How Investors May Respond To Cabot (CBT) Surpassing Industry ROCE With Strong Reinvestment Strategy

- In recent news, Cabot's return on capital employed (ROCE) reached 21% over the past five years, substantially exceeding its industry average of 9.2% as the company increased both returns and capital employed.

- This strong trend in reinvestment and profitability has resulted in a very strong return to shareholders, signaling growing investor confidence in Cabot's operational fundamentals.

- We’ll explore how Cabot’s sustained improvement in ROCE shapes its ongoing investment narrative amid recent share price fluctuations.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

What Is Cabot's Investment Narrative?

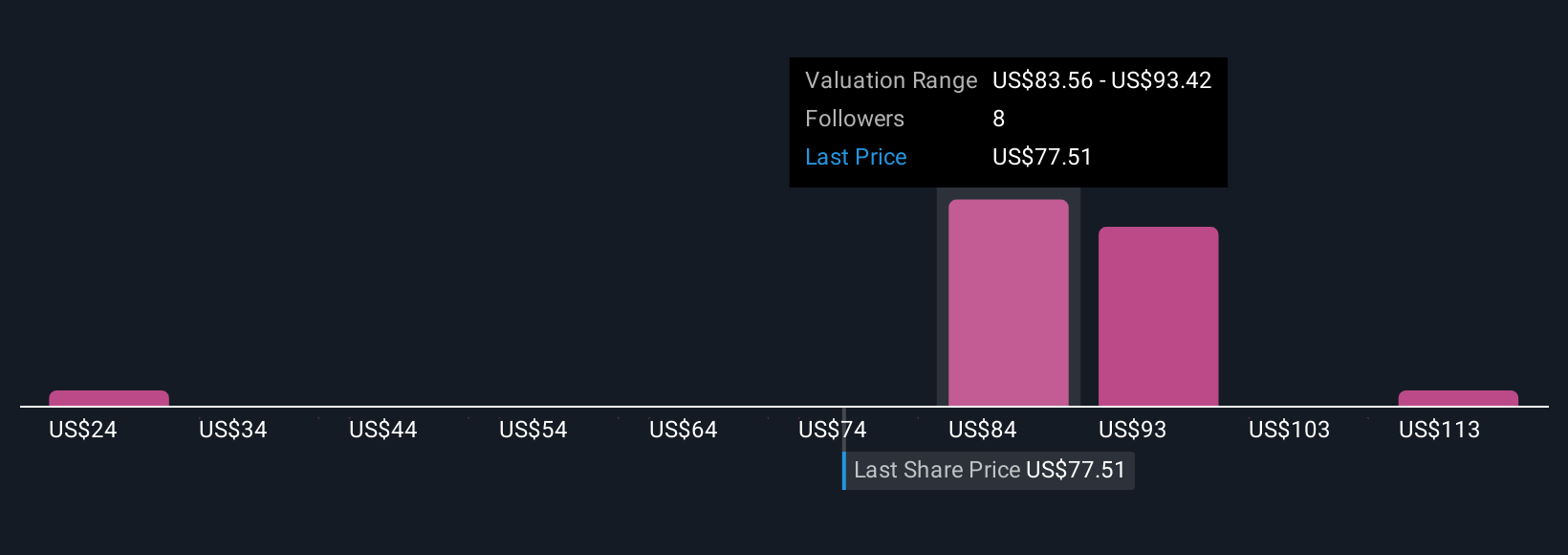

Anyone considering Cabot as an investment candidate right now needs to be comfortable with a story driven by operational efficiency and consistent capital reinvestment. The recent surge in return on capital employed, now hitting 21%, has meaningfully outstripped industry averages and arrives just as Cabot has completed new share repurchases and maintained a rising dividend. While this adds weight to the company’s fundamental strength, shareholders have still faced a decline in sales over recent quarters and negative one-year total returns, despite net income growth. This latest news largely reinforces prior strengths rather than overturning existing risks and catalysts: investor focus remains on whether Cabot can translate efficient capital deployment into renewed, broad-based revenue growth, especially as the market continues to view the shares as undervalued based on both consensus and historic five-year returns. Meanwhile, the company’s slower revenue growth forecasts and high debt levels have not meaningfully improved with this announcement, so risk factors remain much the same, albeit with some renewed confidence in management’s reinvestment track record.

However, robust capital efficiency does not erase slower top-line growth or high debt risks, details investors should not overlook.

Exploring Other Perspectives

Explore 4 other fair value estimates on Cabot - why the stock might be worth as much as 56% more than the current price!

Build Your Own Cabot Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cabot research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cabot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cabot's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal