A Fresh Look at Coeur Mining’s (CDE) Valuation on New Exploration Results and Resource Expansion

If you are following Coeur Mining (CDE), you probably noticed today’s buzz around the company’s latest exploration results. Coeur Mining just released a slate of updates from its Las Chispas and Kensington mines, featuring high-grade gold and silver intercepts, resource growth, and promising new discoveries. Drill results such as 4.61 ounces per ton of gold and 392 ounces per ton of silver at Las Chispas, along with new zones of mineralization at both Augusta and Elmira, are fueling investor conversations about whether this marks a turning point for Coeur’s growth prospects.

These exploration updates follow a year in which Coeur Mining’s shares more than doubled, rising over 150% year-to-date and over 110% for the past twelve months. Momentum has increased recently, with the stock up nearly 33% this past month alone. Previous years have been less spectacular, but investors now appear to be repricing the company’s risk as fresh discoveries and an accelerated drilling program generate increased optimism.

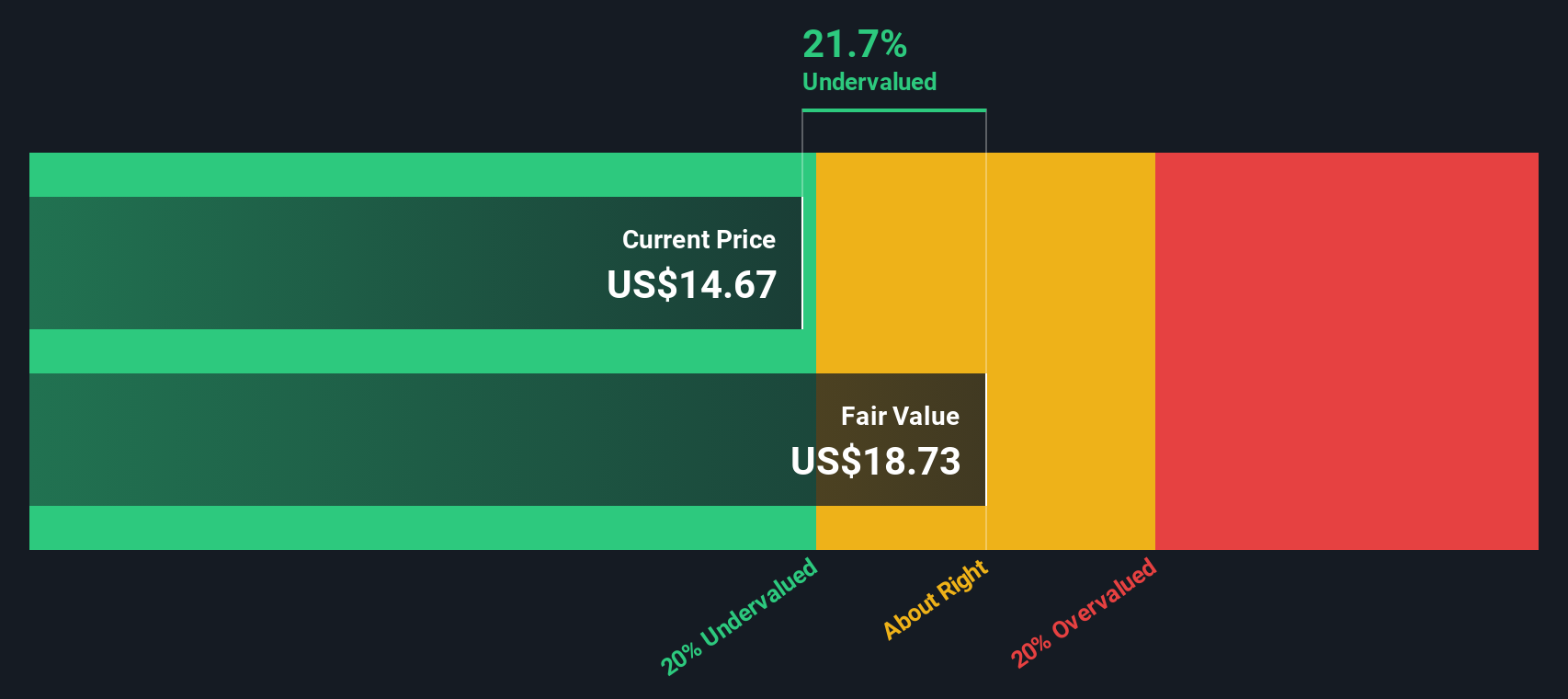

With all this momentum behind Coeur Mining, the question arises: is the stock still trading at a discount to its actual value, or is the market already factoring in all the future growth?

Most Popular Narrative: 18.7% Overvalued

The most widely followed narrative currently suggests that Coeur Mining stock is trading well above its estimated fair value. Analysts highlight impressive operational momentum and earnings prospects, but their consensus price target is noticeably below today’s share price.

The successful ramp-up and integration of the Rochester expansion and Las Chispas asset are driving significant increases in silver and gold production. This is positioning Coeur for robust revenue and earnings growth in the near to medium term.

Want to unpack the assumptions behind this red-hot valuation? One future metric stands out as the catalyst for the street’s high expectations. The narrative teases three years of growth, profit margin expansion, and a dramatic shift in company multiples. Curious which financial forecasts are fueling this call? There is more to the story. Find out what could be pushing analysts to this surprisingly optimistic price target calculation.

Result: Fair Value of $13.08 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained regulatory hurdles or unexpected shortfalls in exploration results could challenge these optimistic forecasts and limit Coeur Mining’s ability to deliver on growth expectations.

Find out about the key risks to this Coeur Mining narrative.Another View: Our DCF Model Suggests a Different Story

While analysts point to Coeur Mining being overvalued, the SWS DCF model tells a different tale. According to this cash flow-based approach, shares actually appear undervalued. Could the market be missing something crucial?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Coeur Mining Narrative

If you see things differently or want to explore the numbers for yourself, you can build your own narrative in a matter of minutes, and Do it your way.

A great starting point for your Coeur Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investing universe and make smarter moves with strategies that can sharpen your portfolio. Miss out on these opportunities, and you could be leaving gains on the table.

- Tap into the next wave of innovation by checking out exciting opportunities in AI-driven businesses with AI penny stocks.

- Lock in reliable income streams and safeguard your wealth with a curated selection of stocks yielding over 3% through dividend stocks with yields > 3%.

- Seize overlooked bargains trading below their intrinsic value with our data-backed picks for smart investors at undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal