Curtiss-Wright (CW): Evaluating Valuation After $200 Million Buyback Expansion and Analyst Upgrades

If you’ve been watching Curtiss-Wright (CW), the company’s latest move might have you reconsidering your next step. Management just unveiled a $200 million expansion to its 2025 share repurchase program, which signals that leadership is backing up its faith in the business with real capital. Alongside this, momentum is building from analyst upgrades that highlight rising earnings estimates. Together, these factors suggest a company with both strategic conviction and the potential for stronger shareholder returns.

This announcement follows a string of recent activity for Curtiss-Wright, including a new quarterly dividend declaration and discussion of future acquisitions. The stock’s upward movement is notable, with a 45% increase so far this year and a 65% gain over the past twelve months, significantly outpacing the broader market. Over the long term, performance during the past three and five years has shown even stronger compounded returns, reflecting growing investor confidence as new developments emerge.

But after a year of rapid appreciation and renewed optimism, is Curtiss-Wright undervalued, or are markets already factoring in all the growth ahead?

Most Popular Narrative: 2% Undervalued

The most widely followed narrative views Curtiss-Wright as slightly undervalued, with current analyst projections suggesting its fair value is just above the latest share price. This outlook reflects optimism about the company's growth drivers and management’s strategy to capitalize on defense and nuclear opportunities.

Surging global defense budgets, increased geopolitical tensions, and a potential expansion of NATO's spend target from 2% to 5% of GDP are fueling strong multi-year demand for Curtiss-Wright's defense systems, including embedded computing, mission-critical electronics, and platform content. Management expects 20% growth in direct foreign military sales for 2025 and a visible international pipeline, positioning the company for sustained revenue and earnings expansion.

Want to unravel why analysts think Curtiss-Wright’s value could still climb? Their forecast hinges on ambitious growth targets and industry-breaking profit margins, but how bold are these assumptions? Discover the key drivers and surprising financial projections that power this valuation story.

Result: Fair Value of $520 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on large defense and nuclear contracts, as well as shifts toward software-based solutions, could challenge the bullish growth outlook for Curtiss-Wright.

Find out about the key risks to this Curtiss-Wright narrative.Another View: Room for Doubt?

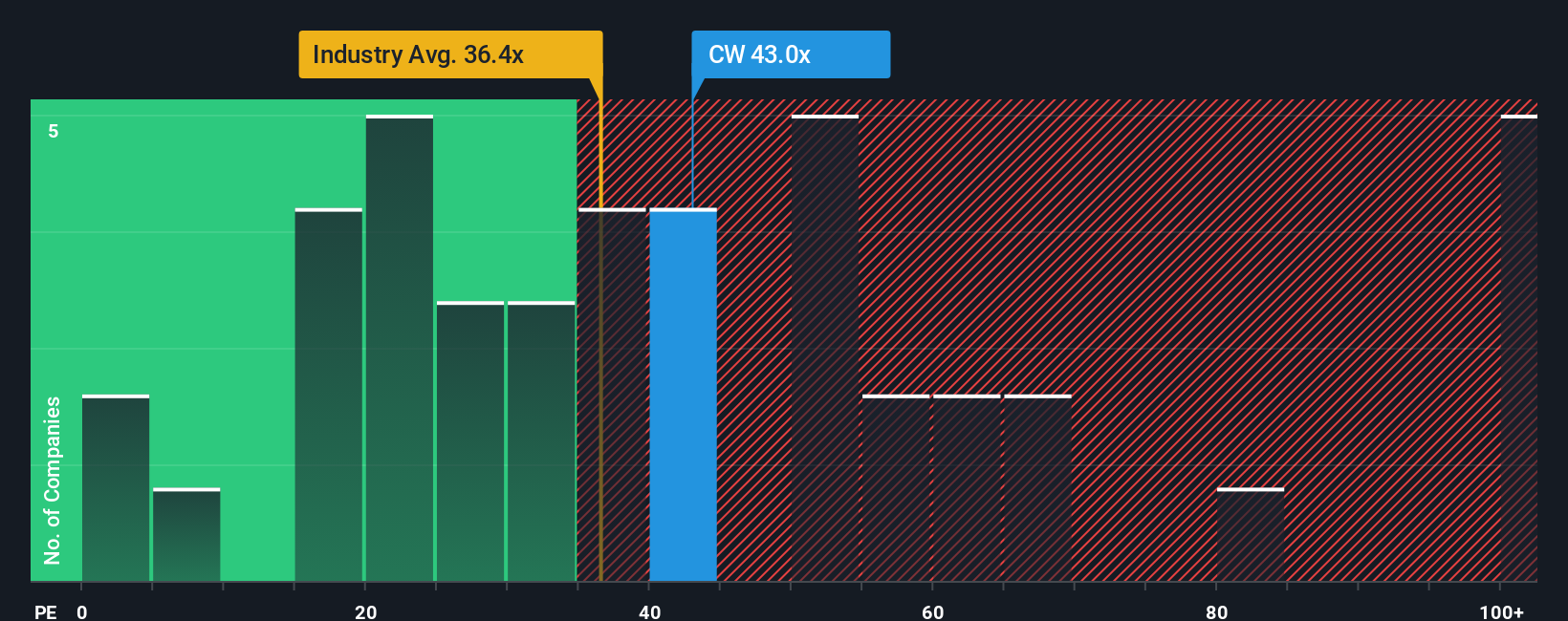

Taking a closer look from a different angle, valuation based on how the market prices similar companies suggests Curtiss-Wright is more expensive than its industry. So, are investors being too optimistic, or is something special in play?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Curtiss-Wright Narrative

If you think the story runs deeper or want to reach your own conclusions, you can dig into the data and shape your perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Curtiss-Wright.

Looking for more investment ideas?

Don’t just stop with Curtiss-Wright. Some of the market’s most promising opportunities are only a click away. Tap into the next breakthrough before others catch on.

- Unlock potential high-yield returns and stable income by checking out dividend stocks with yields > 3% for stocks with strong dividend payouts and solid balance sheets.

- Spot untapped value and future upside with undervalued stocks based on cash flows to find quality companies trading below their intrinsic worth based on cash flows.

- Ride innovation’s next wave by acting on insights from AI penny stocks, featuring emerging businesses harnessing the power of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal