A Fresh Look at AngloGold Ashanti (NYSE:AU) Valuation as Gold Surge Fuels Investor Attention

If you’re eyeing AngloGold Ashanti (NYSE:AU), recent headlines might have grabbed your attention. The stock’s latest rally seems closely tied to surging gold prices as traders react to shifting geopolitical dynamics and renewed talk of Federal Reserve rate cuts. Combine this with fresh analysis suggesting the company could be trading at a steep discount to its projected fair value, and it’s easy to see why interest is heating up.

This burst of activity comes after a strong year for AngloGold Ashanti. Momentum has clearly been building, with shares up more than 140% over the past year and even higher gains stacked up for longer-term holders. The company’s top and bottom lines have both shown annual growth, thanks to its exposure to rising gold prices and operational discipline, adding further fuel to the stock’s move higher.

But after such a run, and with valuation models flashing a possible bargain, are investors staring at a real buying opportunity or is the market now fully pricing in AngloGold Ashanti’s growth prospects?

Most Popular Narrative: 22.4% Overvalued

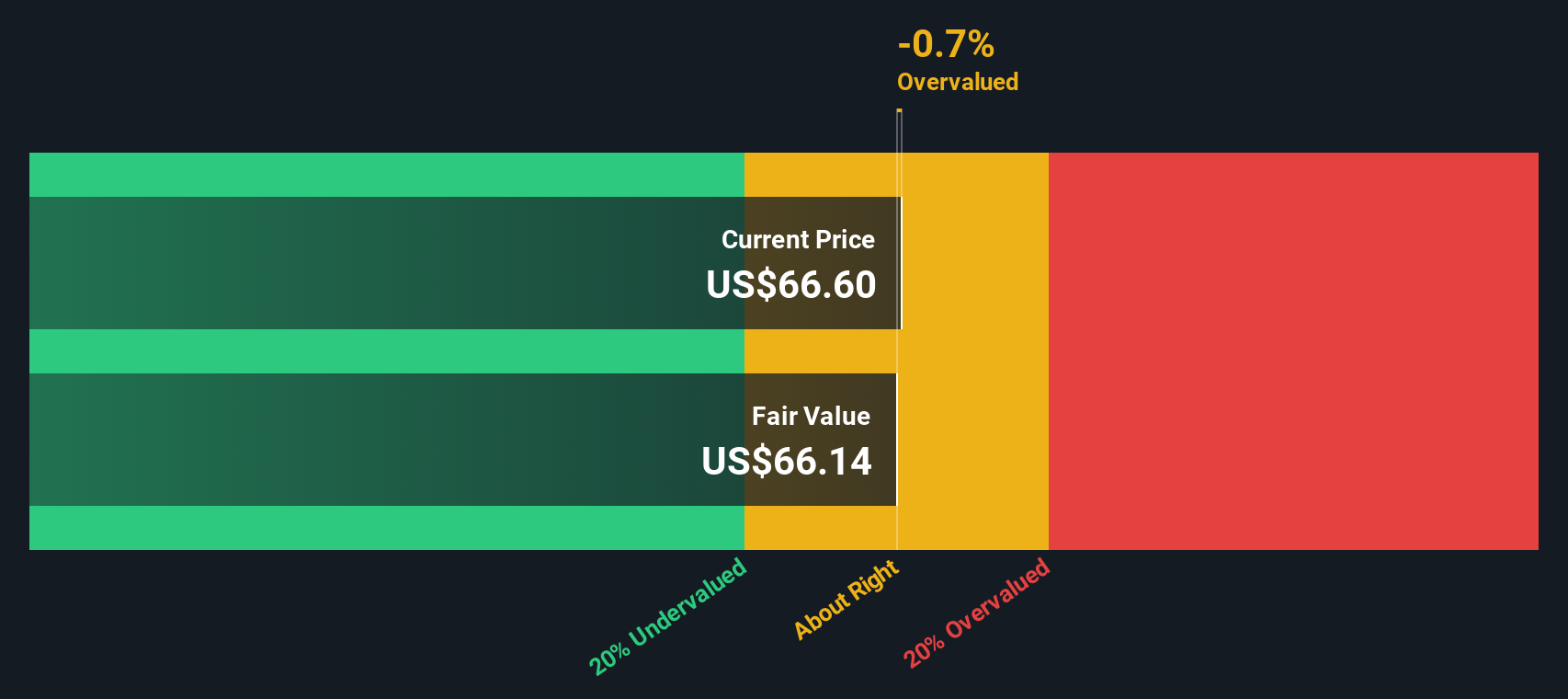

According to the most widely followed analyst consensus, AngloGold Ashanti is currently considered overvalued, with its share price trading well above the narrative's estimated fair value.

Ongoing optimization of the asset portfolio toward lower-risk jurisdictions, combined with disciplined cost control (notably, stable cash cost and AISC in real terms despite sectoral inflation), is improving production stability and supporting structurally stronger net margins. Organic production growth from brownfield projects (Obuasi ramp-up, Cuiabá, Siguiri, Geita, and upcoming Nevada developments) is set to increase output volumes and extend mine life. This is expected to drive future revenue and earnings growth over the next decade.

Curious what’s driving such a bold valuation call? The fair value estimate is built on detailed projections around future production growth, persistent margin gains, and disciplined expansion across global operations. Want to discover which optimistic assumptions about revenue, earnings, and profit multiples are fueling this price target? Uncover the analyst narrative to see what could transform AngloGold Ashanti into a long-term outperformer or leave it priced for perfection.

Result: Fair Value of $54.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising costs and uncertain regulatory timelines could limit AngloGold Ashanti’s upside. Margins may come under pressure if inflation or project delays persist.

Find out about the key risks to this AngloGold Ashanti narrative.Another View: What Does Our DCF Model Say?

While analysts see AngloGold Ashanti as overvalued using future earnings multiples, our SWS DCF model tells a different story. It indicates the shares may actually be undervalued. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AngloGold Ashanti Narrative

If these takes don’t quite fit your outlook, know that you can easily dig into the numbers and shape your own thesis in just a few minutes. Do it your way.

A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Level up your portfolio by seeking out smart opportunities with our targeted screeners. Don’t let these market moves pass you by; there’s something for every type of investor!

- Uncover growth potential in companies tackling the future of healthcare with our healthcare AI stocks, and spot AI-driven innovators transforming patient outcomes and diagnostics.

- Accelerate your search for income by using our tool showcasing dividend stocks with yields > 3%, helping you focus on stocks rewarding shareholders with robust yields above 3%.

- Zero in on tomorrow’s success stories by quickly sorting penny stocks with strong financials to find opportunities that combine affordable entry with strong financial foundations and upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal