Did the PPG VELOCITY Refinish Launch Just Shift PPG Industries' (PPG) Investment Narrative?

- In recent weeks, PPG Industries introduced the PPG VELOCITY refinish system in the United States, aiming to improve efficiency and environmental compliance for automotive collision repair shops.

- This product rollout, coupled with industry recognition for PPG’s commitment to technological innovation and leadership, highlights the company’s ongoing influence in advanced coatings solutions.

- Next, we'll review how PPG’s new refinish system launch could strengthen its investment narrative through enhanced technological advancement and market presence.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

PPG Industries Investment Narrative Recap

Investors in PPG Industries typically look for steady innovation, strong global presence, and management’s ability to drive growth through product launches and strategic expansion. The recent roll-out of the PPG VELOCITY refinish system underscores this focus but is unlikely to materially change near-term catalysts or ease the major risk from soft US and European auto production, which still weighs on the Industrial Coatings segment outlook.

Against this backdrop, the latest industry recognition, honoring PPG’s Patrick O’Neill with a Lifetime Achievement Award for pioneering lead-free electrocoat technology, directly ties to the company’s push for advanced, compliant coatings. This ongoing leadership in sustainability and product innovation supports existing revenue growth initiatives, yet doesn’t fully offset macroeconomic pressures facing several business lines.

In contrast, investors should be aware that foreign currency headwinds continue to …

Read the full narrative on PPG Industries (it's free!)

PPG Industries' outlook forecasts $16.9 billion in revenue and $2.0 billion in earnings by 2028. This assumes 2.7% annual revenue growth and a $0.7 billion increase in earnings from the current level of $1.3 billion.

Uncover how PPG Industries' forecasts yield a $127.35 fair value, a 15% upside to its current price.

Exploring Other Perspectives

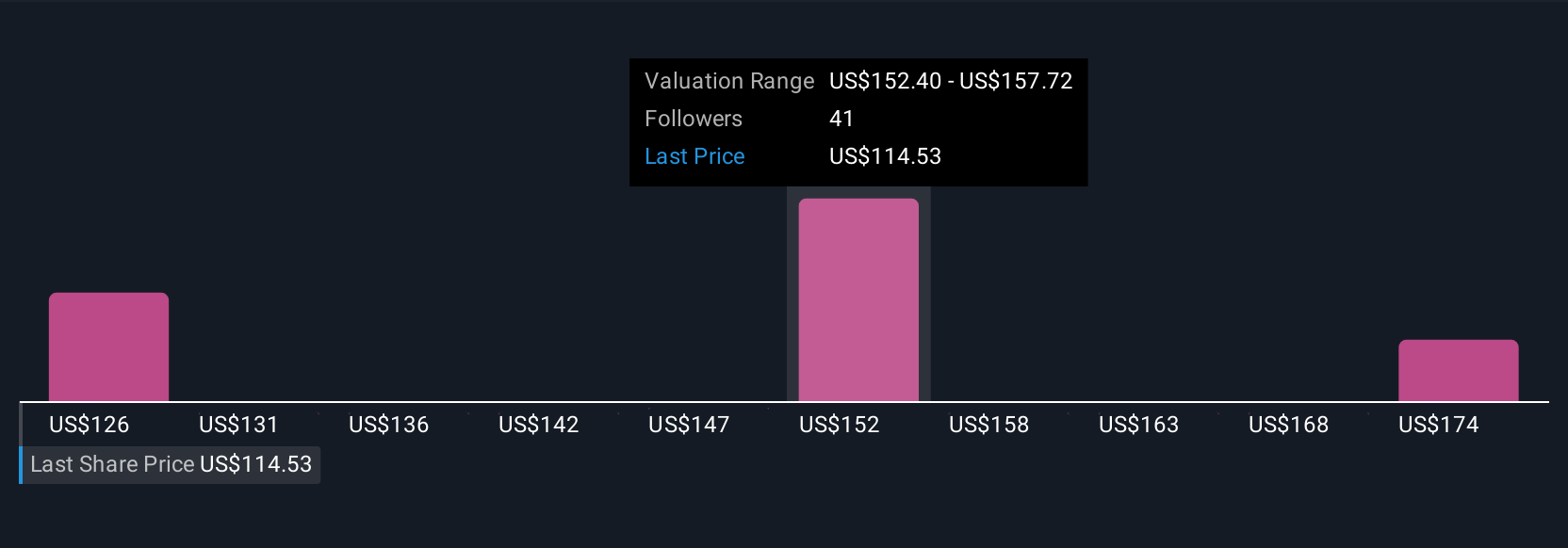

Fair value estimates from three Simply Wall St Community members for PPG range from US$127.35 to US$165.08 per share. While many see promise in PPG’s innovation efforts, opinions vary widely, prompting you to weigh both currency volatility and competitive innovation as you consider the company’s performance outlook.

Explore 3 other fair value estimates on PPG Industries - why the stock might be worth just $127.35!

Build Your Own PPG Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PPG Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PPG Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PPG Industries' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal