country-specific macroeconomic and policy shifts, which could still impact future revenues regardless of earnings momentum.

Among recent announcements, Laureate’s upwardly revised revenue guidance for 2025, increased by US$55 million due to favorable foreign currency movements, directly relates to current analyst optimism. This highlights how external market forces, such as exchange rate changes, can boost short-term financial outlooks, potentially amplifying near-term catalysts while masking underlying structural risks in the business model.

But keep in mind, despite analyst enthusiasm, investors should be aware of the potential impact from Latin American economic or regulatory changes...

Read the full narrative on Laureate Education (it's free!)

Laureate Education's narrative projects $2.0 billion revenue and $343.9 million earnings by 2028. This requires 8.4% yearly revenue growth and a $89.7 million earnings increase from $254.2 million currently.

Uncover how Laureate Education's forecasts yield a $28.00 fair value, a 5% downside to its current price.

Exploring Other Perspectives

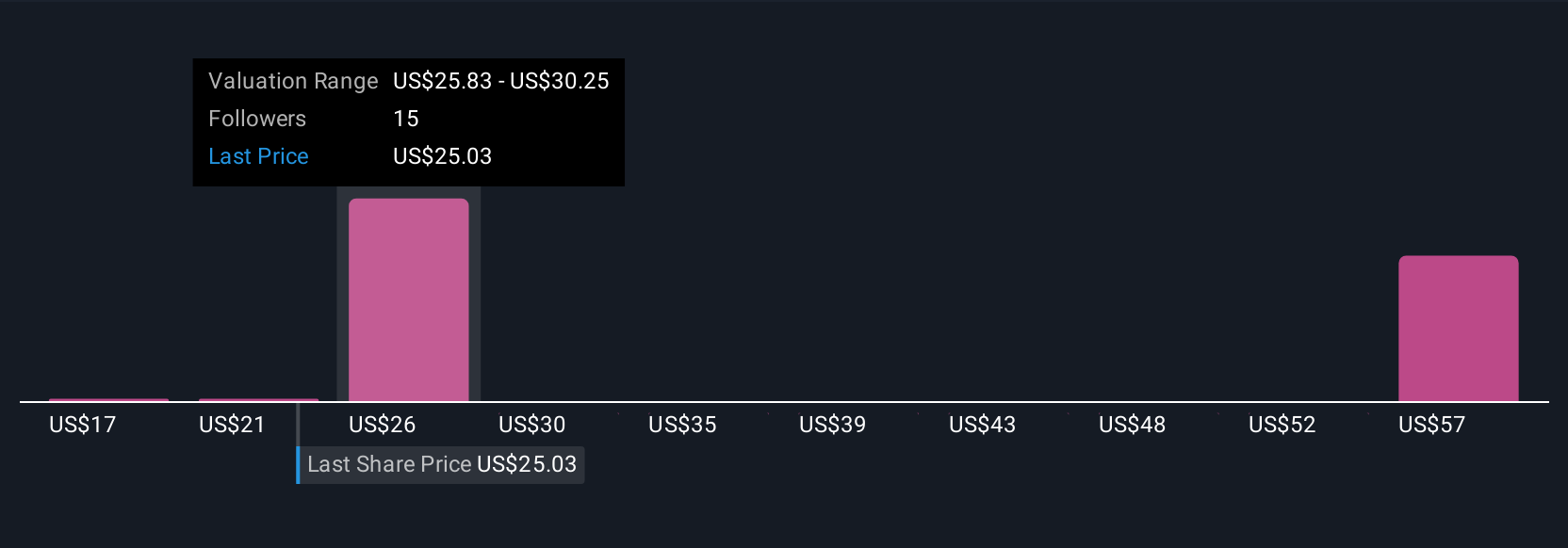

Retail investors in the Simply Wall St Community estimate Laureate’s fair value between US$17 and US$64.74, based on five distinct forecasts. While opinions vary widely, many are weighing the same concentrated country risk seen in analyst coverage, offering a spectrum of views to consider for those tracking the stock’s prospects.

Explore 5 other fair value estimates on Laureate Education - why the stock might be worth 42% less than the current price!

Build Your Own Laureate Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Laureate Education research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Laureate Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Laureate Education's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal