Northern Oil and Gas (NOG): Assessing Valuation After Debt Concerns and EBIT Growth Drive Investor Focus

Northern Oil and Gas (NOG) has landed in the spotlight after the latest analysis underscored its hefty debt load, which outweighs its cash and receivables by a big margin. For investors sizing up the company, this is more than just a blip on the radar. It puts a magnifying glass over financing costs and the risk of dilution. What makes the situation even more interesting is that, despite these liabilities, Northern Oil and Gas has managed meaningful EBIT growth in the past year. Still, its negative free cash flow leaves questions about long-term financial flexibility.

This renewed attention to debt comes after a year where Northern Oil and Gas stock has faced a steady grind lower. Over the past year, shares are down 22%, and the trend year-to-date is even softer, with the stock falling 33%. Looking back a bit further, the past three years haven't delivered for long-term holders, and momentum hasn’t quite found its footing this year. It is clear that the market is recalibrating its perception of risk, especially as investors digest not just debt headlines but also recent swings in oil prices and sector sentiment.

After all these shifts, the question is front and center. Is Northern Oil and Gas trading at a discount that reflects genuine risk, or could the market be overlooking its earnings growth and potential for a rebound?

Most Popular Narrative: 24.5% Undervalued

According to the most widely followed narrative, Northern Oil and Gas is trading at a notable discount relative to its projected fair value. Analysts believe the current share price reflects substantial market skepticism compared to their quantified outlook.

The company's disciplined shift toward acquisitions of long-dated, stable production assets amid a volatile commodity environment positions NOG to benefit from continued global energy demand and the ongoing importance of energy security. This supports more resilient long-term revenue and leads to less volatile cash flows.

Curious why this oil and gas player is considered dramatically undervalued? The narrative highlights a distinct combination of forward-looking assumptions and sector-specific metrics that challenge market expectations. Want to discover which strategic moves and financial projections are fueling this bullish valuation? The full narrative reveals the bold logic that powers the analyst consensus.

Result: Fair Value of $33.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if oil prices remain volatile or acquisitions fail to deliver expected synergies, the bullish outlook on Northern Oil and Gas could quickly change.

Find out about the key risks to this Northern Oil and Gas narrative.Another View: Discounted Cash Flow Perspective

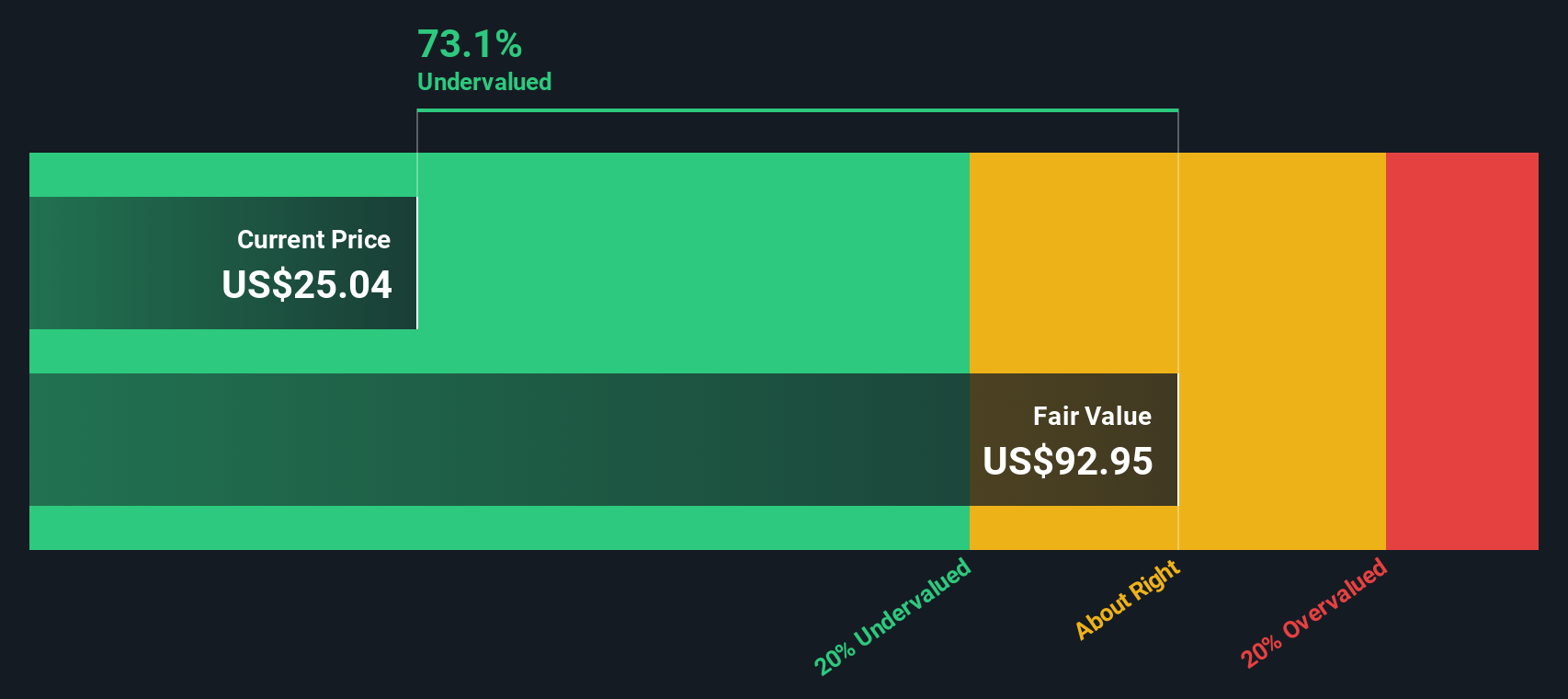

While analyst price targets suggest the market undervalues Northern Oil and Gas, our SWS DCF model also indicates the stock is trading well below its intrinsic value. But can a cash flow approach really capture future uncertainty in this sector?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Northern Oil and Gas Narrative

If these perspectives don’t quite match your view or you want to dig deeper into the numbers yourself, building your own narrative can take just a few minutes. Do it your way

A great starting point for your Northern Oil and Gas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Explore stocks that match your interests and elevate your portfolio with these expert-curated stock ideas from Simply Wall Street’s screeners.

- Begin your search for potential turnaround stories by exploring undervalued stocks based on cash flows, which features companies trading below their fair value and may be awaiting market recognition.

- Discover the future of medicine with healthcare AI stocks, where innovation meets healthcare through breakthroughs in artificial intelligence and biotech-driven advances.

- Enhance your passive income by viewing dividend stocks with yields > 3%, which highlights companies with strong yields that can help support consistent returns over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal