How Investors May Respond To Dycom Industries (DY) Rising Returns and Increased Reinvestment Activity

- In recent news, Dycom Industries reported a growing return on capital employed reaching 15%, along with a 51% uplift in capital invested over the past five years, pointing to substantial reinvestment activity.

- This combination signals that Dycom has found and executed on profitable growth opportunities, which has underpinned strong long-term value creation for its investors.

- We will now look at how Dycom's improvement in capital allocation could influence its investment outlook and sector positioning.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Dycom Industries Investment Narrative Recap

To invest in Dycom Industries, you need confidence in its ability to find sustained profitable growth through reinvestment, particularly as fiber buildouts and data connectivity remain long-term industry drivers. While the recent improvement in return on capital employed reassures, it does not materially change the fact that revenue concentration among a handful of major telecom customers is still the biggest near-term risk, any pullback or changes from these clients could create near-term volatility.

Among Dycom’s recent announcements, the updated full-year 2026 guidance, projecting contract revenues between US$5.290 billion and US$5.425 billion (up 12.5% to 15.4%), ties directly to the outlook for ongoing fiber and data infrastructure investment, a key industry catalyst underpinning its growth prospects.

Yet, despite these positive signals, investors should be aware that if a major customer were to delay or reduce spending, the impact on Dycom's revenue visibility could be both sudden and significant…

Read the full narrative on Dycom Industries (it's free!)

Dycom Industries' outlook anticipates $6.6 billion in revenue and $424.6 million in earnings by 2028. This projection relies on a 9.7% annual revenue growth rate and a $163.6 million increase in earnings from the current $261.0 million.

Uncover how Dycom Industries' forecasts yield a $297.89 fair value, a 16% upside to its current price.

Exploring Other Perspectives

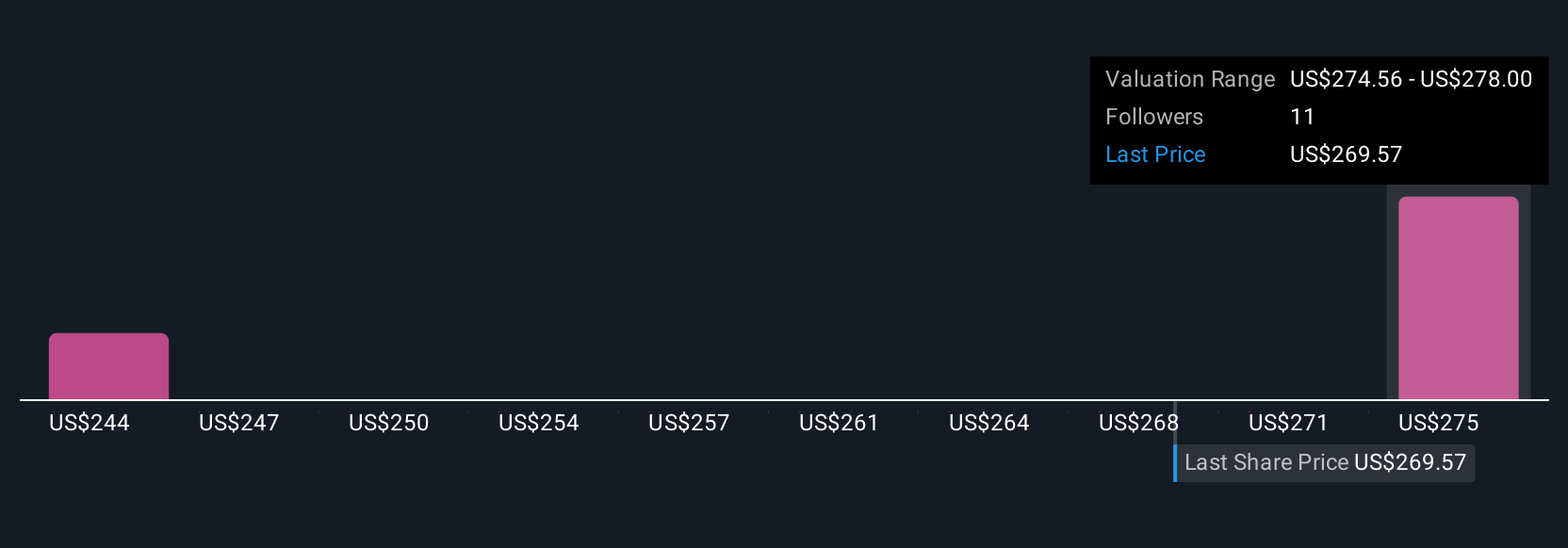

Two community members have estimated Dycom’s fair value between US$208.32 and US$297.89. While many see growth potential in fiber infrastructure, a reliance on a concentrated customer base still leaves the company exposed to rapid shifts in contract demand, so you’ll want to compare these varied viewpoints before making any big decisions.

Explore 2 other fair value estimates on Dycom Industries - why the stock might be worth 19% less than the current price!

Build Your Own Dycom Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dycom Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dycom Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dycom Industries' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal