Marqeta (MQ) Valuation in Focus After Profit Growth Warning from New CEO

Most Popular Narrative: 17% Undervalued

According to the most popular narrative, Marqeta is currently undervalued by 17% relative to its future prospects. Analysts see meaningful upside based on expected improvements in profitability and robust earnings expansion over the next several years.

The completed TransactPay acquisition gives Marqeta full program management and EMI capabilities in Europe. This enables entry into larger enterprise opportunities, creates uniformity of service across North America and Europe, and allows easier multi-market expansion for clients. This unlocks new revenue streams, increases take rates, and improves earnings scalability.

Curious why analysts think Marqeta deserves a premium valuation? The narrative hinges on bold financial goals, with future profit multiples that usually spark headlines. Want to be ahead of the curve? See exactly which moving pieces and growth projections drive this eye-catching fair value call.

Result: Fair Value of $7.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on a handful of major clients and intensifying competition could quickly spark volatility in Marqeta’s growth story.

Find out about the key risks to this Marqeta narrative.Another View: Price Check Against the Sector

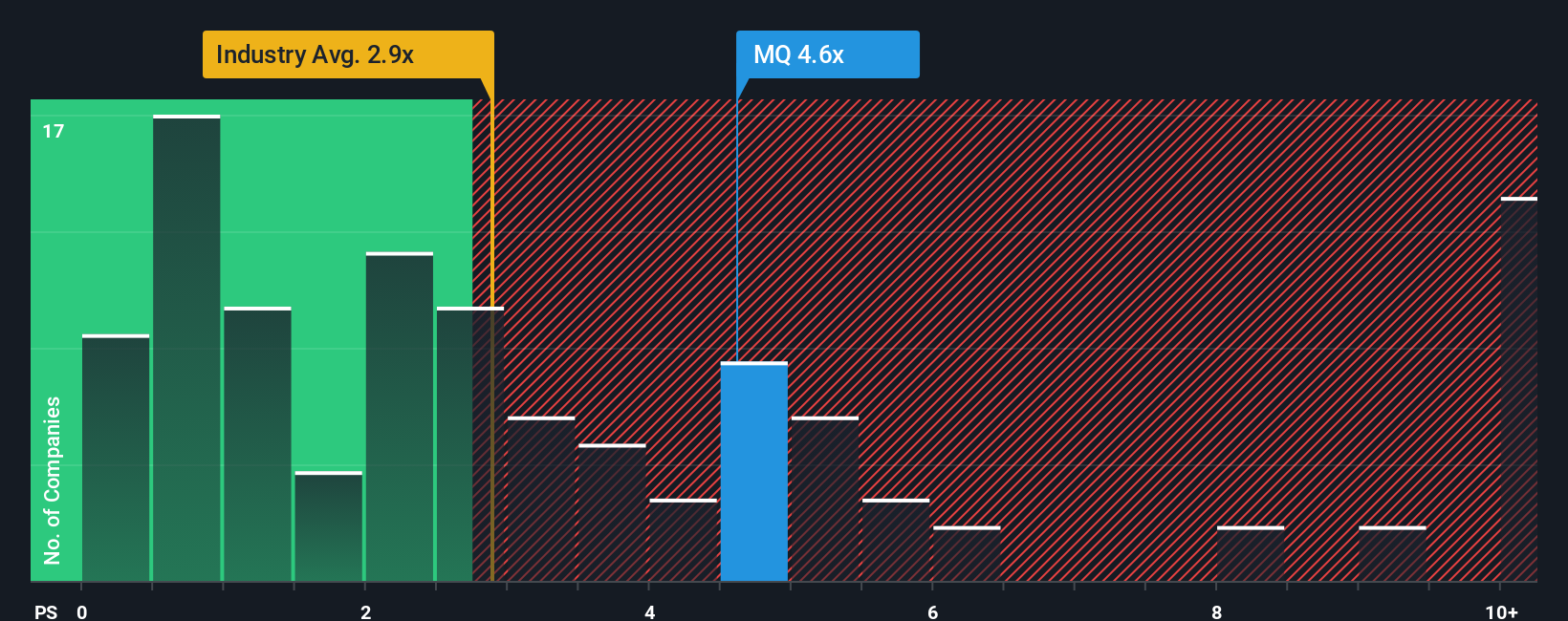

While one perspective sees Marqeta as undervalued, a different method checks its value by comparing its sales to those of similar industry players. On this basis, Marqeta actually looks expensive. Could different market lenses change the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marqeta Narrative

If you see the story differently or want your own deep dive, you can explore Marqeta's numbers and shape your assessment in just minutes. Do it your way.

A great starting point for your Marqeta research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Seize your next edge. The market is full of hidden gems beyond Marqeta. Get ahead while others hesitate by targeting opportunities that match your goals and interests.

- Uncover potential in small-but-mighty companies with untapped upside when you check out penny stocks with strong financials using penny stocks with strong financials.

- Ride the tidal wave of innovation by zeroing in on cutting-edge healthcare pioneer stocks fueled by artificial intelligence through healthcare AI stocks.

- Strengthen your portfolio with reliable income streams. Scan for stocks offering yields above 3% in today's market using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal