Should International Seaways’ (INSW) $250 Million Bond for VLCC Repurchases Prompt Investor Action?

- On September 9, 2025, International Seaways, Inc. announced the pricing of US$250 million in senior unsecured bonds maturing in September 2030 with a fixed interest rate of 7.125%, aimed at funding the repurchase of six VLCCs and supporting general corporate purposes.

- This bond issuance both finances the company's fleet renewal and demonstrates market access to sizable, non-dilutive capital for operational flexibility.

- We’ll explore how the new bond financing, earmarked for vessel repurchases, could reshape International Seaways’ future growth outlook.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

International Seaways Investment Narrative Recap

To be a shareholder of International Seaways, one likely needs to believe in the continued relevance of global crude and product shipping, and that the company’s ongoing fleet renewal can help offset industry volatility and environmental pressures. The recent US$250 million bond issuance enhances financial flexibility for vessel repurchases, supporting the near-term fleet upgrade catalyst, but does not materially reduce exposure to sector risks like declining fossil fuel demand or increasing regulatory costs.

Among recent announcements, the Q2 2025 earnings report stands out, with revenue and net income declining year-over-year and profit margins narrowing from previous highs. This context underscores why improving operational efficiency through new vessel acquisitions, as enabled by the recent bond deal, is being prioritized as a key catalyst for future performance.

Yet, in contrast to these renewal efforts, investors should be aware of the persistent risk that environmental compliance costs...

Read the full narrative on International Seaways (it's free!)

International Seaways' outlook projects $848.0 million in revenue and $288.7 million in earnings by 2028. This scenario assumes 2.0% yearly revenue growth and a $50.1 million increase in earnings from the current $238.6 million level.

Uncover how International Seaways' forecasts yield a $53.50 fair value, a 14% upside to its current price.

Exploring Other Perspectives

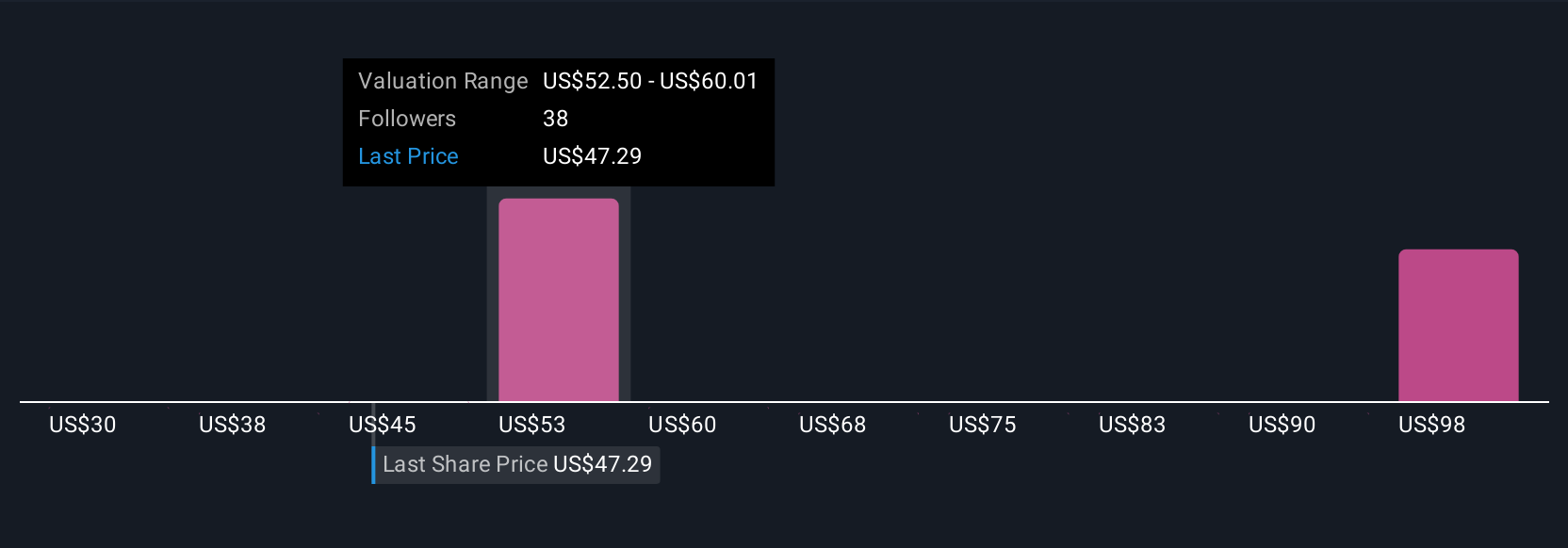

Six independent fair value estimates from the Simply Wall St Community range from US$30 to US$104.89 per share. While some expect higher valuations, the risk of tighter environmental regulation could still influence the company’s future returns in unpredictable ways.

Explore 6 other fair value estimates on International Seaways - why the stock might be worth over 2x more than the current price!

Build Your Own International Seaways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Seaways research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free International Seaways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Seaways' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal