Do Upward Analyst Revisions Signal a Turning Point for Qorvo’s (QRVO) Competitive Edge?

- In recent days, seven analysts revised their earnings estimates upwards for Qorvo, signaling increased optimism about the company's prospects amid its role as a core radio frequency solutions provider for key sectors including mobile, infrastructure, and aerospace/defense.

- This collective analyst confidence stands out and contrasts with at least one analyst maintaining a cautious stance, underscoring the diverse views on Qorvo within the investment community.

- Next, we’ll assess how these upward earnings revisions shape the overall investment narrative for Qorvo and its outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

Qorvo Investment Narrative Recap

To be a Qorvo shareholder today, you generally need to believe in the company's ability to leverage its radio frequency solutions across mobile, infrastructure, and defense amid rapid connectivity shifts. The recent wave of upward earnings estimate revisions by analysts may influence short-term sentiment, but the most important catalyst, Qorvo’s ability to capitalize on wireless infrastructure expansion, remains unchanged. The key risk continues to be heavy customer concentration, which could cause volatility if demand from its largest customer shifts. The impact of the analyst sentiment change, while positive, does not fundamentally alter these dynamics.

Among recent announcements, Qorvo’s updated Q2 revenue guidance of about US$1.025 billion stands out as directly relevant to current optimism, providing a tangible near-term benchmark for investors. This forecasted step-up in sequential revenue, if achieved, could help offset concerns about underperforming segments and maintain confidence in anticipated growth drivers. Combined with its ongoing efforts to consolidate operations and enhance efficiency, this revenue outlook serves as a closely watched validation point for Qorvo’s near-term story.

Yet, in contrast, Qorvo’s reliance on a single major customer, and what happens if demand from that customer unexpectedly drops, is information investors should be aware of...

Read the full narrative on Qorvo (it's free!)

Qorvo's outlook anticipates $4.1 billion in revenue and $480.9 million in earnings by 2028. This projection is based on a 4.4% annual revenue growth rate and a $400.1 million increase in earnings from the current level of $80.8 million.

Uncover how Qorvo's forecasts yield a $97.29 fair value, a 12% upside to its current price.

Exploring Other Perspectives

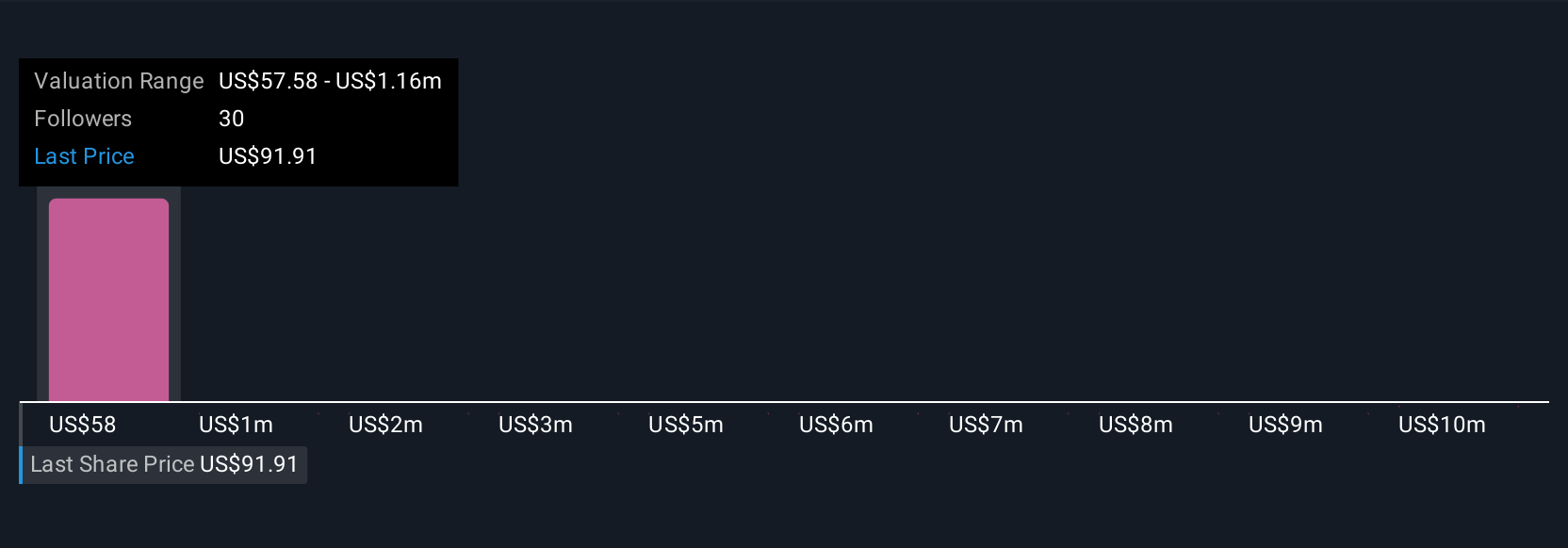

Five individual investors in the Simply Wall St Community submitted fair value estimates for Qorvo, stretching from US$57.58 to over US$11,561,842.06. With such a range of views and a central concern around customer concentration risk shaping the company’s outlook, you may want to examine multiple angles before making up your mind.

Explore 5 other fair value estimates on Qorvo - why the stock might be a potential multi-bagger!

Build Your Own Qorvo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Qorvo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qorvo's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal