Can Analyst Optimism at Gastech Shift Long-Term Perceptions of Evercore’s (EVR) Global Energy Ambitions?

- On September 9, 2025, Evercore Inc. presented at the Gastech Exhibition & Conference, where Christopher Buckingham, Managing Director of Infrastructure & Energy Debt Advisory, highlighted the firm's global expansion in energy advisory.

- The event underscored growing analyst confidence in Evercore’s earnings outlook, as reflected by recent upward earnings estimate revisions and a favorable Zacks Rank.

- We'll explore how positive analyst sentiment and upward earnings revisions highlighted at the conference influence the broader investment outlook for Evercore.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Evercore Investment Narrative Recap

Owning shares in Evercore means believing in the firm’s ability to expand its global advisory presence and maintain earnings momentum, especially as it pursues growth in energy and infrastructure segments. The Gastech conference appearance underscores positive analyst sentiment and recent upward earnings estimate revisions, but does not materially shift near-term risk: Evercore remains exposed to elevated fixed costs and potential margin compression if deal volumes soften.

Of the recent announcements, Evercore’s robust Q2 2025 earnings, with revenue and net income rising meaningfully year-over-year, stands out. This financial progress supports the optimistic outlook, but execution risk around international expansion and margin management remains a point to watch.

However, investors should be aware that while sentiment is strong, persistent competition in advisory and private capital...

Read the full narrative on Evercore (it's free!)

Evercore's outlook anticipates $5.4 billion in revenue and $953.1 million in earnings by 2028. This is based on an expected 18.7% annual revenue growth rate and an increase in earnings of $490.9 million from their current level of $462.2 million.

Uncover how Evercore's forecasts yield a $364.20 fair value, a 7% upside to its current price.

Exploring Other Perspectives

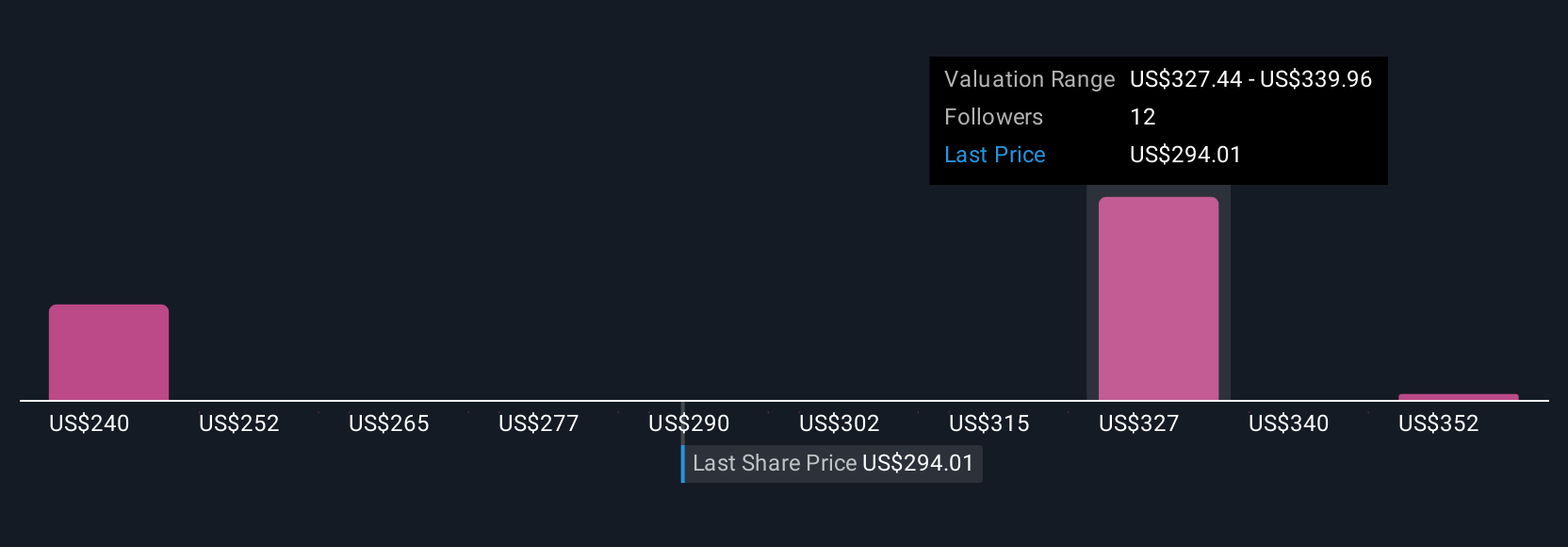

Simply Wall St Community members offered fair value estimates between US$217 and US$365, highlighting considerable divergence across three perspectives. While some expect significant revenue gains, many caution that cost pressures could still affect future margin strength.

Explore 3 other fair value estimates on Evercore - why the stock might be worth as much as 7% more than the current price!

Build Your Own Evercore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evercore research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Evercore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evercore's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal