KLA (KLAC) Is Up 6.5% After AI Focus and Rate Cut Hopes Fuel Market Optimism—Has the Bull Case Changed?

- In the past week, KLA benefited from strong market optimism as major U.S. stock indexes reached record highs amid expectations of Federal Reserve interest rate cuts. Investor enthusiasm was further fueled by the company's emphasis on AI and advanced packaging technologies, which are seen as key drivers of its future opportunities and resilience.

- The combination of positive macroeconomic momentum and KLA’s positioning in advanced semiconductor technologies has heightened investor confidence, even as risks such as global tariffs and shifting demand profiles remain important considerations for the company.

- We'll examine how the anticipated rate cuts and KLA’s AI initiatives could reshape its investment narrative going forward.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

KLA Investment Narrative Recap

To be a KLA shareholder today, you need to believe in the sustained rise of semiconductor process control intensity, fueled by AI adoption and advanced packaging. The recent surge in KLA’s share price on expectations of Federal Reserve interest rate cuts isn’t likely to alter the most important near-term catalyst: strong demand for the company's inspection platforms. However, structural risks from global tariffs and margin pressure remain material to the business and could impact future returns.

Among recent announcements, KLA’s increased share buyback authorization of US$5 billion in May 2025 stands out as particularly relevant, underscoring management’s confidence in the company’s cash generation and its commitment to shareholder returns. This move provides support to the stock during positive market cycles and may continue to be an attractive feature for investors as revenue from advanced packaging ramps up.

Yet, despite robust demand signals, it’s crucial to remember that added tariff exposures and uncertainty around the company’s ability to fully mitigate these costs warrant close attention for those evaluating KLA’s story...

Read the full narrative on KLA (it's free!)

KLA's outlook anticipates $14.8 billion in revenue and $5.3 billion in earnings by 2028. This projection assumes a 6.9% annual revenue growth rate and a $1.2 billion increase in earnings from the current $4.1 billion level.

Uncover how KLA's forecasts yield a $929.68 fair value, a 4% downside to its current price.

Exploring Other Perspectives

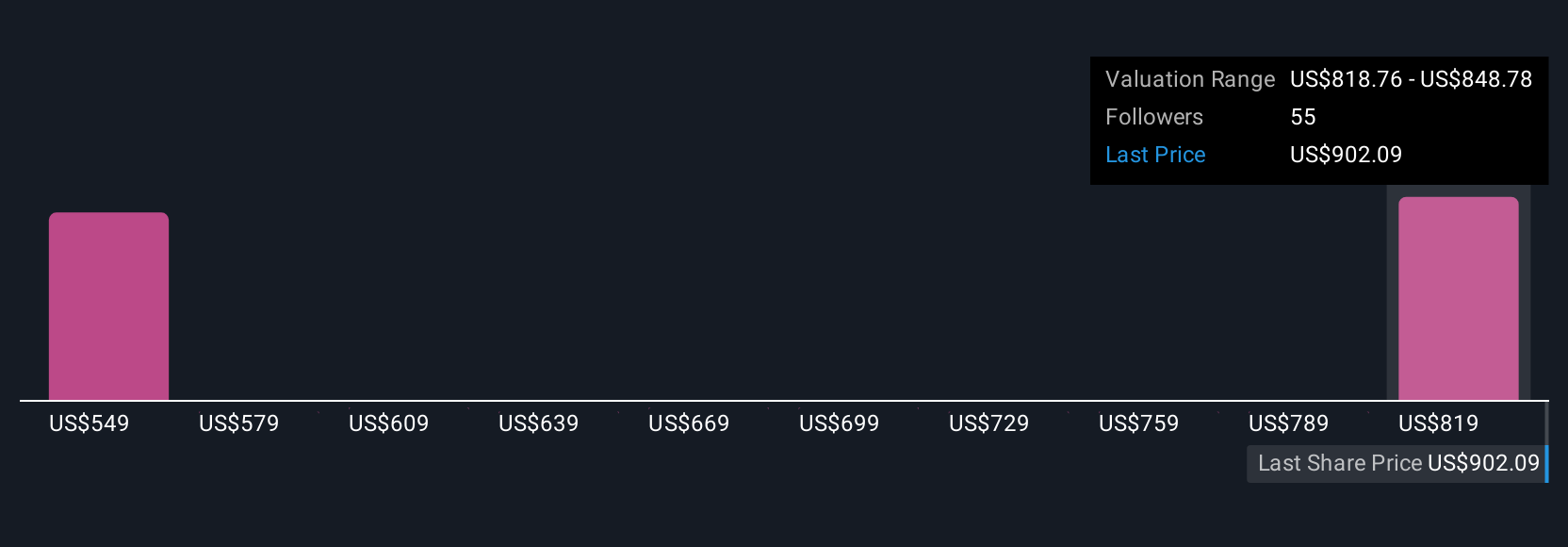

Six fair value estimates from the Simply Wall St Community range from US$575.66 to US$929.68 per share, underscoring a wide spectrum of investor outlooks. As expectations rise around KLA’s advanced packaging market expansion, this diversity of opinion shows how broader shifts in growth drivers can reshape your view of the company’s future.

Explore 6 other fair value estimates on KLA - why the stock might be worth as much as $929.68!

Build Your Own KLA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KLA research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free KLA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KLA's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal